Bitcoin (BTC), the world’s biggest cryptocurrency is poised for a massive price crash as whales and institutions have dumped notable BTC in the past 24 hours. On September 5, 2024, prior to the opening of the US Stock market, a smart Bitcoin whale dumped a significant 680 BTC worth $38.77 million to the Binance.

Whale Sell-off Millions Worth BTC

This smart whale purchased a significant 4,562 BTC worth $120.66 million at an average price of $26,449 in late 2022. However, he sold 3,938 BTC worth $181 million when BTC was trading near the $46,000 level. Combining all these sell-offs, this smart whale has made a profit of approximately $96 million.

The recent massive dump occurred when BTC was trading near the $57,000 level and formed a strong bearish candle on the four-hour time frame. Since this dump, the BTC price has been continuously falling, heading toward the $54,000 level. Additionally, dormant BTC holders have also become active, which is a potentially bearish sign.

Bitcoin Price Could Fall to $54,000 Level

According to expert technical analysis, BTC looks super bearish. It is also forming a pattern where each recent high price is lower than the one before, and each low price is also lower. This suggests a downward trend. If BTC closes a four-hour candle below the $56,000 level, there is a strong possibility it could fall to the $54,000 level in the coming days.

On-Chain Metrics Signaling Massive Sell-off

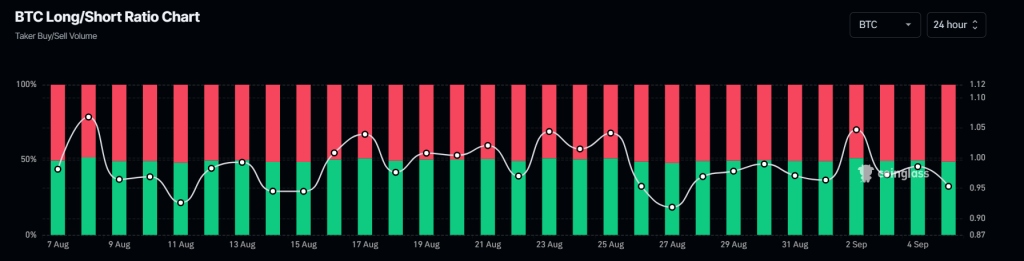

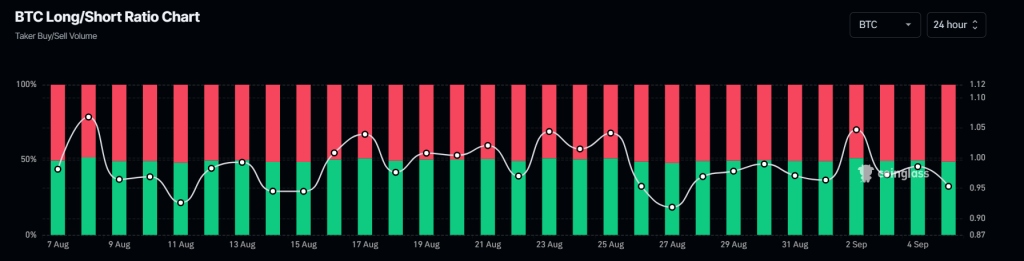

Besides this price action, BTC’s on-chain metrics data is also signaling a massive sell-off. CoinGlass’s BTC Long/Short Ratio chart is below one and currently stands near the 0.953 level indicating a bearish sentiment among traders. At present, 51.2% of top BTC traders are holding bearish short positions, while only 48% are holding long positions.

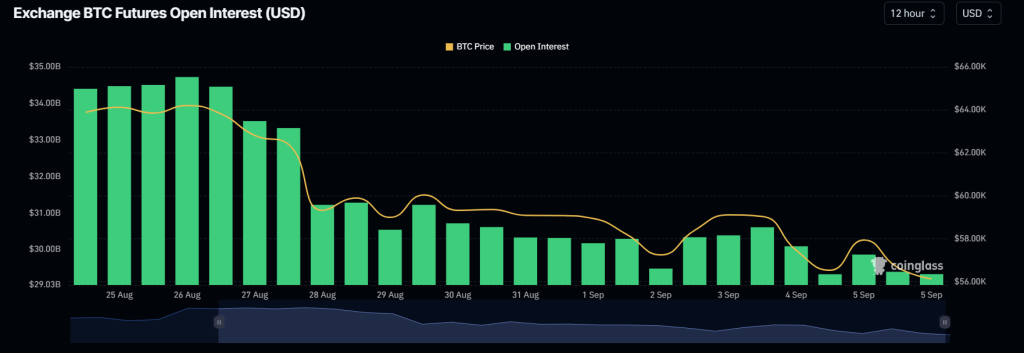

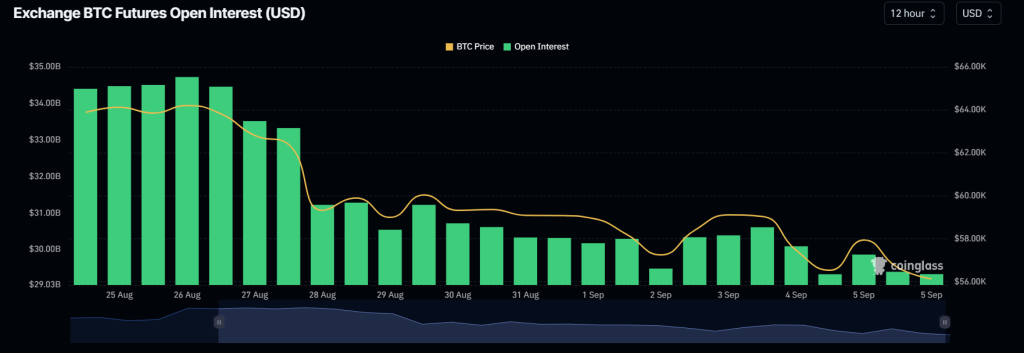

Additionally, BTC futures open interest has been continuously falling, indicating lower interest from top traders amid bearish sentiment. Since August 24, 2024, the BTC’s open interest has dropped from $34.72 billion to $29.33 billion.

Bitcoin Price Momentum

At press time, BTC is trading near the $55,900 level and has experienced a price drop of 3.7% in the last 24 hours. Meanwhile, its trading volume has increased by 12% during the same period, indicating higher participation from traders amid this sharp price decline.