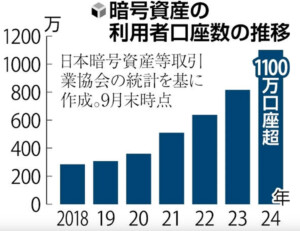

Key Points

- Bitcoin’s momentum is retained despite falling below the $70,000 resistance level.

- The MVRV indicator suggests a potential surge in Bitcoin’s value.

Bitcoin, after several attempts to exceed $70,000, has once again fallen beneath this resistance level. This indicates potential difficulties in maintaining a positive momentum.

At the time of writing, the cryptocurrency was valued at $68,581, with a minor increase of 0.3% over the past 24 hours. This suggests that the market might need additional strength to establish a long-term move above $70,000.

Bitcoin’s MVRV Cycle

CryptoQuant analyst CoinLupin shared insights into Bitcoin’s MVRV (Market Value to Realized Value) cycle. The MVRV ratio, currently around 2, indicates that Bitcoin’s market value is twice its estimated on-chain value.

Rather than focusing solely on the current MVRV value, CoinLupin used tools like the 365-day Bollinger Band for MVRV and the four-year average to better understand Bitcoin’s cycles. The MVRV ratio has moved above this annual average, hinting that while Bitcoin’s trend continues to rise, there is still potential for a higher cycle peak.

Long-Term Price Indicators and Future Targets

The current MVRV level suggests a sustained upward trajectory, but one that has not yet reached historical peak levels. Assuming a stable Realized Value, BTC would require a 43-77% increase to potentially hit price targets between $95,000 and $120,000.

Rising market interest and buying momentum could push the Realized Value higher, suggesting that future peaks may exceed these levels based on previous cycles. CoinLupin also noted that Bitcoin has risen significantly over the past year and has only recently approached the MVRV indicator’s average level, maintaining its positive momentum.

Examining Key Bitcoin Metrics and Market Interest

Bitcoin’s ongoing performance can be further understood by examining its on-chain metrics. The number of active addresses has remained within a range, fluctuating between 870,000 and 546,000 active addresses over recent months.

This steady activity suggests that while there is interest in BTC, significant new retail engagement may be limited. A major influx of new participants may be necessary for BTC to establish a more solid upward trajectory.

Furthermore, a look at whale transactions, a key indicator of larger holders’ actions, provides another perspective on Bitcoin’s potential. Data shows that Bitcoin’s whale transactions recently peaked before declining. This drop in large-scale transactions suggests a temporary reduction in whale activity, which might impact Bitcoin’s short-term momentum.

If whale activity increases again, it could provide renewed support for Bitcoin’s price. This could potentially help the asset surpass key resistance levels.