Bitcoin (BTC) has maintained an uptrend since last Wednesday’s Federal Reserve rate cut. Currently trading at $63,509, the leading crypto asset’s price has grown by almost 10% in the past seven days.

With rising demand and improving market sentiment, the king coin could reach a two-month high of $69,000. This analysis dives into the key factor driving this potential surge.

Bitcoin Miners May Be The Key

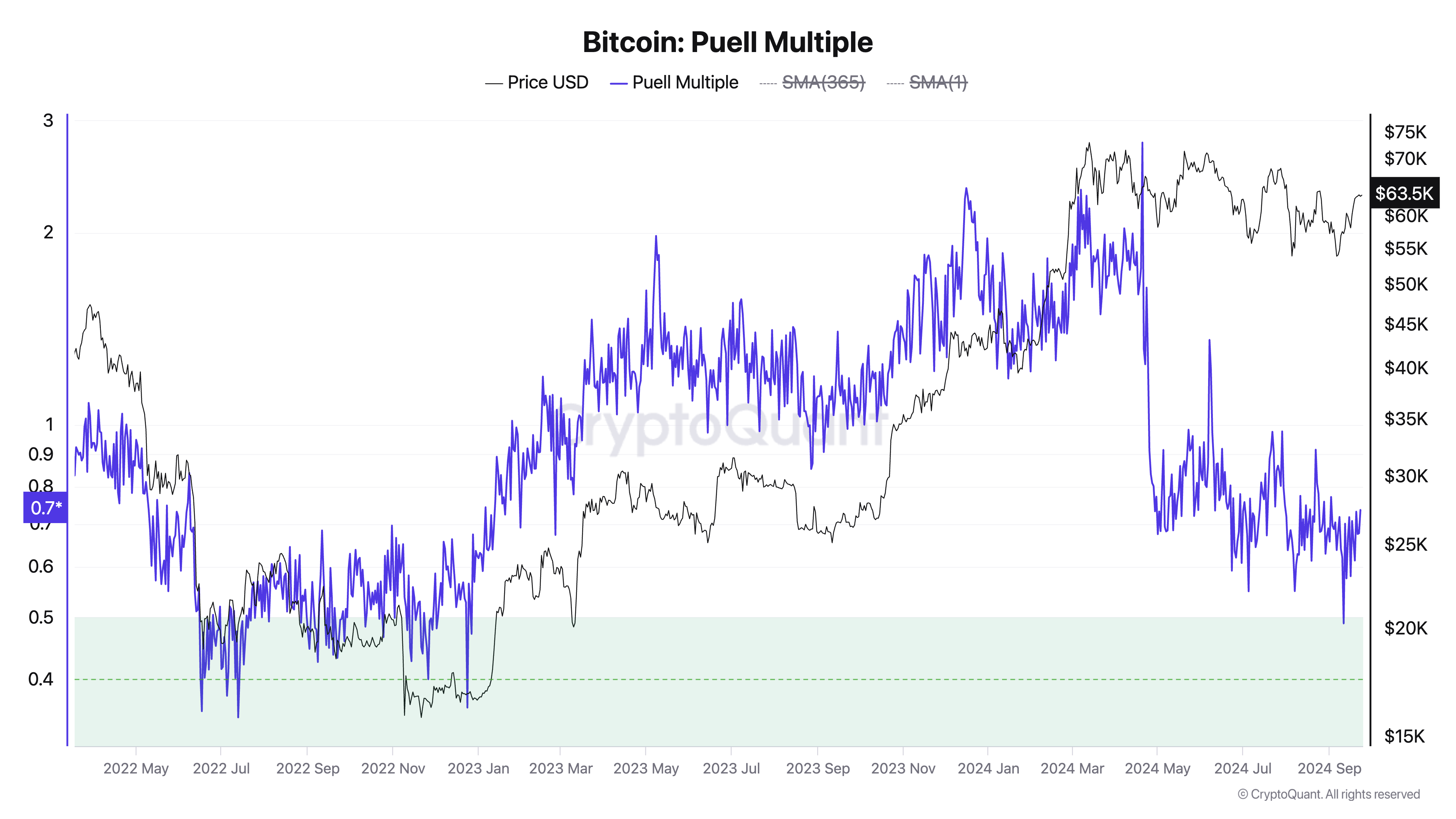

BeinCrypto’s assessment of Bitcoin’s Puell Multiple suggests that the leading coin might be poised for an extended rally. For the first time since the end of the 2022 bear market, the value of this metric, which assesses the profitability of Bitcoin miners, has hit the 0.5 “green zone.”

When BTC’s Puell Multiple is above 4, the market is said to be in the “red zone” where miners are making substantial profits. This often signals a market top and is characterized by an increased selling pressure, which causes a price decline.

Read more: Bitcoin Halving History: Everything You Need To Know

Conversely, when the coin’s Puell Multiple enters the “green zone,” mining profitability is significantly lower than usual. This phase often results in an upward price movement because these unprofitable conditions force miners to scale back or shut down operations. The resulting decrease in BTC supply drives its value higher.

In a recent blog post, CryptoQuant contributor Darkfost confirmed this.

“Historically, when the green zone was reached, it was followed by an upward price movement. Conversely, reaching the red zone has typically preceded a downward market move,” the analyst noted.

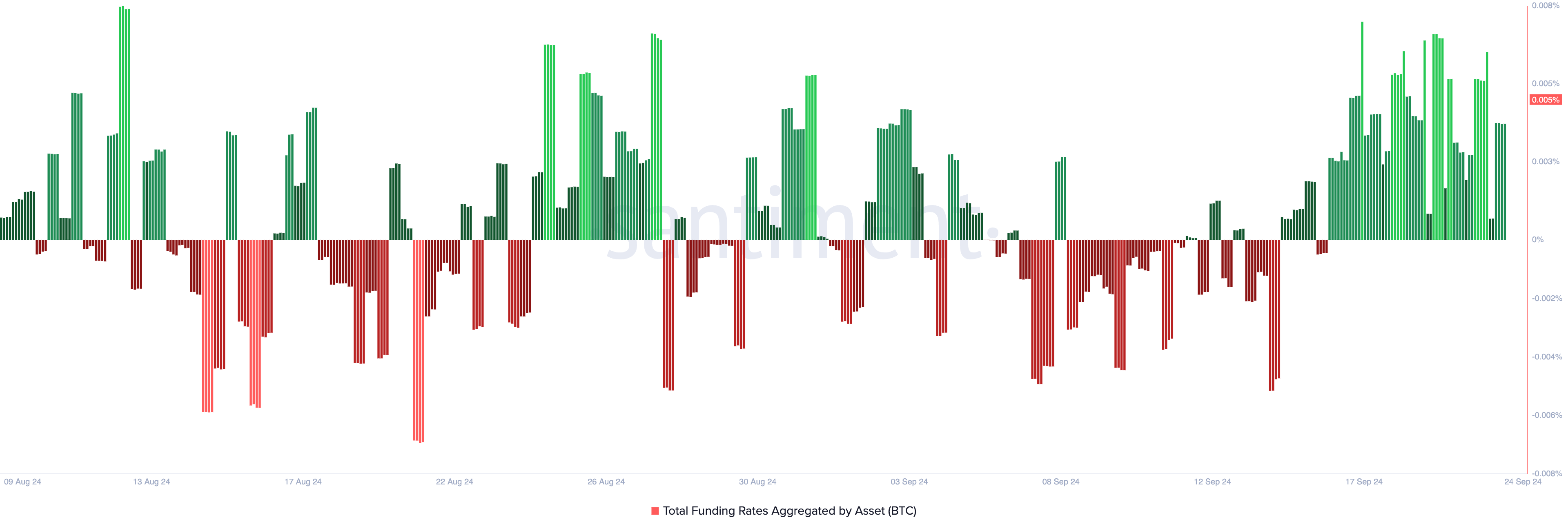

Bitcoin’s positive funding rate since September 15 is another bullish indicator that its price may continue to rally. At press time, the coin’s funding rate, which represents a periodic fee paid to ensure that its contract price stays close to its spot price, is 0.005%.

A positive funding rate suggests that most traders expect the price to increase, leading to more demand for long positions than short positions.

BTC Price Prediction: $69,000 Imminent If History Repeats Itself

If history repeats itself and readings from Bitcoin Puell Multiple hold true, the leading cryptocurrency will likely witness an uptrend, potentially rallying toward the resistance at $67,078. A successful break above this level could pave the way for Bitcoin to reach $69,000, a price it last touched in July.

Read more: Bitcoin Halving History: Everything You Need To Know

However, if the anticipated accumulation spree fails to materialize and selling pressure intensifies instead, Bitcoin’s price could decline toward $54,672.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.