PEPE has surged to new heights as the token’s price has spiked by 43.34% in the past 24 hours, accompanied by a 42.27% rise in trading volume. This surge is likely influenced by PEPE’s recent listing on Robinhood, a major trading platform, sparking comparisons to similar pumps seen with Coinbase listings in the past.

Crypto analyst Scott Melker, known as “The Wolf Of All Streets,” shared on X (formerly Twitter) that this “Robinhood listing pump” might be the new equivalent of previous Coinbase-driven rallies, adding that PEPE’s price has now reached a new all-time high.

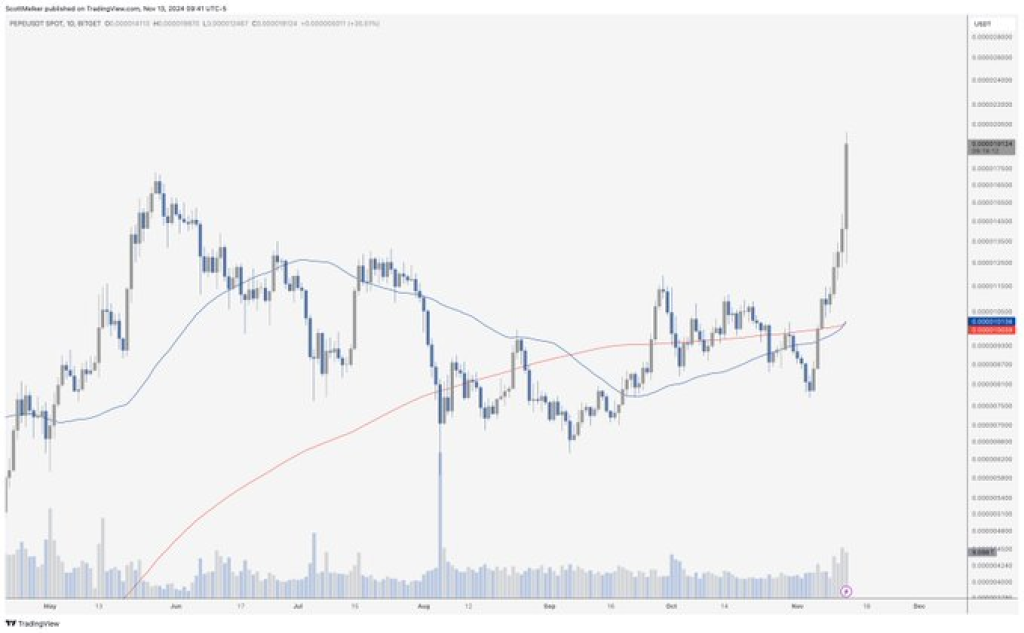

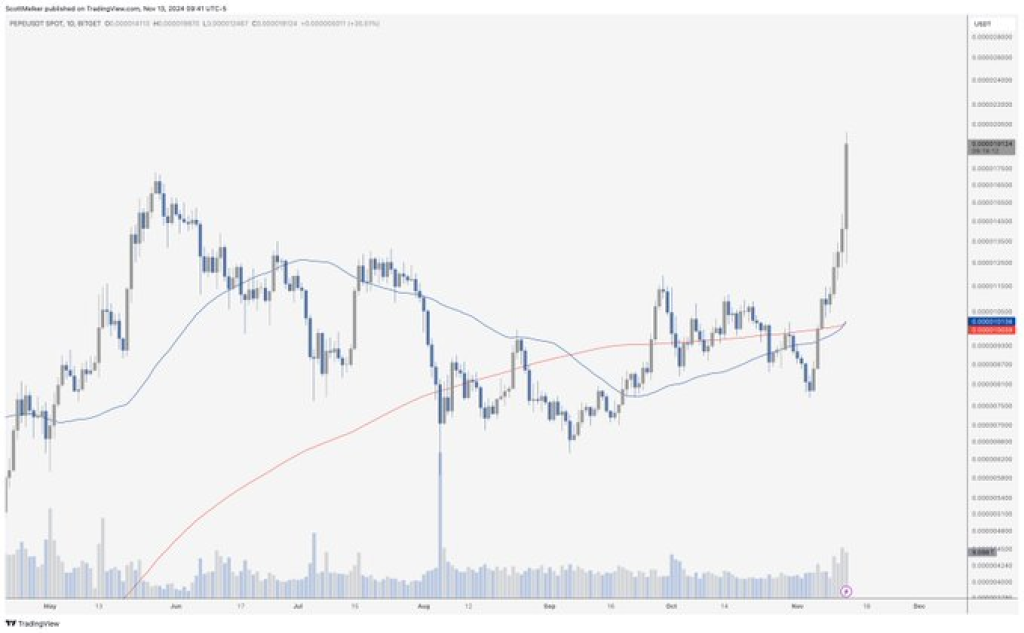

The recent price movement of PEPE shows a strong upward trend, with a sharp spike visible on the chart following the Robinhood listing announcement. This kind of listing often brings a fresh wave of interest from retail traders due to easier access to the asset.

Before this spike, PEPE had maintained relatively stable, though fluctuating, price levels. The sudden increase reflects an injection of market enthusiasm that could attract additional traders and investors looking to capitalize on the momentum.

This current trend aligns with patterns seen in previous listing pumps for various cryptocurrencies, where significant platform additions have led to rapid price escalations. The increased accessibility and visibility often drive an influx of retail investment, pushing prices higher.

PEPE Chart Analysis: Moving Averages Indicate Bullish Momentum

The chart reveals that PEPE’s price has surged well above its 50-day and 200-day moving averages, indicating a strong bullish trend. These moving averages, typically used to gauge long-term price trends, reflect the shift from a consolidation phase to a breakout. The close proximity of the 50-day and 200-day averages prior to this movement suggested a period of neutrality, which was quickly disrupted by the recent listing news.

The positioning of PEPE’s price above these moving averages is generally viewed as a positive indicator for further upward movement. However, given the steep rise, some short-term correction or consolidation may occur as traders secure profits.

Breaking Past Support and Resistance Levels

Before this surge, PEPE had established support levels around the area where the 50-day and 200-day moving averages converge. This recent rally, however, has propelled PEPE past all previous resistance points, setting a new all-time high, as noted by Melker in his tweet.

With no historical resistance at these levels, the new high could act as a psychological point for potential future pullbacks, depending on continued trading interest.

As the price advances, these past resistance levels could become new support zones if the price stabilizes above them, potentially creating a foundation for sustained growth in the coming days.

Read Also: Bitcoin Price Breaks $91k For the First Time – Why Is the Crypto Market Up Today?

The volume analysis supports the upward momentum, with trading volume surging in tandem with the price spike. Higher trading volume during this rally indicates strong market interest, which often confirms the robustness of a price movement. The substantial volume on this breakout reinforces the current bullish sentiment, driven largely by news of the Robinhood listing.

Increased trading activity during price rises generally signals that traders and investors are actively participating in the movement, lending strength to the trend. However, volume declines could signal reduced interest, leading to potential price corrections.

Outlook for PEPE

In the short term, PEPE’s price could continue to rise if the momentum holds, especially as Robinhood’s listing expands accessibility to a broader audience. However, sentiment-driven movements, like the one triggered by the Robinhood listing, are often volatile and may lead to a pullback once initial excitement dissipates.

This pattern of rapid price increases on listing news emphasizes the influence of market sentiment in the cryptocurrency space, where platform accessibility can drive substantial short-term gains. Whether PEPE will sustain this price level or experience a correction will depend on continued interest, trading volume, and the broader crypto market sentiment in the days to come.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link