Polkadot (DOT) has seen a significant drop in the past seven days, with its price falling by 9.69%. This decline comes as many other altcoins also experienced price drops.

Despite the negative market sentiment, analysts remain hopeful. DOT might drop to $5.54 in the short term, but in a bullish scenario, it could rise to $6.65.

Optimism for Polkadot (DOT) Amid Price Decline

At press time, DOT was trading at $5.85 with a market cap of $8.4 billion, according to CoinMarketCap. Like other altcoins, DOT has faced external market pressures, such as volatile BTC prices, contributing to its recent decline.

Despite the drop, many crypto analysts remain optimistic, forecasting an imminent price surge. Pseudonymous analyst Crypto Thanos believes DOT is poised for a rise, stating, “DOT flushed March and November 2023 levels on higher time frames, making me even more bullish in the upcoming move; dips will vanish soon.” Based on his analysis, DOT is expected to respect the lower support level and begin an uptrend.

Similarly, Rekt Frencer shared an optimistic view on X, highlighting Polkadot’s recent entry into the AI race. He mentioned that projects like @origin-trail and Phala Network are already using Polkadot’s technology for AI applications. If this trend continues, Polkadot could become a key hub for AI projects.

Analysts remain positive that the growing adoption and collaborations between Polkadot and other firms will help drive a price surge.

Polkadot (DOT) Faces Critical Market Movements

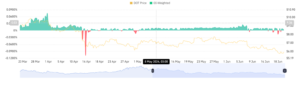

Analysis indicates that on the 18th and 19th of June, and as of the time of writing, DOT breached the critical support level around $6. This decline caused DOT to fall to its lowest price since late last year, reaching $5.505. Currently, DOT aims to reclaim the critical support level as a resistance level around $6. If successful, it will establish a new resistance level around $7.3.

Source: Tradingview

However, the Relative Strength Index (RSI) at 34 shows continued bearish market sentiment. The RSI crossed the RSI-based moving average (MA) from above, dipping further towards the oversold zone. These movements indicate higher selling pressure, driving prices down.

Further analysis using Coinglass data on the weighted funding rate shows a declining funding rate, which was below negative on the 18th and 19th. Declining funding rates indicate investors’ reluctance to open long positions, resulting in market neutrality.

Source: Coinglass

According to Santiment, DOT has reported declining open interest since the 8th of June. Falling open interests imply fewer new positions, with traders closing existing positions. Given DOT’s decline, many investors are likely to avoid entering positions due to the price impact.

Source: Santiment

DOT Faces Bearish Sentiment Amid Negative Funding Rates

DOT has experienced negative funding rates for two consecutive days, accompanied by reduced open interest. These movements signal a strong bearish market sentiment.

In the short term, these factors suggest a continued decline, potentially falling to its previous low of $5.542. However, if there is an increase in buying pressure, DOT could surge to $6.649.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News