With rising demand in the AI sector, RENDER has seen a sharp bullish trend, as highlighted by crypto analyst Crypto Rand. His tweet, “Riding the $RENDER bull wave, couldn’t be more bullish on the #AI sector,” captures the sentiment surrounding RENDER’s potential as it benefits from the growing AI hype. This analysis dives into RENDER’s technical setup and explores the factors driving its upward momentum.

Read Also: This Analyst Predicts Major Breakout for Starknet (STRK) Price—Here’s Why!

RENDER Price Trend and Breakout Signal Strong Reversal

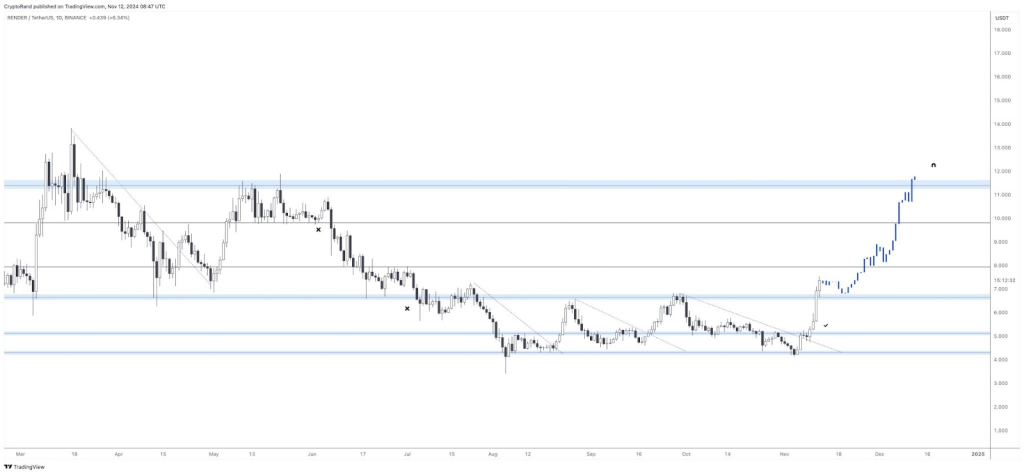

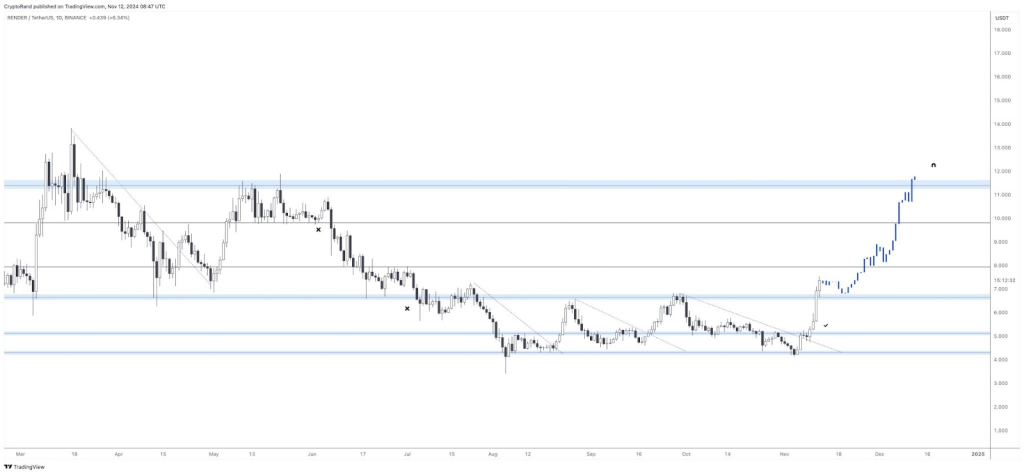

The Render chart reveals a shift in price action, with the token rebounding from a prolonged period of consolidation. Earlier this year, RENDER faced a steady decline, with price rejections around the $13–$14 resistance zone. After a significant downtrend, the token stabilized mid-year within a defined range, suggesting consolidation before any major movement.

However, a breakout from this downtrend channel indicates a shift from bearish to bullish sentiment. This breakout aligns with a falling wedge pattern visible on the chart, a formation that often signals a reversal in technical analysis. As RENDER’s price moved above previous resistance zones, it showcased potential to maintain its upward trajectory, with key resistance around $11–$12 in sight.

Key Support and Resistance Levels in Focus

Examining support and resistance levels provides insight into potential price targets. The chart identifies the $4 range as a major support level that served as a solid foundation for RENDER’s latest surge.

Another notable support zone appears between $6 and $7, where the price consolidated before breaking out. Currently, RENDER is nearing the $11–$12 resistance zone, which could be a testing point for further gains.

If momentum sustains, RENDER may target the $13–$14 range, where previous rejections occurred. However, should RENDER face resistance, a pullback toward the $8–$9 area is possible, offering a new level of support in its upward path.

Crypto Rand’s tweet highlights his optimism for RENDER, emphasizing its association with the growing AI sector. This fundamental interest bolsters the token’s technical breakout, as investors view RENDER as an opportunity within the expanding AI market.

Although volume indicators are not shown, the recent price surge suggests increased buying interest and accumulation, aligning with bullish expectations for the token.

Read Also: Worldcoin (WLD) Price Could Hit $4 Soon – Analyst Says It’s a ‘Good Looking Chart!’

Projected Price Movement and Investor Outlook

With strong technical and fundamental indicators supporting RENDER’s price movement, many investors are optimistic about its potential to reach new highs. Should RENDER break above $11–$12, the next target could be the previous high of $13–$14, marking a retest of earlier peaks. However, if resistance stalls the rally, a pullback might stabilize the price at the newly established support levels.

This bullish scenario for RENDER aligns with the overall interest in AI-related projects. As RENDER continues its climb, the market will be watching closely to see if it sustains its upward momentum or pauses at critical resistance zones.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link