What is happening

Shiba Inu (SHIB) has been in rebound mode over the past week, recovering from a low of $0.00001231 on Sept. 6 to reach a high of $0.0000137 after three days. SHIB’s price has gained 2.88% over the past seven days, correlating with an overall market recovery.

Overall, the SHIB price has gained 2.88% in seven days.

Shiba Inu’s recovery correlates with an overall market recovery. Bitcoin is making a nice comeback following a rough start to September, with the price falling below $53,000 at one point last Friday.

However, according to a recent report released by analytics platform Santiment, the meme coin Shiba Inu (SHIB) is currently experiencing “tremendous” levels of fear, uncertainty and doubt (FUD).

Burn rate through roof

On Sept. 11, Shiba Inu (SHIB) saw a remarkable increase in its burn rate, spiking by 8,193% after 3,106,197 SHIB tokens were removed from circulation through eight transactions.

The largest of these burns sent 1 million tokens to dead wallets. This burn activity briefly lifted SHIB’s price to $0.00001367 before it settled at $0.00001359.

By Sept. 12, the daily burn rate had grown by another 340.27%. The burn rate is directly impacted by transaction activity on Shibarium, Shiba Inu’s Layer-2 network, where gas fees paid in BONE tokens are partially converted into SHIB and automatically burned.

This process has automated what used to be manual burns, further accelerating SHIB’s deflationary efforts.

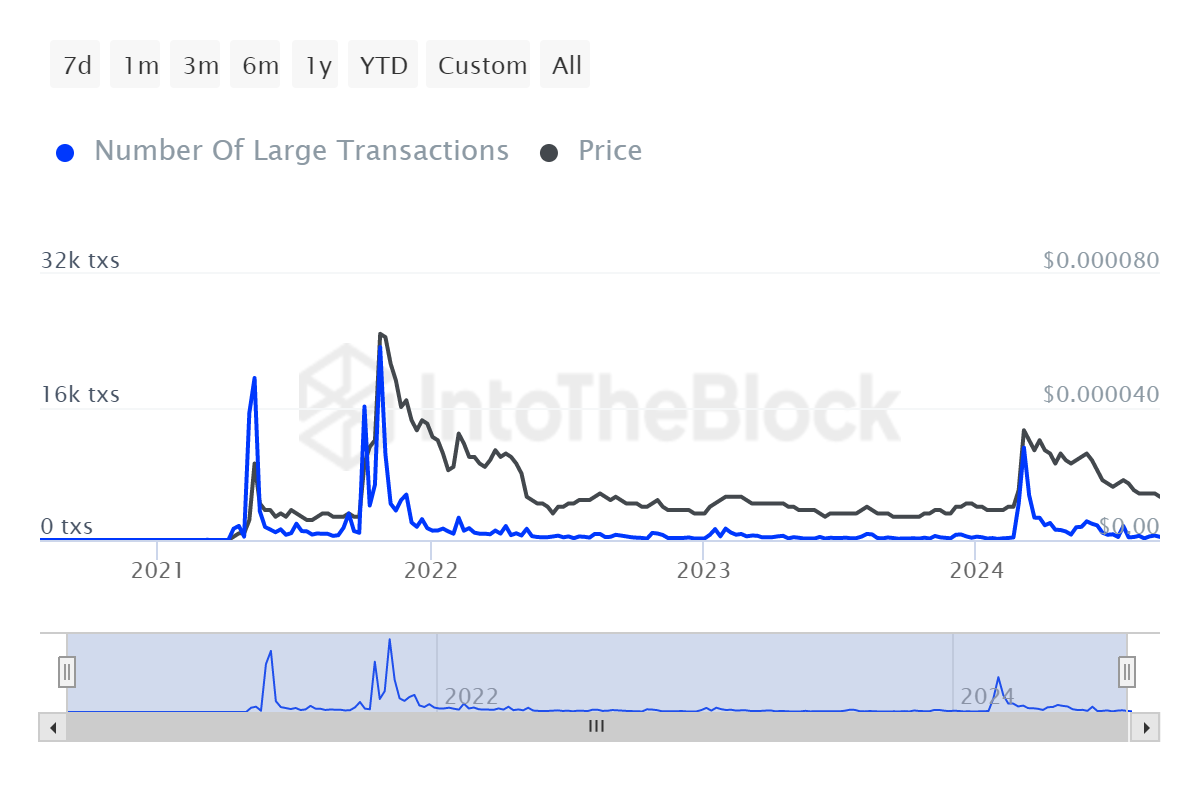

Whale activity

Whale accumulation in Shiba Inu (SHIB) could potentially provide the buying pressure needed to overcome current resistance levels if it continues or strengthens.

However, data from IntoTheBlock shows that SHIB experienced a significant 30,045% drop in Large Holders Netflow, indicating that whales are likely reducing their positions or selling. This decrease in netflows may be linked to profit-taking or changes in market sentiment.

Earlier this week, whale activity peaked, with 98 large transactions recorded and a substantial 3.21 trillion SHIB moved on Sept. 9.

This was in stark contrast to the lower 645 billion SHIB moved just two days prior, on Sept. 7. Despite the overall decline in whale netflows, some whales remain active, moving large volumes of SHIB for potential strategic reasons — whether liquidation or accumulation.

On Sept. 10, Shiba Inu experienced a 367% surge in large transaction volume, reaching $43.52 million (or 3.21 trillion SHIB). This suggests a rise in whale activity, which has historically played a key role in SHIB’s price movement due to the concentration of large holdings.

Price prediction

Santiment has suggested that Shiba Inu (SHIB) could start performing “relatively well” once Bitcoin resumes its rally, despite SHIB’s long-term returns standing at approximately -32%, earning it a reputation as a “worse-performing Dogecoin.”

However, there are signs of a potential shift in momentum. SHIB is forming a higher low, a technical indicator that the long-term downtrend might be reversing.

The formation of a higher low is encouraging, as it indicates a change in market sentiment, with buyers potentially gaining strength over sellers. If this pattern holds, it could signal the beginning of a more sustained recovery for Shiba Inu.

Typically, higher lows suggest growing bullish momentum, signaling a potential trend reversal in the near future.

Tracking transaction volumes, particularly among major investors or whales, remains crucial, as their actions often influence SHIB’s price direction. A continued increase in buying activity from whales could further support the higher low pattern and strengthen the possibility of a recovery.