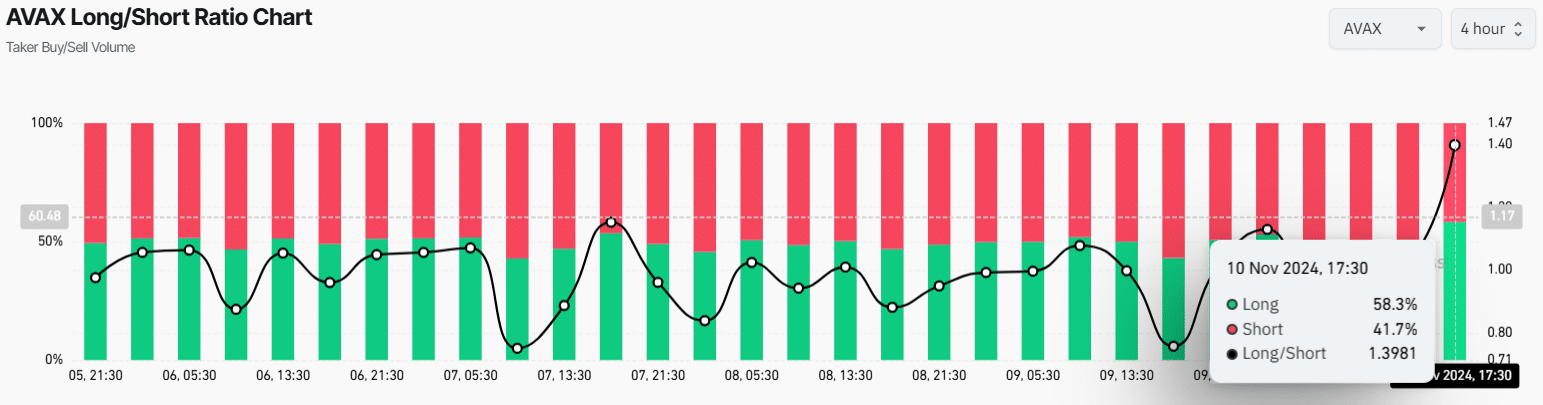

- AVAX’s Long/Short ratio stood at 1.40, suggesting strong bullish sentiment.

- 58.3% of top AVAX traders held long positions at press time, while 41.7% held short positions.

Amid the ongoing bullish market sentiment, Avalanche [AVAX] has already gained an impressive 40%, and despite this, it was poised for further notable upside momentum.

Like major cryptocurrencies, the AVAX daily chart presented bullish price action, suggesting a perfect buying opportunity.

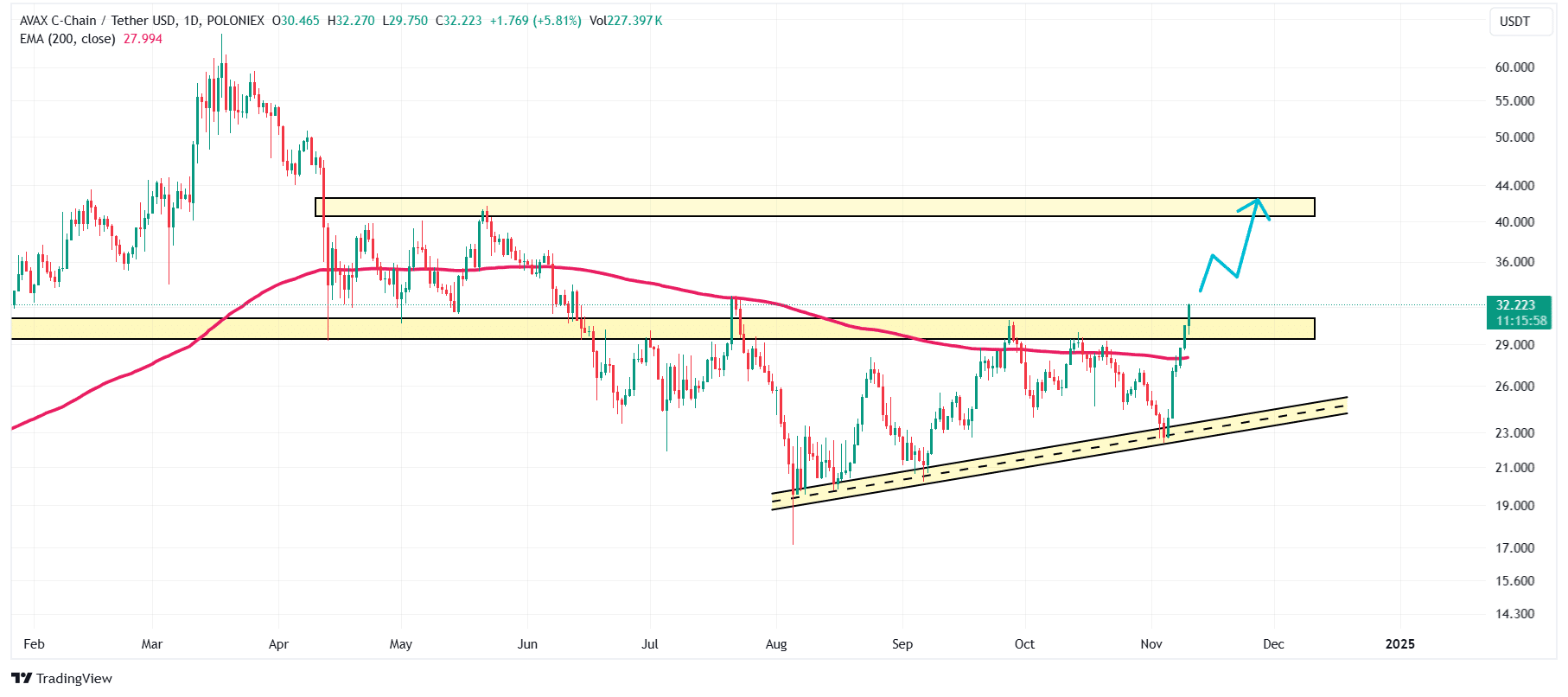

Avalanche technical analysis and key levels

According to AMBCrypto’s technical analysis, AVAX has broken out from a strong resistance level of $30 and is now heading toward the next resistance level.

With the recent price surge, the asset has already breached the resistance of the 200 Exponential Moving Average (EMA) on the daily time frame, shifting the sentiment from a downtrend to an uptrend.

Based on historical price momentum, if AVAX closes a daily candle above the $32 level, there was a strong possibility it could soar by 35% to reach the $42.5 level in the coming days.

Given the current market conditions, it appears the asset could easily achieve this level without facing significant difficulties.

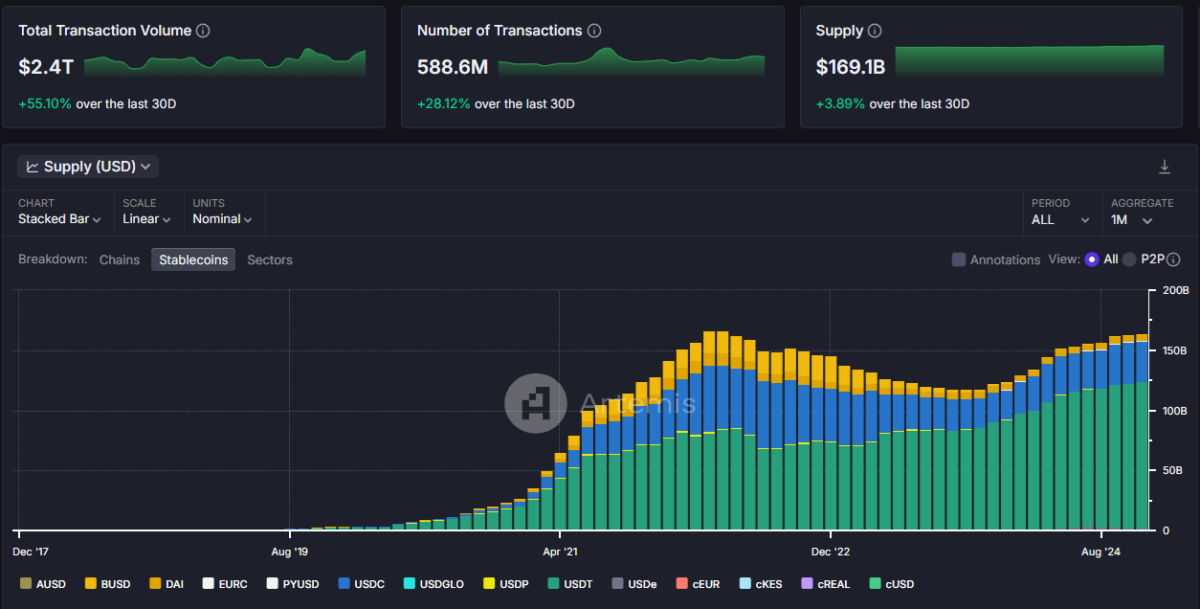

AVAX is bullish, on-chain

According to the analytics firm Coinglass, AVAX’s Long/Short ratio stood at 1.40, as of the time of writing. This ratio suggested also strong bullish sentiment among traders.

Additionally, its Open Interest soared by 13.6% over the past 24 hours, indicating robust participation from traders following the recent breakout.

At the time of writing, 58.3% of top AVAX/USDT traders held long positions, while 41.7% held short positions.

Thus, it appeared that bulls and whales were dominating the asset, which could result in a notable upside rally in the coming days.

Is your portfolio green? Check out the AVAX Profit Calculator

At press time, AVAX was trading near $32.05, having gained over 9.6% in the past 24 hours.

During the same period, its trading volume surged by 26%, indicating strong participation from traders and investors amid the bullish sentiment.