Investors often monitor the buying patterns of crypto whales, as these large players can heavily influence market prices. The first week of November 2024 has been no exception, with whales funneling substantial funds into several altcoins.

In this analysis, BeInCrypto examines the altcoins that have attracted these significant investments and why whales are buying them. The top three include Aave (AAVE), Cardano (ADA), and Avalanche (AVAX).

Aave (AAVE)

AAVE, the native token of the decentralized lending platform Aave, is among the altcoins that crypto whales have bought this week. This trend is closely linked to Donald Trump’s recent election victory and his launch of a crypto project using the protocol, which has drawn increased interest in AAVE and other DeFi tokens.

Data from IntoTheBlock reveals that Aave’s large holders’ netflow surged by 1,000% over the last seven days, indicating substantial whale accumulation outpacing sales.

This influx of whales has also positively impacted AAVE’s price, reinforcing the significance of their buying power in the market.

At press time, AAVE’s price was $182.95, representing a 27% hike in the last 30 days. Should whales continue to buy the token, the price can increase. On the other hand, if these investors opt against that, the altcoin’s value might drop.

Cardano (ADA)

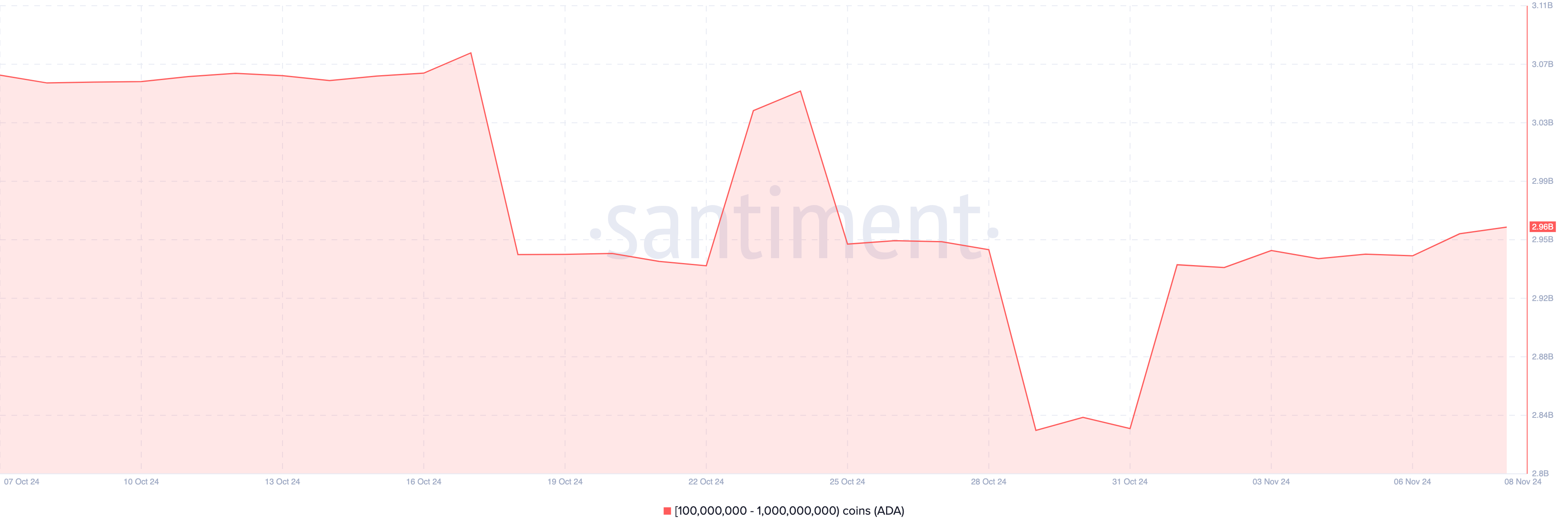

Cardano is also another altcoin that crypto whales bought this week. According to Santiment, the balance of addresses holding between 100 million to 1 billion ADA was 2.83 billion on October 31.

Today, that figure has increased to 2.96 billion, meaning crypto whales bought 130 million ADA this week. At the altcoin’s current price, this amounts to 55.90 million. Due to the purchase, ADA’s price increased by 25.31% in the last seven days and is the performing altcoin out of the top 10 cryptocurrencies.

Should whales continue to accumulate more tokens, ADA’s price might continue to increase. Otherwise, the altcoin’s value might decrease.

Avalanche (AVAX)

Last on the list of altcoins that crypto whales bought is Avalanche (AVAX). On November 6, AVAX large holders’ netflow was -85,700, indicating that Whales had sold a lot of the altcoin.

But as reports spread that BlacRock could launch its tokenization Fund on the Avalanche blockchain, things changed, and whales began to buy the token. As of this writing, the large holder’s netflow is 533,580, meaning that these stakeholders purchased over $15 million worth of the token.

This accumulation also impacted AVAX’s price, which saw a 12% hike to $28.2 this week. Thus, if the altcoin continues to see such accumulation, the price can go higher. If not, it could consolidate or trade lower.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.