Bitcoin, reaching new highs around $76,990 on Bitstamp following Donald Trump’s recent U.S. presidential election win, has entered price discovery territory.

With market dynamics shifting, analysts are forecasting an ambitious price target of $100,000 for BTC, possibly before Trump’s inauguration in January.

Analysts Forecast Bitcoin Surge Following Trump’s Election Win

In the wake of Trump’s presidential win, Bitcoin has demonstrated robust price growth, with investors and analysts increasingly optimistic about a favorable regulatory climate under his administration. According to Ryan Lee, Chief Analyst at Bitget Research, Bitcoin is well-positioned to breach the $100,000 mark. Lee suggests this outlook is driven by substantial open interest in Bitcoin futures markets and an influx of stablecoin liquidity, both factors that support heightened market volatility and BTC price increases.

“The market capitalization of stablecoins is reaching around $160 billion, which enables substantial leverage in Bitcoin’s price movements,” Lee explained, adding that this influx could push Bitcoin toward $100,000 within three months.

Supporting Predictions from Market Research

A recent report from Copper.co, a digital asset custodian, aligns with this bullish outlook. Copper.co’s research points to a positive price trajectory for Bitcoin that may continue into the new year, potentially achieving the $100,000 benchmark. Fadi Aboualfa, Head of Research at Copper.co, cited factors like heightened market optimism and the possibility of favorable crypto policies under the incoming administration.

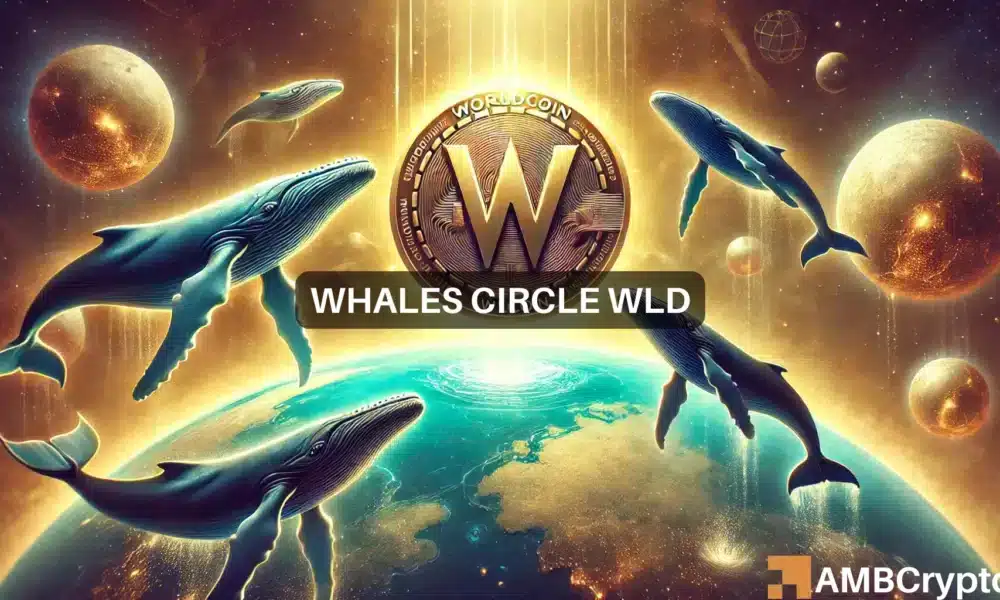

“Bitcoin reaching $100,000 is plausible as we approach inauguration day,” Aboualfa said. He referenced trends in spot Bitcoin accumulation by ETFs, which currently hold approximately 1.1 million BTC—a significant amount that can further impact Bitcoin’s price trajectory.

Copper.co’s insights also highlight the back-tested trends in ETF-based Bitcoin accumulation, aligning with the projection of a $100,000 target.

Market Indicators Signal Potential Parabolic Movements

Technical analyst Gert van Lagen suggests Bitcoin’s recent breakout from a descending broadening wedge pattern indicates a possible parabolic move, setting BTC on a path toward $200,000 in the longer term. His chart analysis shows Bitcoin completing a reaccumulation phase, with the current price discovery phase potentially setting a new upper price range of $90,000 to $100,000. Van Lagen anticipates further significant gains, potentially reaching $200,000 by mid-2025.

Macro Conditions and Policy Outlook

As Bitcoin’s price continues to surge, analysts are watching macroeconomic trends closely. Lee predicts that inflation in the U.S. may stabilize above 3.5% in the medium to long term, a condition that could add upward pressure on Bitcoin’s price as investors seek inflation-resistant assets. Expectations around Trump’s policies are also anticipated to provide clearer regulatory direction for the cryptocurrency industry, which could facilitate innovation and boost confidence in digital assets.