Binance Launchpool, a platform that lets you gain early access to some of the most awaited projects, has recently announced its 61st project: Usual.

Usual is not usual, it aims to challenge traditional stablecoin models by decentralizing ownership and redistributing value.

Stablecoins are one of the most important component of the crypto market as they are designed to provide price stability. However, the majority of the stablecoins operate within centralized frameworks, limiting user ownership and participation in their ecosystems.

For example, in Q3 alone Tether reported over $2.5B in profits.

Click here to register on Binance and learn more about Usual on the Binance Launchpool. Let’s dive into the details.

1. What is Usual?

Usual is a decentralized protocol that aims to address challenges commonly found in the $191B stablecoin market.

It focuses on redistributing ownership and providing users with more control and benefits through its ecosystem, which is built around three key components:

USD0++: Liquid Staking Token

USD0++ builds on USD0 by providing users with the opportunity to earn rewards through staking. It allows users to lock up their USD0 for a period of time to earn $USUAL tokens while still keeping their funds transferable.

This product is similar to a savings account but is fully integrated within the DeFi space, making it accessible for anyone who wants to benefit from their holdings.

$USUAL: Governance Token

The $USUAL tken powers the Usual protocol. The token provides governance rights, empowering token holders to influence decisions related to the management of the protocol, such as what types of collateral are accepted or how revenue is distributed.

$USUAL is also tied directly to the protocol’s revenue, this is to ensure that holders share in the protocol’s financial growth.

One of the unique aspects of $USUAL is its approach to token issuance. The number of $USUAL tokens released is linked to the Total Value Locked (TVL) in the protocol, this ensure that there is a balance between supply and revenue. This model helps reduce dilution, making the token more attractive for long-term holders.

USD0: Stablecoin Backed by RWA

Usual’s stablecoin, $USD0, is designed to maintain stability by being backed by real-world assets like U.S. Treasury Bills.

This stablecoin is meant to be like a dollar in a digital form, which means that it can be used as a medium of exchange, as a store of value, as a trading asset, and much more.

USD0 focuses on transparency and security, which means that Usual is maintaining real-time reserves, offering an alternative to stablecoins like USDT and USDC.

USD0++: Liquid Staking Token

USD0++ builds on USD0 by providing users with the opportunity to earn rewards through staking. It allows users to lock up their USD0 for a period of time to earn $USUAL tokens while still keeping their funds transferable.

This product is similar to a savings account but is fully integrated within the DeFi space, making it accessible for anyone who wants to benefit from their holdings.

Community Ownership

A key feature of Usual is its focus on community ownership. Ninety percent of the value generated by the protocol is distributed back to the community, either through staking rewards or governance participation.

This approach shifts the traditional model of stablecoins, where profits are often retained by a centralized entity, towards a model where users are active participants in the ecosystem.

2. The Problem Usual Addresses

The stablecoin and DeFi markets face significant challenges, primarily due to centralization and flawed tokenomics.

Stablecoins like USDT and USDC, while offering stability, are controlled by centralized organizations that retain the majority of profits. This creates an imbalance, where a few stakeholders benefit while risks are distributed across the broader crypto market.

Centralization in Stablecoins

USDT and USDC generate billions in revenue annually, but these profits remain with centralized entities. This mirrors traditional banking systems, where profits are concentrated, and risks, such as devaluation, are borne by the wider public.

Issues with DeFi Tokenomics

Many DeFi tokens are speculative, leading to inflation and dilution of user holdings. These tokens often prioritize insider gains over equitable value distribution. Additionally, short-term speculation is incentivized, resulting in instability and a lack of trust in the ecosystem.

Usual’s Solution

Usual challenges this status quo by redistributing 90% of the protocol’s ownership and value to its users. This community-focused model enables users to directly benefit from the stablecoin’s growth and the protocol’s success. The governance token, $USUAL, is tied to the protocol’s revenue and Total Value Locked (TVL), preventing dilution and aligning value with financial health.

By addressing centralization and speculative tokenomics, Usual fosters a sustainable ecosystem that prioritizes fairness, stability, and long-term growth.

3. Core Features of Usual

For additional technical details and a deeper dive into how these components work, you can refer to the Binance Research page on Usual.

4. How Usual Stands Out

Usual redefines stablecoins by tackling their limitations while offering users real ownership and growth opportunities. Here’s what sets it apart:

Combining Yield and Growth

Traditional stablecoins like USDT and USDC generate billions, but users see none of it. Even yield-bearing stablecoins, like those from Ondo or Mountain, only share yield—not growth.

Usual changes the game by giving users both:

- Cash Flows: $USUAL holders earn revenue from the protocol.

- Governance Rights: Decide how funds are allocated and managed.

- Utility Rights: Stake, direct liquidity, and more.

This model turns users into active stakeholders in the protocol’s success.

Redistribution of Value

Usual’s community-first approach redistributes 90% of all value to users. Rewards from staking, governance, and more go back to the people—not just a select few.

Instead of periodic payouts, value is pooled into a treasury and distributed fairly through $USUAL governance, shifting power to the community.

Disinflationary Tokenomics

$USUAL tokens are issued less frequently as the protocol grows, creating:

- Protection Against Dilution: Early supporters benefit the most.

- Alignment with Financial Health: Token supply matches revenue.

- Incentives for Long-Term Holders: Rewards increase as the protocol scales.

This ensures a sustainable and growth-oriented ecosystem.

Transparency and Stability

Unlike many stablecoins, Usual ensures USD0 is fully backed by real-world assets, with reserves independently verified and viewable in real-time. This transparency builds trust and positions USD0 as a reliable choice in any market.

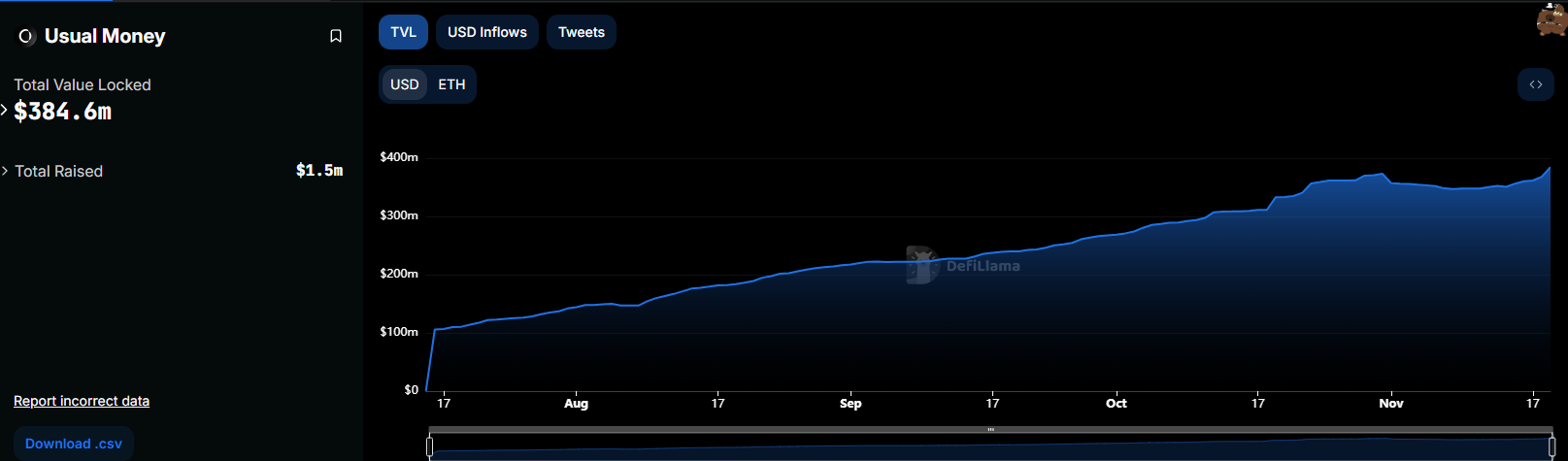

5. Usual in Numbers

Understanding the key metrics behind Usual provides insight into its current scale and potential for growth. These figures illustrate the traction the protocol has gained since its launch and highlight the community-driven approach at the heart of its design.

Total Value Locked (TVL)

Within just three months of its launch, Usual has accumulated $384 million in Total Value Locked (TVL). TVL is a critical indicator of a DeFi project’s success, reflecting the total amount of assets secured within its ecosystem.

Growing User Base

Usual has already attracted over 50,000 users. This growth shows increasing interest in a stablecoin model that redistributes value and ownership to its community.

Funding and Backing

The protocol has raised $7 million in funding and is supported by 160 investors. This financial backing reflects confidence in the protocol’s long-term sustainability and its potential to reshape the stablecoin market.

Tokenomics of $USUAL

The tokenomics of $USUAL are designed to ensure fair distribution, long-term sustainability, and alignment with the protocol’s growth. Below is a breakdown of the $USUAL token supply and allocation:

| Category | Percentage | Allocation |

|---|---|---|

| Community Incentives | 64.5% | Rewards and ecosystem growth |

| Binance Launchpool | 7.5% | 300 million tokens |

| Initial Airdrop | 8.5% | User onboarding incentives |

| Investors & Advisors | 5.68% | Early backers and guidance |

| Team Allocation | 4.32% | Development and operations |

| DAO & Ecosystem Growth | 7.5% | Decentralized governance |

| Liquidity | 2% | Trading and market support |

Key Supply Details:

- Total Token Supply: 4,000,000,000 $USUAL

- Circulating Supply at Launch: 494,600,000 (12.37% of the total supply)

- Binance Launchpool Rewards: 300,000,000 tokens

How to Get Involved with Usual on Binance

Usual’s inclusion on Binance Launchpool and Pre-Market provides a straightforward way for users to participate in its ecosystem. Whether through staking in the Launchpool or trading in the Pre-Market phase, Binance users can easily access $USUAL tokens and benefit from its offerings.

Binance Launchpool Participation

Binance Launchpool is a platform where users can stake their cryptocurrencies to earn rewards in new tokens. For Usual, users can stake BNB or other supported assets to earn $USUAL tokens during the Launchpool phase.

Key Details for Launchpool:

- Start Date: November 15, 2024, 00:00 (UTC)

- End Date: November 18, 2024, 23:59 (UTC)

- Rewards: 300 million $USUAL tokens (7.5% of total supply)

- Eligibility: KYC is required to participate.

To get started, users need to:

- Register or log in to their Binance account.

- Visit the Binance Launchpool page.

- Stake their BNB tokens to start earning $USUAL rewards.

For more details, visit the Binance announcement page.

Binance Pre-Market Trading

After the Launchpool phase, Binance Pre-Market allows users to trade $USUAL tokens before their official spot listing. This provides early access to the token and a chance to engage with it in a live trading environment.

Key Details for Pre-Market:

- Start Date: November 19, 2024, 10:00 (UTC)

- End Date: To be announced.

- Trading Options: Buy and sell $USUAL tokens before spot listing.

- Maximum Holding Limit: 40,000 $USUAL per user.

Binance Pre-Market is an exclusive feature that gives users an early advantage in the fast-paced world of cryptocurrency trading. To participate, ensure your Binance account is set up and ready for trading.

Click here to register on Binance and explore Usual’s Launchpool and Pre-Market opportunities.