- dtcpay is shifting its focus to stablecoins, ending its support for Bitcoin and Ethereum in favor of more stable payment solutions.

- Stablecoins like USDC, USDT, and FDUSD will dominate dtcpay’s services, reflecting user preferences and reducing volatility risks.

Dtcpay, Singapore’s regulated cryptocurrency payment institution, has announced a strategic move that might redefine the payment services sector.

Beginning in January 2025, dtcpay will solely support stablecoins, including USDC, USDT, FDUSD, and WUSD, therefore stopping support for well-known cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), according to Fintech News.

Stablecoins: A Solution to Volatility in Digital Payments

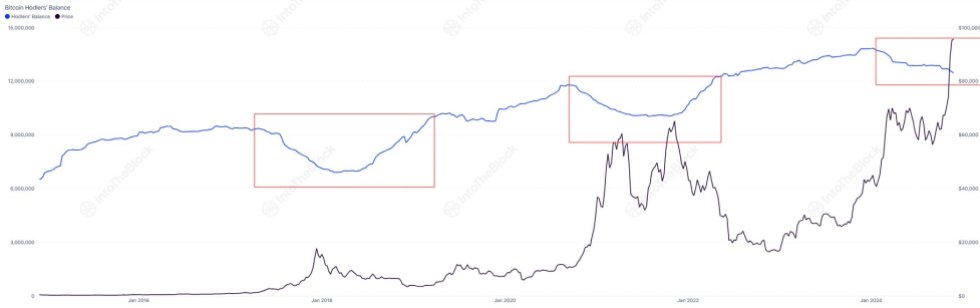

The company has identified the inherent volatility of traditional crypto as a primary factor contributing to this shift. Although leaders in the cryptocurrency market, Bitcoin and Ethereum are well-known for their sharp price swings that could cause volatility in payment systems.

Turning now to stablecoins, dtcpay seeks to give consumers and companies a more consistent, smooth payment experience.

Especially, transactional data proving a significant inclination among dtcpay customers for stablecoins supports the choice. Most of the transactions handled by the platform during the past year have comprised stablecoins, which are linked to fiat money like the US dollar.

Apart from endorsing recognized stablecoins like USDT and USDC, dtcpay intends to increase its product range to include newly developed choices like First Digital USD (FDUSD) and Worldwide USD (WUSD).

These stablecoins are supposed to give consumers more freedom and confidence, therefore reinforcing dtcpay’s leadership in digital payment solutions. By concentrating on stablecoins, dtcpay not only solves user issues regarding volatility but also opens the path for more general acceptance of digital payments.

This change fits a rising trend in Singapore and around the world whereby stablecoins are an essential component of payment systems.

Stablecoin payments in Singapore alone have reportedly hit about US$1 billion in quarterly transaction volume, underscoring the growing dependence on these digital currencies for safe and quick transactions, according to recent industry estimates.

Moreover, dtcpay’s actions fit its innovative history, which includes its involvement in worldwide fintech projects and industry award recognition.

Other institutions are likewise advancing the bridging of traditional and digital finance. Singapore Gulf Bank earlier offered Bahrain’s first regulated, crypto-compatible corporate banking services, according to CNF.

This project presents flawless and safe digital asset management for business customers, therefore enhancing Bahrain’s leadership in digital finance among the MENA countries.