Why is Bitcoin up today? Bitcoin’s recent rise to $90,000 was driven mainly by optimism in the crypto community following the U.S. election results. President-elect Donald Trump’s victory brought new hope for cryptocurrency, especially since Trump previously shifted from a crypto skeptic to a supporter of the industry.

His campaign included promises to make the U.S. a “crypto capital,” pledging to help Bitcoin and other digital assets thrive. Investors view his win as a step toward a more supportive environment for crypto, which helped drive up Bitcoin’s price.

His commitment includes establishing a national Bitcoin reserve, repealing capital gains taxes on Bitcoin, and creating a regulatory environment that fosters innovation in the cryptocurrency space.

Trump has also indicated he will replace Gary Gensler, the current head of the U.S. Securities and Exchange Commission (SEC), who has maintained a strict regulatory approach to crypto markets.

Market participants anticipate that a change in leadership could ease restrictions and boost industry growth, generating optimism across the cryptocurrency landscape.

Increased Interest in Spot Bitcoin ETFs

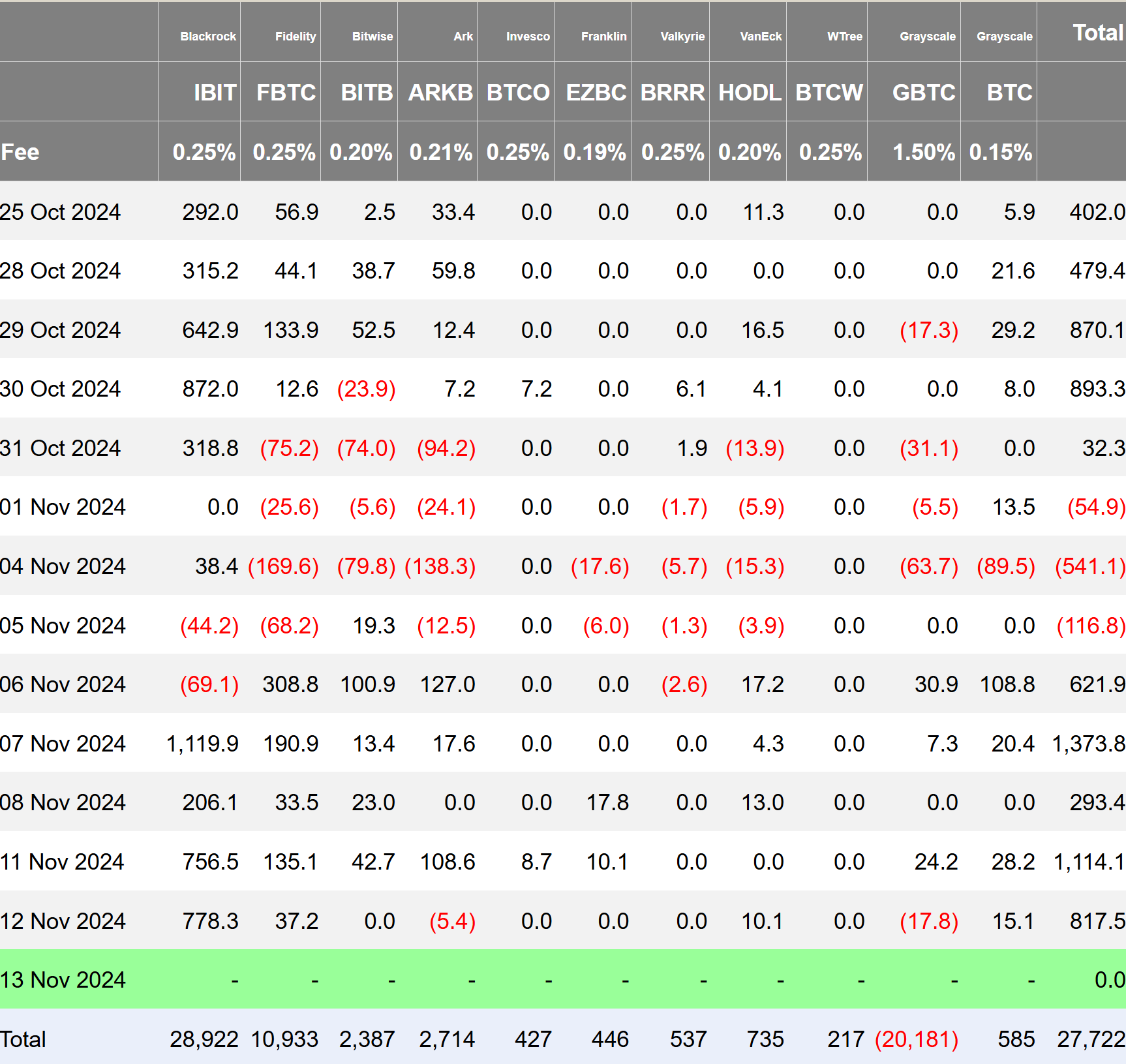

Following Trump’s election win, spot Bitcoin ETFs saw a surge in investment inflows. Data from Farside Investors indicates that U.S.-based spot Bitcoin ETFs recorded $1.1 billion in net inflows on Monday, followed by an additional $817.5 million on Tuesday. This trend is attributed to heightened investor demand for Bitcoin exposure and growing interest in ETF products, which allow investors to gain Bitcoin exposure without direct ownership.

Among the ETFs, BlackRock’s IBIT received the largest inflows, drawing $778.3 million on Tuesday alone and reaching $1.93 billion in net inflows for the week. Analysts at Citi noted that these ETFs could continue to drive Bitcoin’s performance, as they provide new avenues for retail and institutional investors alike, another factor in why is Bitcoin up today.

Largest Single-Day Price Jump in Dollar Terms

Bitcoin’s historic surge also marked its largest single-day dollar gain, jumping $8,343 on Monday. This price increase outpaced previous records, making it a notable milestone for Bitcoin as it approached the $90,000 mark.

Monday’s rally alone saw Bitcoin’s value climb from $80,427 to a high of $89,864, setting the stage for further price increases. Although not the highest daily percentage gain, the dollar amount underscores Bitcoin’s increased market value compared to earlier years.

Possible Market Volatility from Economic News

After briefly reaching $90,000, Bitcoin’s rally slowed as investors took profits, causing a minor correction in the market. Analysts like Valentin Fournier from BRN suggest that this dip may be temporary, answering why is Bitcoin up today for those closely watching the charts. Fournier noted, “This indicates some profit-taking by large investors, potentially leading to a brief correction before prices resume their upward momentum.”

As Bitcoin consolidated around $86,100 on Tuesday, market watchers highlighted the potential for volatility tied to upcoming U.S. inflation data. The Consumer Price Index (CPI) report, scheduled for release later this week, may influence Bitcoin’s short-term trajectory if inflation numbers exceed expectations.

Broader Market Boost and a Trillion-Dollar Milestone -reasons why Bitcoin is up today

Bitcoin’s rise contributed to a broader crypto market rally, pushing total cryptocurrency market capitalization past $3.15 trillion—a new all-time high. This surge reflects both Bitcoin’s dominant performance and gains in other major cryptocurrencies, although some, like Ether, have seen minor pullbacks. The broader market’s value surpassed previous records set in 2021, when Bitcoin was trading at around $69,000.

Impact of Trump’s Crypto Policy Commitments

In addition to Trump’s election victory, his crypto-specific commitments are fueling optimism among market participants. His 11-point plan includes policies aimed at making the U.S. a global hub for cryptocurrency and creating a “Bitcoin & Crypto Advisory Committee” to oversee crypto policies. The proposed National Bitcoin Reserve and support for U.S.-based Bitcoin mining operations underscore Trump’s vision of a crypto-integrated economy.

Trump’s other commitments—such as repealing the capital gains tax on Bitcoin transactions, protecting individuals’ right to self-custody crypto, and rejecting the idea of a U.S.-issued Central Bank Digital Currency (CBDC)—have been received positively by industry stakeholders. These policies signal a potential shift towards a more crypto-friendly regulatory framework in the U.S., which could foster broader adoption and innovation in the sector.

DOGE and Musk’s Role in Trump’s Crypto Plans

Another notable development contributing to the recent surge in crypto sentiment is Trump’s announcement of a new government initiative called the Department of Government Efficiency (DOGE), with prominent figures Elon Musk and Vivek Ramaswamy set to lead the agency. DOGE, aimed at reducing federal spending and bureaucratic inefficiencies, represents Trump’s push for an “entrepreneurial approach” to governance, which many believe could benefit the crypto industry by streamlining regulations.