Key Points

- While Bitcoin struggles below $70,000, a new bull run could propel the coin to $100,000 by February.

- Multiple factors could catalyze the upward move for BTC.

Over the past year, Bitcoin recorded a price surge of around 100%, but the coin still has to climb more to reach its March ATH above $73,000.

Network economist and author of “Metcalfe’s Law as a Model for Bitcoin’s Value” Timothy Peterson, weighs in on the possibility that BTC will reach $100,000 by February 2025.

The $100,000 Case For Bitcoin

According to Peterson, Bitcoin’s current trajectory is not that different compared to historical price paths, and this puts a big dent in the “diminishing marginal returns” argument.

In a recent post via X, he noted that a move just above the trend would place BTC on track for $100,000 within 90 days, meaning that the coin could reach six figures by February next year.

He shared a graph, explaining that the red line mirrors a conservative scenario that propels BTC around the level mentioned above by next year, and this is likely to happen regardless of the US election result, he says.

Peterson mentioned more metrics that show that BTC is not currently overpriced while highlighting that a drop below thr $60,000 level becomes less and less likely.

According to his graph, BTC is currently positioned around the ignition of a new bull market.

Historical data shows that BTC should enter the first stage of a new bull run. Peterson calls the period before this “ignition point”, the “Pre-flight” representing the price trajectory ahead of the ignition point.

His graph reveals price moves since the 2015-2017 and the 2019-2021 bull markets, scaled to 2023-2024, with standard deviation ranges.

If things go according to the chart and historical data, a 2nd stage of the bull market should also take place in 2025, around 900 days after the bottom.

Potential Upcoming Cycle Culmination

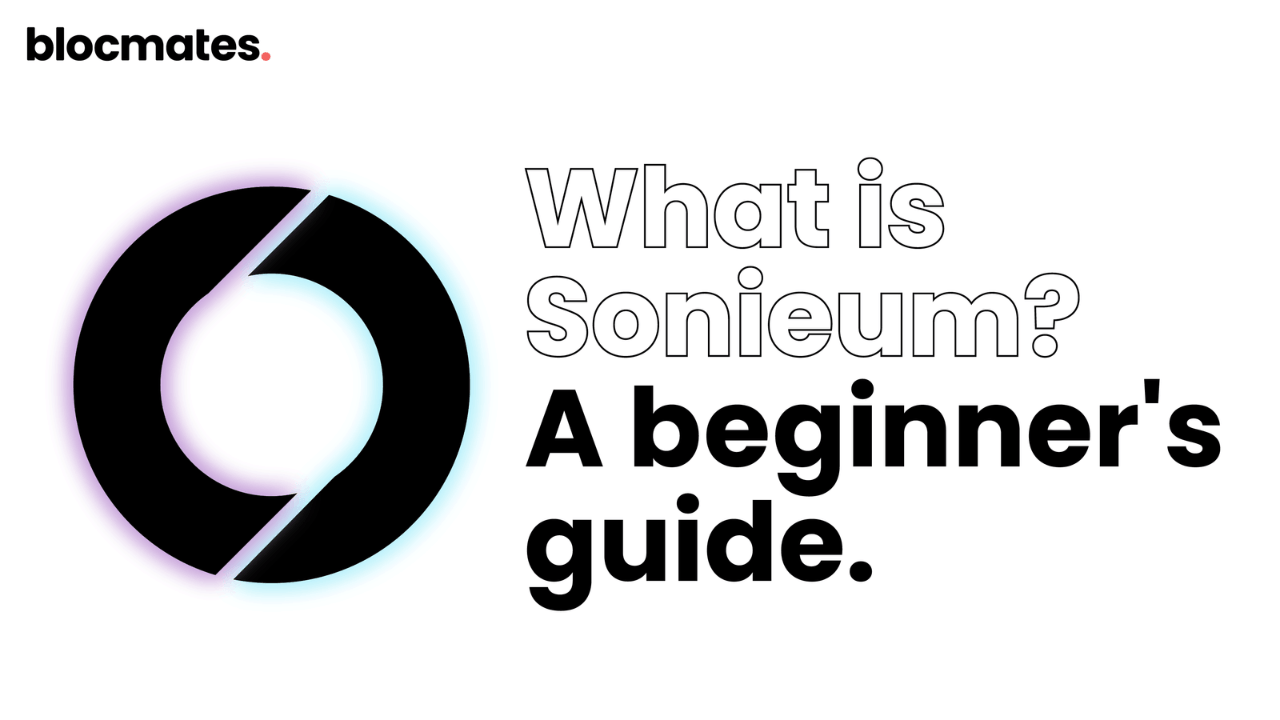

Regarding the potential future trajectory of Bitcoin, another metric worth analyzing is the LTH/STH SOPR Ratio.

LTHs or long-term holders are entities holding Bitcoin for more than 155 days, and STHs or short-term holders are wallets that hold BTC for less than 155 days.

This is currently at 1.8, and as CryptoQuant author, Axel Adler, noted today, when this metric rises to a level of 7, there will be a risk of cycle culmination, followed by a downward trend in prices, as seen in the graph below using data from 2015 and 2019.

Now, there’s a bullish cross of the metric with its 90-day moving average.

According to CryptoQuant’s graph, the LTH/STH SOPR Ratio surged from a level of around 0.6 at the beginning of the year to its current level of 1.8. It’s estimated that level 7 of the metric will be reached sometime next year.

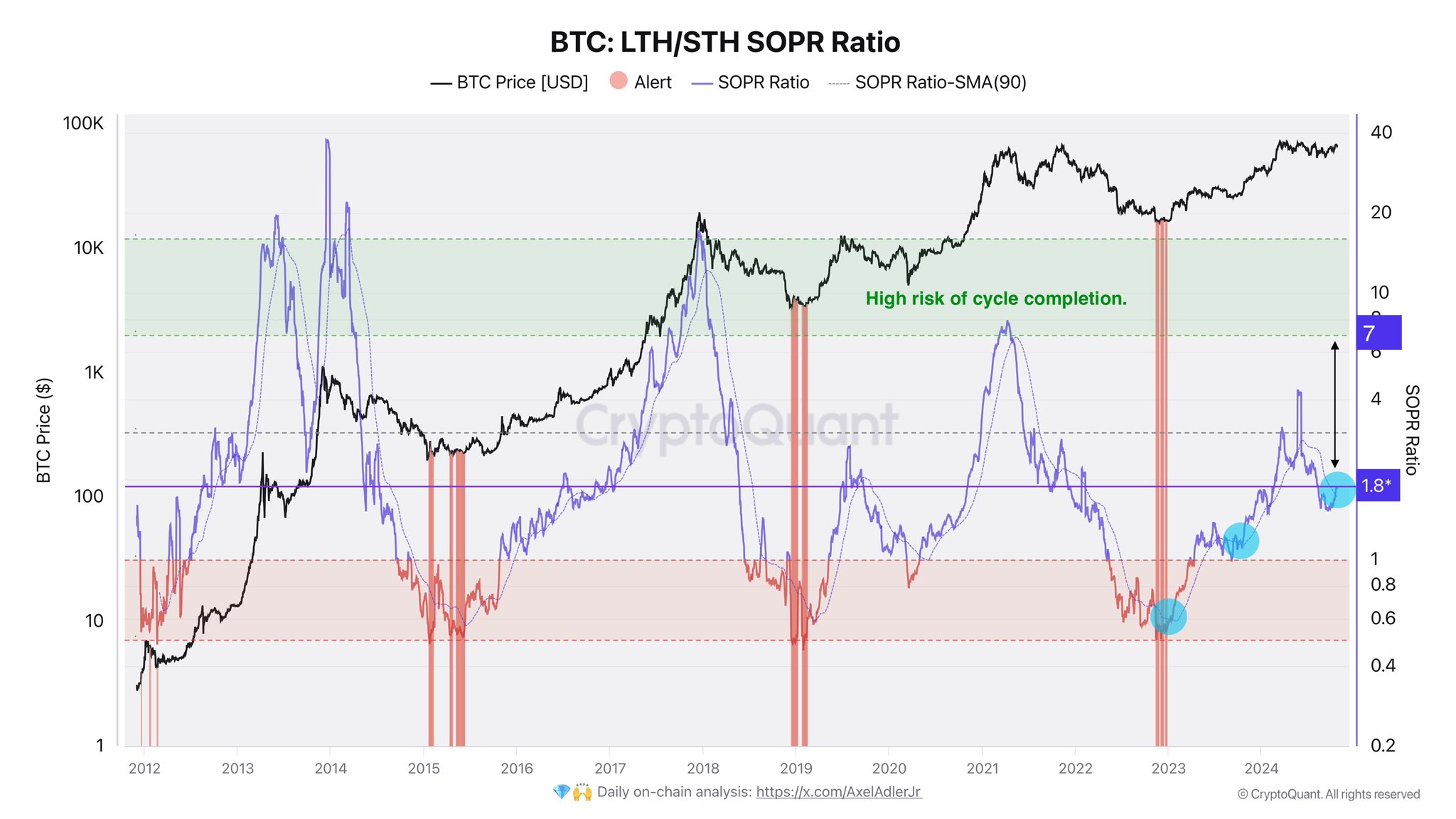

BTC Price Increased Support

Also, recent data from Glassnode shows that net capital inflows in Bitcoin have accelerated, surging by 3.3% or $21.8 billion over the past 30 days. This results in the Realized Cap ticking up to an upcoming new ATH, which could reach more than $646 billion.

Liquidity across the asset class is on the rise, and meaningful capital inflows will support the price increase.

BTC to $100,000 Next Year, A Viable Possibility

Peterson’s prediction odds of Bitcoin reaching $100,000 by February 2025 are not related to the outcome of the US Presidential Elections scheduled for November 5, however, it helps that both parties have been boosting Bitcoin and crypto’s popularity in 2024.

This year, BTC’s price rise was supported by the launch of BTC ETFs in the US which bought almost 1 million BTC so far, and the intensifying crypto adoption around the world. The best example that supports the latter claim is that Bitcoin became a focus on the political scene in the US ahead of the elections, but also during the BRICS latest summit.

Also, the US expects more interest rate cuts which could boost the price of BTC even more, judging by historical moves around the Fed’s rate cuts. The most significant ones were back in 2020, marking the debut of a strong BTC rally.

It’s also worth noting that yesterday, Pennsylvania, an important state in the US elections, propelled Bitcoin and crypto adoption by passing the Bitcoin Rights bill, which protects people’s rights to self-custody BTC and crypto.

Important Bitcoin metrics, along with a favorable political and economic climate, could push BTC to $100,000 in 2025, but it remains to be seen whether this materializes by February.

At the moment of writing this article, BTC is trading near $68,000.