- WIF may be mirroring DOGE’s early 2021 cycle, reigniting hopes for a breakout.

- An AMBCrypto strategy could help make that breakout a reality.

dogwifhat [WIF], dubbed Solana’s mascot, has seen a 14% surge over the past week, trading at $1.74 – double the gains of DOGE in the same period.

Despite pulling back from its March ATH of $4.60, WIF’s rising popularity has analysts speculating on a possible bullish cycle akin to DOGE’s meteoric rise in early 2021.

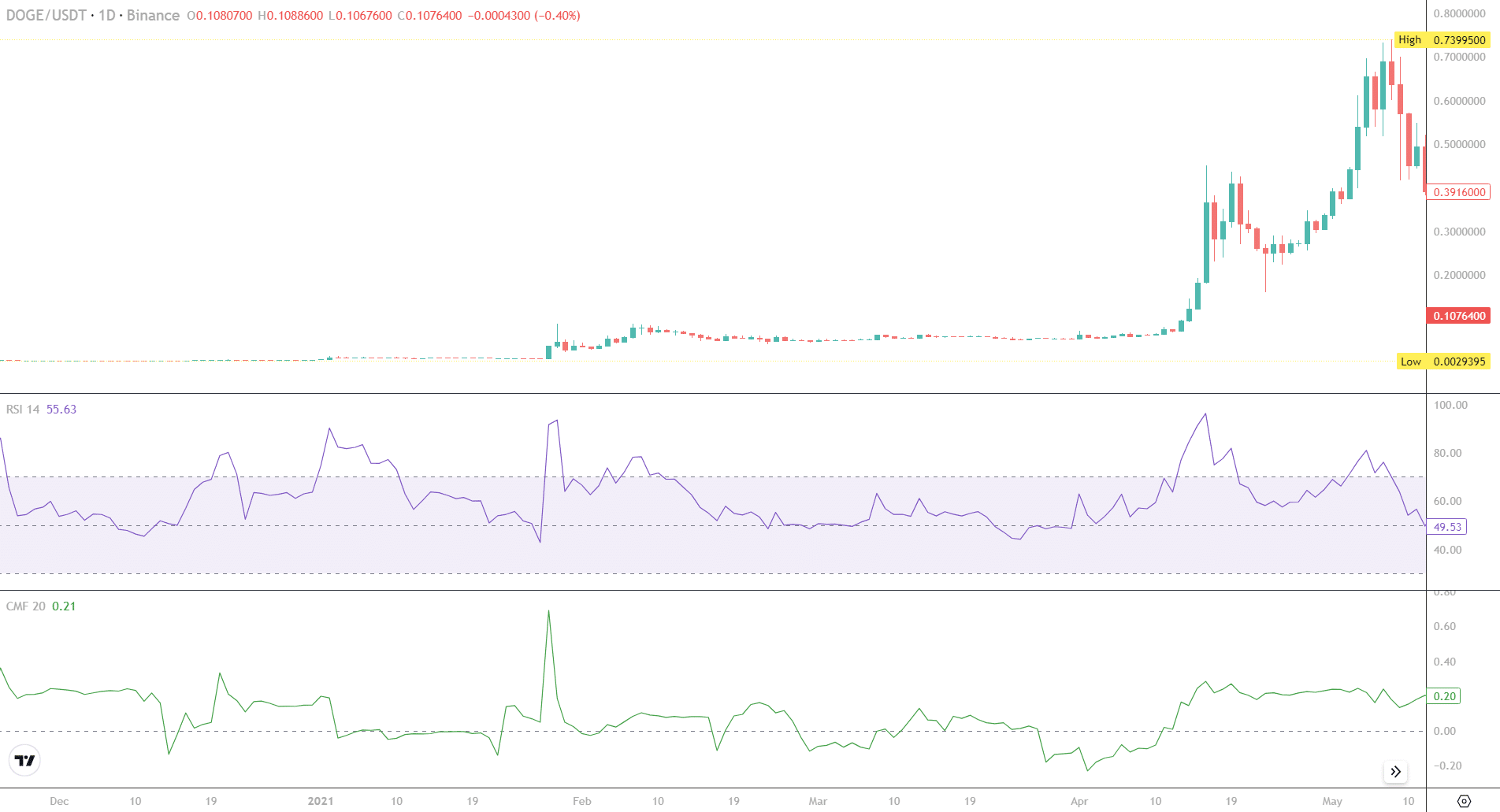

Uncovering the historic 2021 cycle

On the daily price chart, DOGE’s parabolic rally in early 2021 propelled it to prominence, surging 1,333% in just 2 days and closing at $0.0459054.

This was followed by a bullish move weeks later, where DOGE skyrocketed 10,351% over 100 days, reaching an ATH of $0.70. Put simply, that rally provided historic gains for profiteers; however, losses ensued after, with DOGE currently trading at $0.1075.

In contrast, WIF has not yet seen a parabolic rally but looks poised for one. If a similar trend develops, WIF could break its ATH by retesting its mid-July cycle, provided it holds support at $1.70.

Adding to the optimism are Bitcoin’s historic patterns, as October has often proven bullish. This could serve as an additional catalyst for the memecoin to break out from its month-long consolidation.

If the trend holds, WIF may be positioned for a significant correction during the first quarter of next year.

If specific conditions align

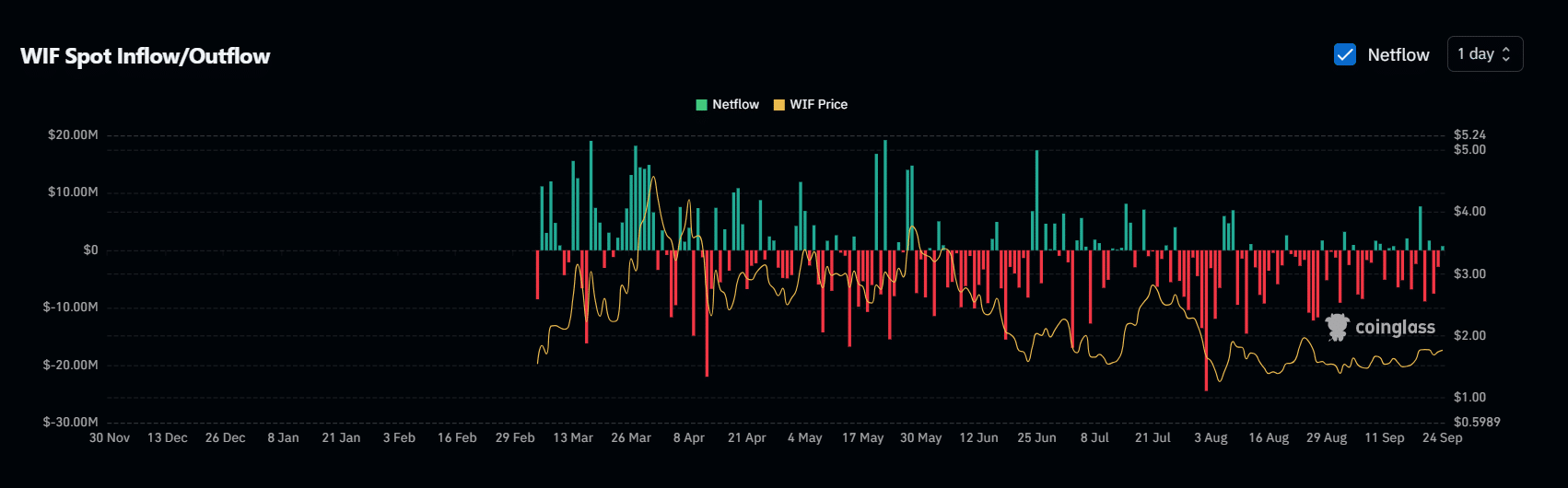

Typically, holders aim to identify a price bottom to begin accumulating before a surge drives prices higher. In the case of WIF, AMBCrypto observed a similar trend.

As previously mentioned, retesting mid-July resistance is crucial for reversing the trend. Supporting this idea are holders who have increased WIF withdrawals, highlighted by a spike in net outflows reaching $26 million on the day WIF hit its bottom at $1.664.

In short, the necessary condition for a price correction is stakeholders refraining from entering the distribution phase. Keeping a watchful eye on that aspect is crucial.

Meanwhile, speculative trading has seen a sharp decline since early August, moving in tandem with WIF’ price. According to AMBCrypto, a reduction in OI could be a bullish sign, making the price less vulnerable to sudden swings.

As futures traders retreat, control may increasingly shift to the spot market. If holder interest remains strong, the chances of a reversal intensify. Therefore, capitalizing on this trend is crucial for anticipating a bullish move forward.

Spot traders must capitalize on this for a WIF reversal

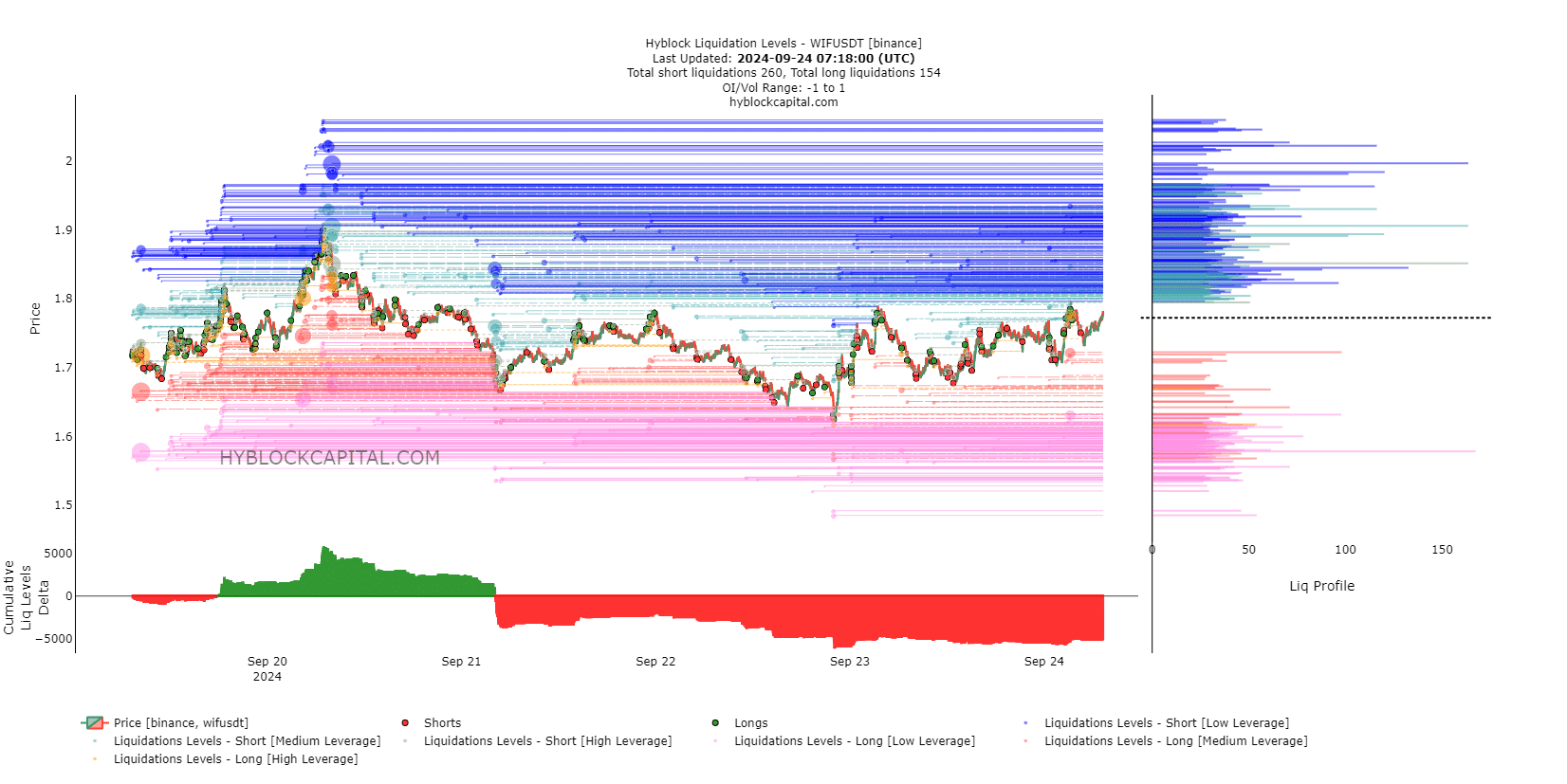

Three days ago, as bears thwarted another attempt to push WIF near its previous rejection at $1.90, longs retreated, resulting in a significant influx of short positions.

While this may not seem bullish, a calculated strategy by spot traders could reset WIF for a breakout. Typically, a slight upward trend forces shorts to close their positions. Since shorts currently dominate, if spot traders continue accumulating, it could trigger massive liquidations.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

In summary, if spot traders enter and bears retreat, a resurgence of crypto longs could push WIF toward the $1.90 range. If this trend holds, the next resistance could be expected near $2.

Overall, given the current market dynamics, the potential for a breakout is clearly present, contingent on traders capitalizing on this strategy.