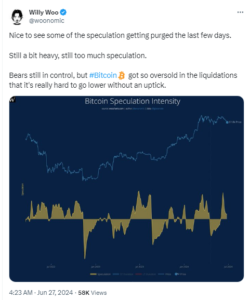

According to Willy Woo, the BTC price might stay unimpressive for a few more weeks as there is a need to remove excess speculators from the market. He mentioned that the recent reversal in BTC was purely technical and not based on fundamental factors.

Earlier this week, Bitcoin (BTC) faced significant selling pressure, followed by a bounceback attempt. However, it struggled to hold above $63,000 and has since slipped back below $61,000, trading 1.5% lower at press time. Crypto analyst Willy Woo believes this recent price increase is temporary, emphasizing that bears still dominate the market.

Willy Woo on Bitcoin’s Recent Market Conditions

Crypto analyst Willy Woo recently commented on the state of the Bitcoin (BTC) market, noting that while the recent price correction helped clear excess leverage, there remains speculative activity in the market. He highlighted that significant BTC liquidations drove the price down to $58,000, placing it in oversold territory, necessitating a temporary bounceback before potential further declines.

Source: X

Woo emphasized that the current bounceback in BTC price is purely technical and not driven by fundamental factors. He pointed out indicators like a TD9 reversal and hidden bullish divergence, suggesting a technical recovery underway. However, he cautioned that breaking the RSI trendline would be crucial to confirm sustained technical improvement.

Bitcoin-BTC-Technical-Chart: Courtesy: Willy Woo

Despite the technical rebound, Woo stressed that the current BTC reversal is not supported by fundamental demand and supply dynamics. He explained that while markets correct for overselling, it doesn’t necessarily imply fundamental justification for continued bullish momentum in Bitcoin.

Willy Woo on Bitcoin’s Fundamental Conditions

Willy Woo discussed the current state of Bitcoin’s fundamental dynamics, highlighting that for bullish structures to form, demand must exceed supply. He noted that spot buyers are actively purchasing coins from exchanges, indicating some fundamental support.

However, Woo pointed out a current issue where synthetic coins are not being adequately replaced. He emphasized the need to address speculators creating synthetic coins and suggested that waiting for the hash rate to rebound, signaling miners have halted selling for hardware upgrades, is crucial.

Woo suggested that investors may need to endure a few more weeks of subdued BTC price action. He cautioned against expecting immediate bullish trends, stating, “It’s not moon boy time,” and advised speculators to consider liquidating their positions due to market boredom. Woo recommended accumulating spot holdings while waiting for speculators to exit the market.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News