- Memecoins could outperform DeFi in the short-term.

- Fed interest rate cut would boost memecoins and DeFi sectors.

As the Fed’s easing cycle begins, memecoins could return as a top performer and even eclipse the DeFi sector in Q4. This was the outlook projected by Toe Bautista, research analyst at crypto trading and liquidity provider GSR.

Bautista told Blockworks that renewed speculative interest could boost memecoins’ upside potential.

“Memecoin strength may continue due to the recent surge in speculative appetite.”

Memecoins vs DeFi

He added that the sector could outperform DeFi as the segment was still riddled with regulatory uncertainty ahead of the US elections.

“On the other hand, DeFi sits in an awkward middle ground. A Trump election win likely leads to regulatory easing, offering potential DeFi outperformance, while a Harris win could bring continued hostility.”

In short, memecoins could enjoy the massive rally in the short term, but the segment’s outperformance against DeFi depended on the the outcome of the US elections.

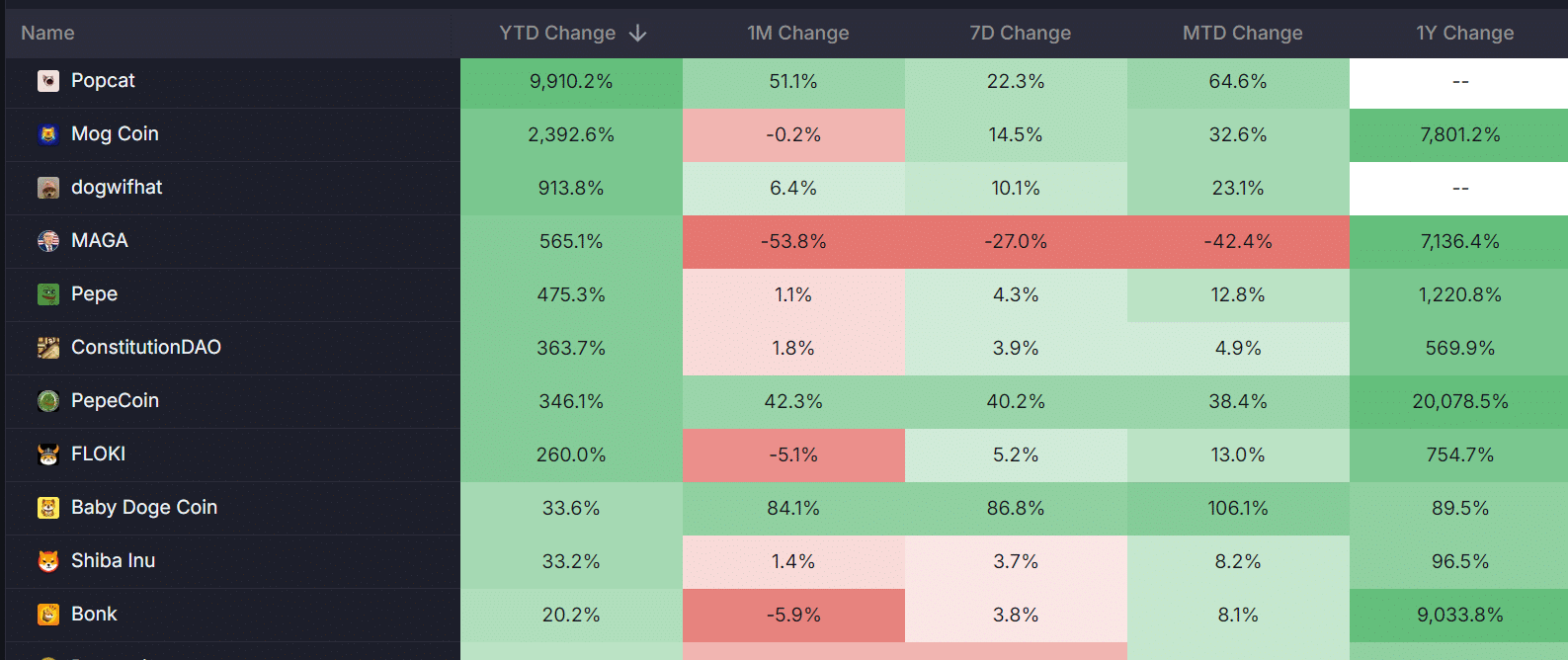

On a year-to-date (YTD) basis, Popcat [POPCAT] topped the charts with nearly 10,000% gains at press time. dogwifhat [WIF] and Pepe [PEPE] were also outliers with triple-digit gains over the same period.

However, a recent Bernstein report tipped the DeFi sector for upside potential amid falling interest rates in TradFi.

Bernstein analysts noted that the DeFi yield could hike above 5%, beating US money market funds and boosting segment leaders like Aave [AAVE], Uniswap [UNI], and Aerodrome Finance [AERO].

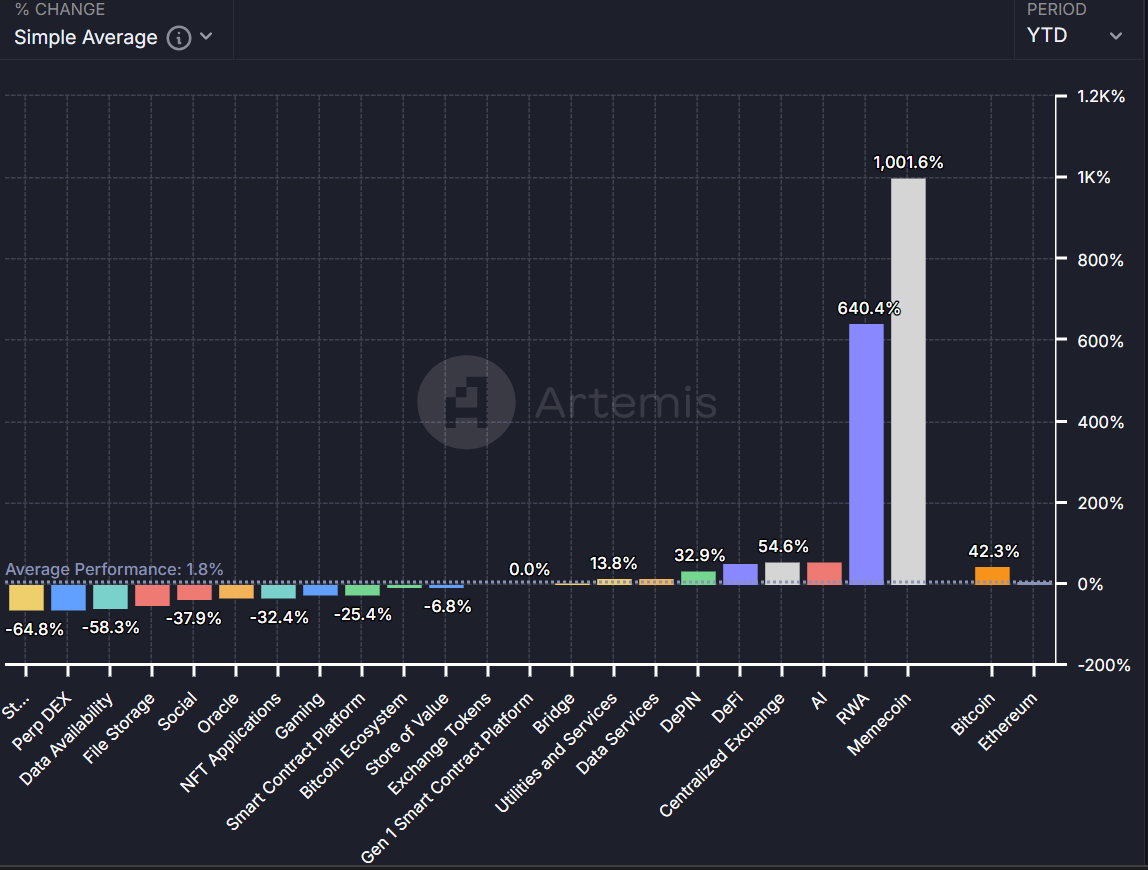

That said, the memecoins moat was still strong in the market. After topping the charts in Q1 and Q2, the segment was still leading on a YTD basis. On the contrary, DeFi ranked fifth with an average of 51% gains per Artemis data.

The Fed pivot will boost memecoin speculation and increase market interest in DeFi yields, which could boost these segments’ returns. However, it remains to be seen how the performance will be affected by upcoming US elections.