- Solana is set to benefit from the pre-election mood as investors turn to low-risk assets.

- Traders could easily push Solana to the next target of $185, especially as top altcoin Ethereum struggles

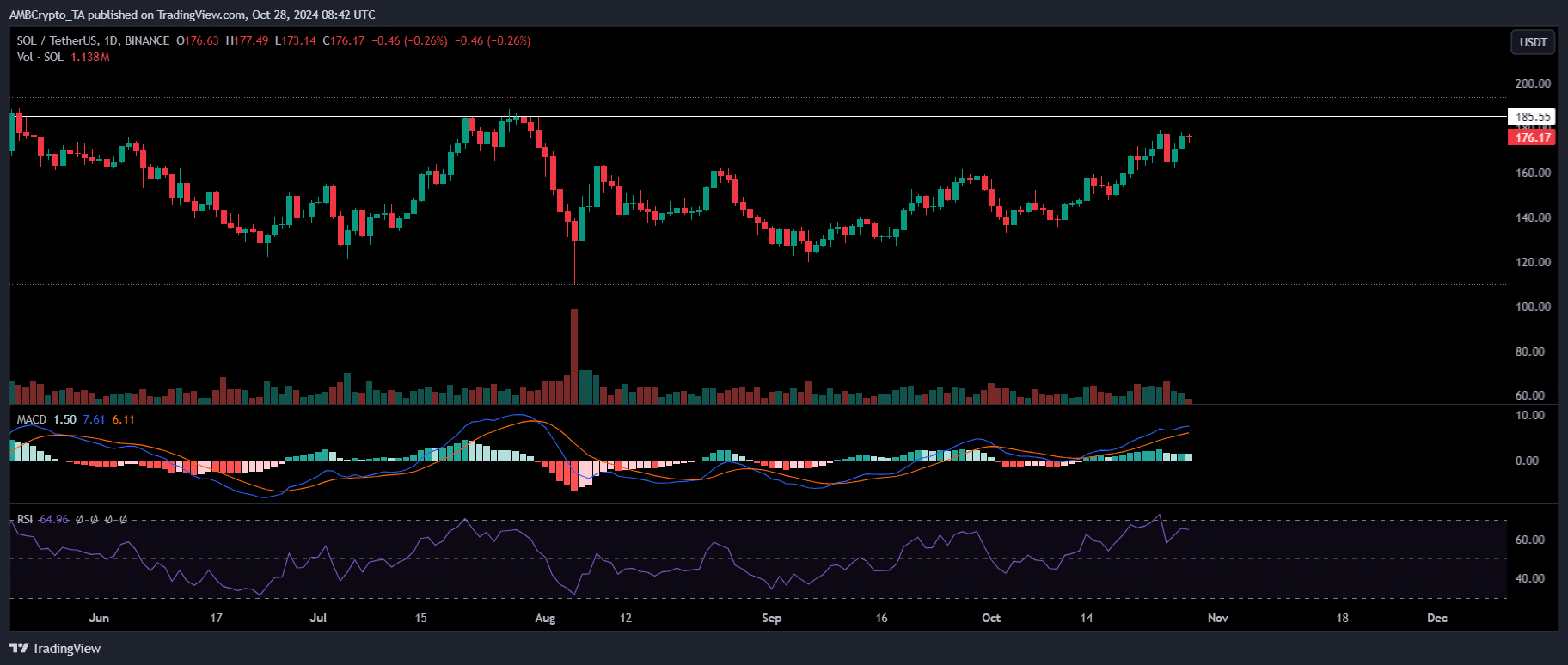

The past week has marked a crucial period for Solana [SOL], as it finally broke through the $160 resistance after multiple attempts, signaling an end to its two-month downtrend.

Although a sharp 6% intraday dip wiped out some gains two days ago, SOL bulls held steady around the $175 range, preventing further pullback.

With election-driven liquidity on the rise, Solana could be poised to reach $185 – and potentially rally toward $200 – if it successfully flips the $160 level into solid support.

Pre-election buildup is kicking-in

During the last presidential election, Bitcoin broke free from its months-long consolidation and closed above $40K for the first time two months later.

This aligns with a common psychological pattern in which low-risk assets typically attract significant attention, especially in a market characterized by the unpredictability of election outcomes.

As a result, investors anticipate a significant rally in the post-election cycle as they adjust to the newly introduced market trends and diversify their portfolios in search of returns from high-cap altcoins.

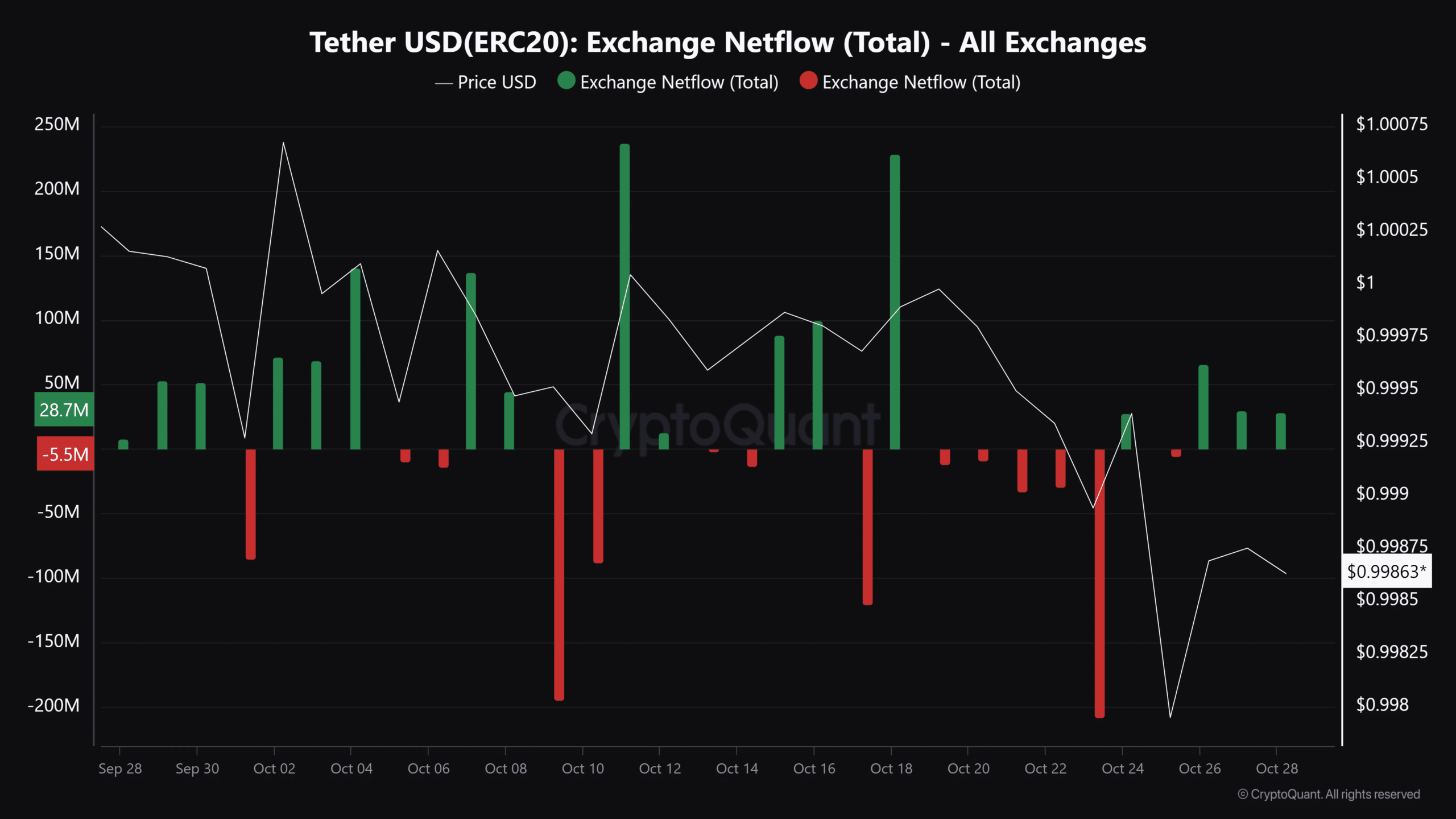

Currently, the market is in a pre-election mood, indicating that investors are positioning themselves to capitalize on high returns from low-risk assets like Solana, as illustrated in the chart below.

In the past three days, USDT inflows have made a notable comeback, with over $28 million in Tether deposited into exchanges. This surge follows a significant withdrawal of $200 million in USDT tokens just five days ago.

Historically, high USDT inflows are often a precursor to Bitcoin reaching daily highs. As a result, analysts expect Solana to benefit, especially since it outperformed many top altcoins in the previous cycle.

If Solana bulls follow THIS pattern

With a weekly gain of over 5%, Solana has broken a two-month slump, rallying past $170 – a level it last reached in July – while the rest of the altcoins struggle in the red zone.

Currently trading at $176 and with a 22% increase in volume over the last 24 hours, it may indicate an overbought condition as the current price is nearing its two-week high, suggesting that a trend reversal could be on the horizon.

However, if bulls view the increased election liquidity as a catalyst for a bullish November, there’s a good chance Solana could absorb this pressure as strong hands enter the cycle.

Is your portfolio green? Check out the SOL Profit Calculator

If this pattern holds true, traders could easily push Solana to the next target of $185, especially as top altcoin Ethereum struggles with its own network health—an area where Solana excels.

In short, the market conditions are ripe for Solana to hit its near-term target price, driven by a shift of capital into high-cap tokens as the pre-election mood raises volatility and SOL’s dominance among the altcoin pool.