The US Presidential election is anticipated to have a substantial impact on global markets, with the cryptocurrency sector standing as no exception. Traders, analysts, and crypto enthusiasts worldwide closely monitor the US, where shifting attitudes toward digital assets make a difference.

In a recent report, on-chain analytics platform Santiment explored the connection between the most important US political event and crypto market movements. With results expected in days, here’s a look back at the crypto market reactions during the last two US presidential election cycles.

How Did US Elections Impact Crypto During Past Cycles

Analysts expect a close race in the 2024 US presidential election and predict a prolonged counting period. Given the tight competition, multiple days may pass after Election Day on Nov. 5 before the final results are confirmed and the next president is publicly announced.

In past elections, markets have reacted swiftly to presidential outcomes. Officials announced Joe Biden’s victory in 2020 four days after Election Day, triggering positive trends despite ongoing global economic turbulence from COVID-19.

While the election influenced market movements, some argue that a bull run was already on the horizon as the international community focused on economic recovery and pandemic response.

After Donald Trump’s 2016 victory, the crypto market saw a minor five-day retrace, with Bitcoin and altcoins dipping before quickly rebounding from the initial volatility. Cryptocurrency markets are famously volatile, and election cycles tend to amplify this effect.

In 2020, Joe Biden’s win fueled optimism for stimulus-driven policies and potentially more lenient monetary practices, leading to a surge in crypto prices. The brief dip and swift recovery in 2016, contrasted with the post-election rally in 2020, highlight how political shifts can significantly impact market trends.

As a result, the announcement of Joe Biden’s victory in the 2020 election was far more positive for crypto, and markets reacted almost instantly after the news broke.

Read more: How Can Blockchain Be Used for Voting in 2024?

The 2024 election is expected to bring significant price fluctuations in crypto markets, driven by the incoming administration’s stance on regulation and policy. Both major presidential candidates have outlined their views on cryptocurrency, offering a glimpse into the potential direction of US digital asset policy in the years ahead.

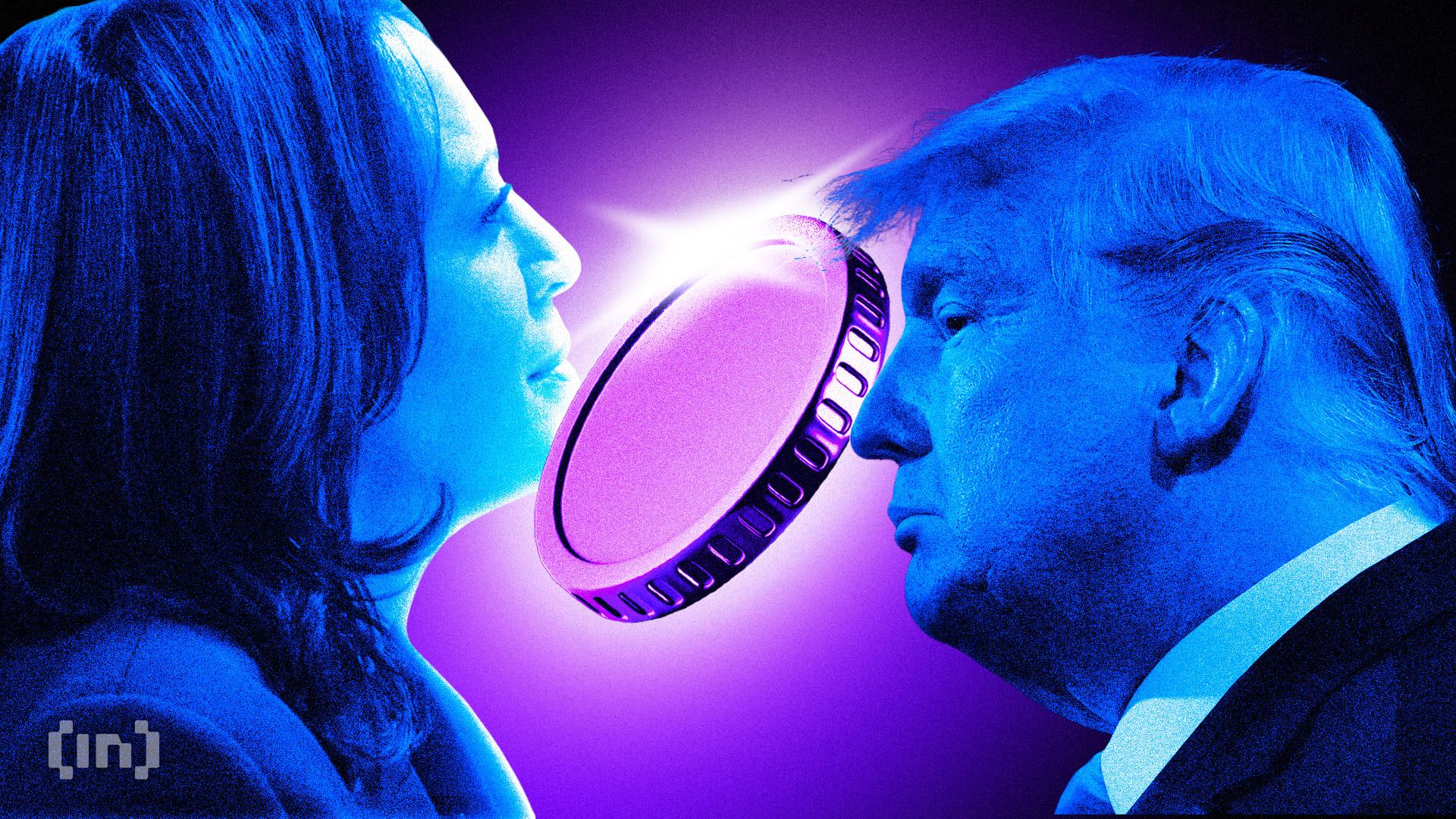

Candidate Positions on Cryptocurrency: Trump vs. Harris

Donald Trump

Cryptocurrency enthusiasts widely view Trump’s proposals as more favorable due to his emphasis on industry-friendly policies and his family’s active involvement in digital assets. The crypto community has largely responded positively to his proposals, which many view as encouraging to market growth:

- National Bitcoin Reserve: Trump proposed creating a national bitcoin stockpile at the Bitcoin 2024 conference in July, aimed at establishing the US as a cryptocurrency frontrunner.

- Crypto-Friendly Regulatory Policies: Trump has pledged to create a presidential advisory council on cryptocurrency, aiming to develop clear, favorable regulations.

- SEC Leadership Overhaul: Trump has stated he would replace SEC Chair Gary Gensler, aiming for a regulatory shift he describes as more favorable to digital assets.

- Family Ventures in Crypto: Trump’s sons, Donald Trump Jr. and Eric Trump, recently launched World Liberty Financial, a cryptocurrency exchange, underscoring the family’s involvement in the industry.

Kamala Harris

Harris, though supportive, emphasizes consumer protection, which some in the crypto space interpret as less conducive to industry expansion:

- Support for Innovation in Digital Assets: Harris has voiced support for digital assets and AI, emphasizing the need to foster innovation while protecting consumers.

- Framework for Regulatory Clarity: Harris proposed a regulatory framework for digital assets in October 2024, focusing on investor protections and transparent guidelines.

- Blockchain’s Potential: Harris has acknowledged blockchain technology’s potential, calling for balanced regulations that support innovation without compromising consumer safety.

- Engagement with Industry Leaders: Harris has engaged in dialogue with cryptocurrency leaders throughout 2024, signaling her openness to digital innovations while maintaining regulatory standards.

These differing approaches have resulted in a significantly higher volume of mentions around Trump’s crypto discussions and policies compared to Harris’s, reflecting the community’s heightened interest in his approach.

On Polymarket, prediction rates show higher support for Trump over Harris among the crypto community, though Harris has recently closed the gap, making it a closer race.

Read more: How To Use Polymarket In The United States: Step-by-Step Guide

Regardless of who wins the 2024 election, the cryptocurrency sector anticipates continued growth and evolving regulatory frameworks as the new administration steps in. The crypto community will closely observe how the incoming administration navigates the rise of digital assets, balancing the drive for innovation with regulatory safeguards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.