- WIF’s Futures Open Interest has dropped by 10% in the last 24 hours, indicating that traders were hesitant to build new positions.

- At press time, 53.4% of top WIF traders were holding short positions, while 46.6% were holding long positions.

After a decent market recovery, the overall cryptocurrency market faced selling pressure.

During this downturn, popular Solana [SOL]-based meme coin dogwifhat [WIF] has been hit hard, experiencing a notable price drop of over 8%.

WIF’s bearish on-chain metrics

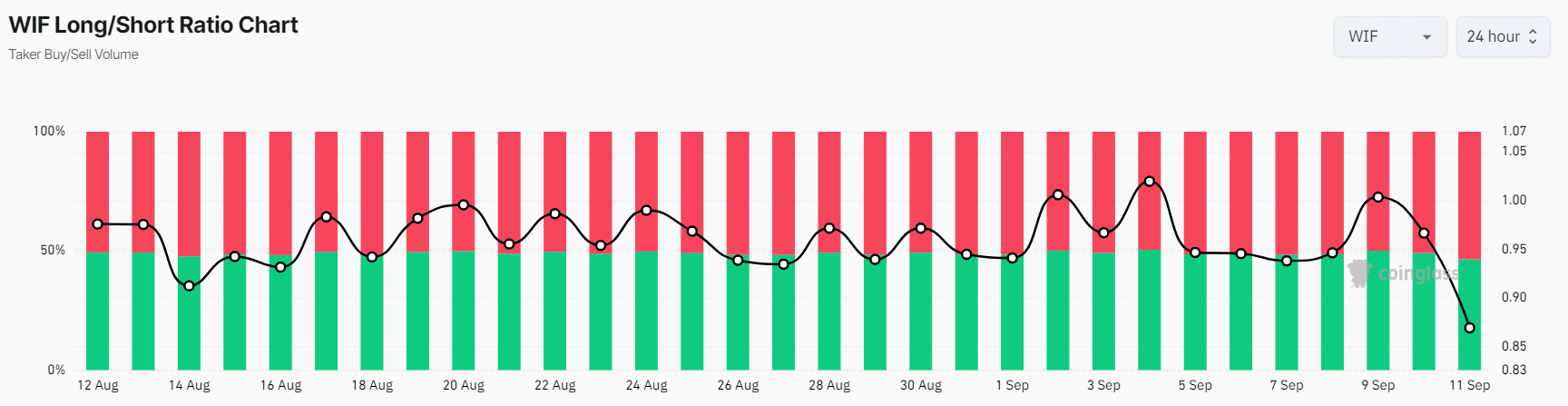

It appears that trader and investor sentiment has turned bearish, according to the on-chain data.

Notably, WIF’s Long/Short Ratio was 0.87 at press time, the lowest since the beginning of August 2024 (a value below 1, indicating bearish market sentiment.

According to data, 53.4% of top WIF traders were holding short positions, while 46.6% were holding long positions.

On the other hand, exchange WIF’s Futures Open Interest dropped by 10% in the last 24 hours, indicating that traders are either liquidating their positions or are hesitant to build new ones.

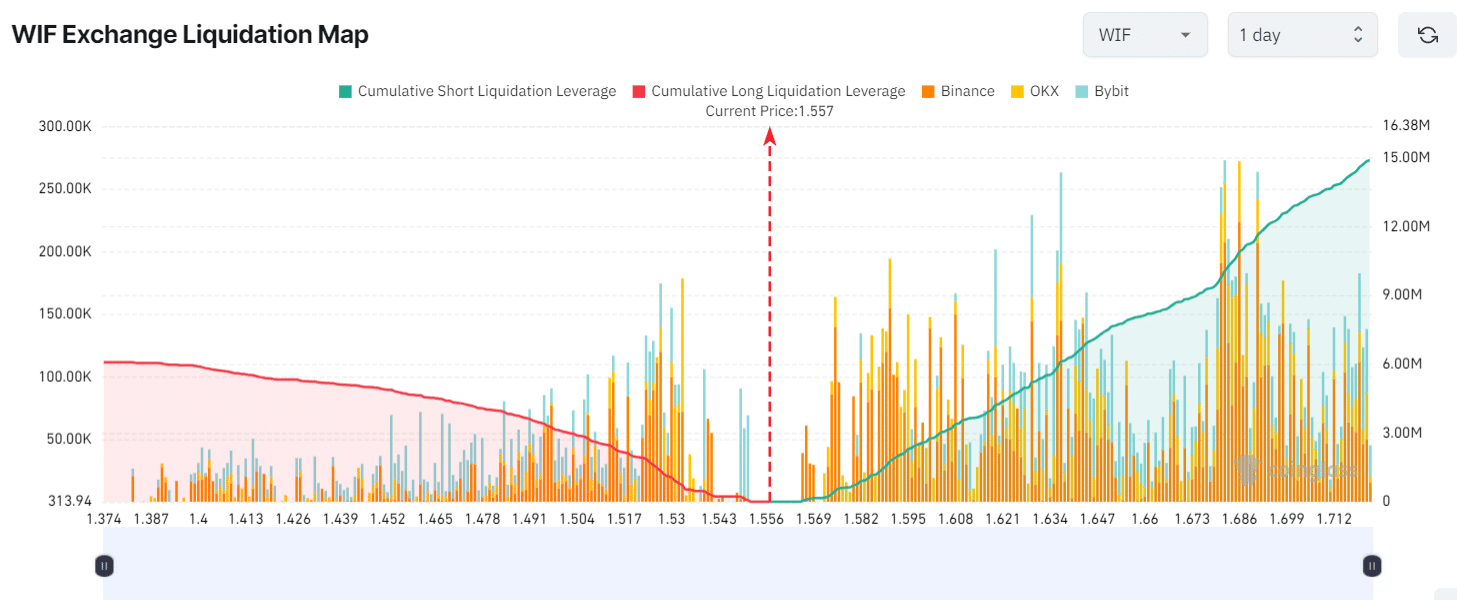

Key liquidation areas

As of press time, major liquidation levels were near $1.52 on the lower side and $1.637 on the upper side, as traders are over-leveraged at these levels, according to Coinglass data.

If the sentiment remains bearish and WIF’s price falls to the $1.52 level, nearly $1.36 million worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to the $1.637 level, approximately $6.13 million worth of short positions will be liquidated.

The data also represented a bearish outlook for the WIF token, as short sellers believed that the price won’t reach the $1.637 level and were over-leveraged at this point.

It also indicated that the bears were dominating the asset, with a high potential for a price decline in the coming hours or days.

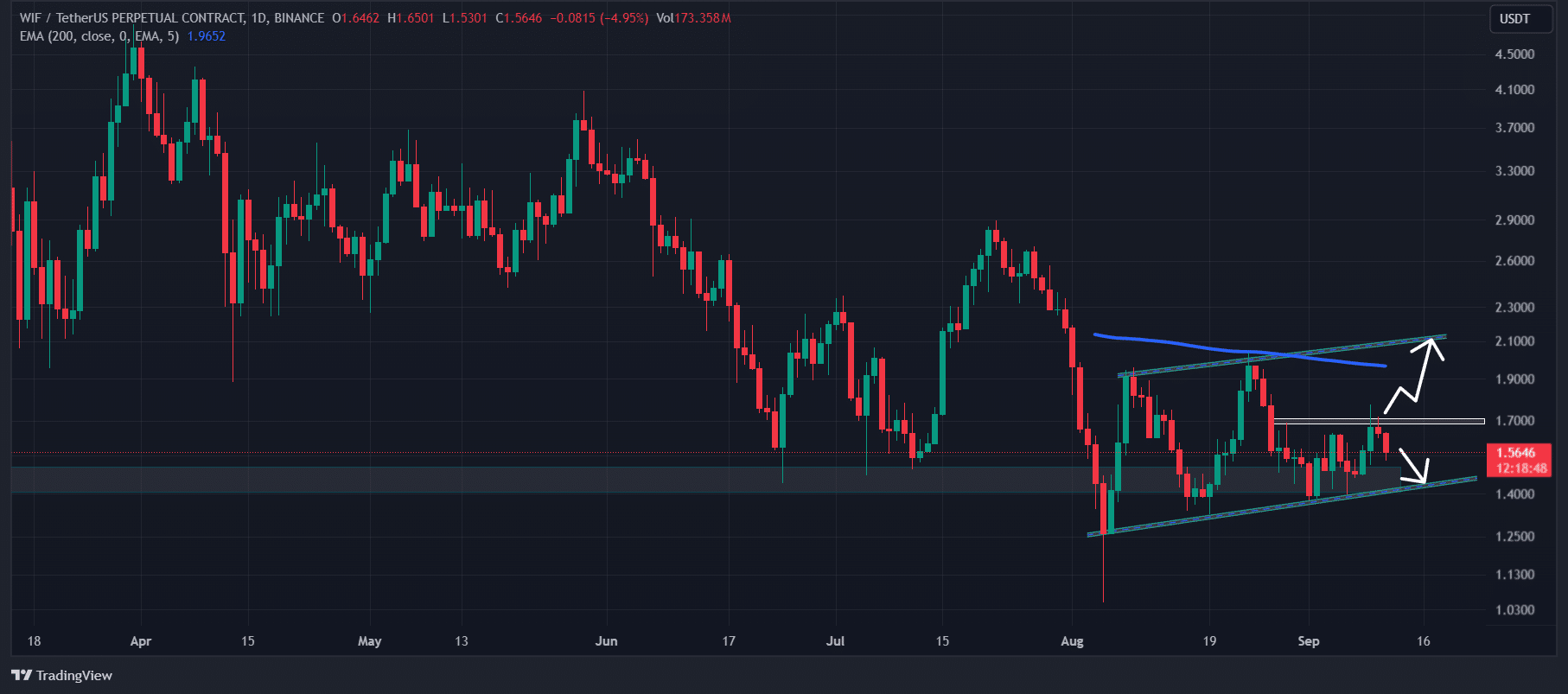

WIF price momentum

At press time, WIF was trading near the $1.54 level, experiencing a price drop of over 8% in the last 24 hours.

Its trading volume has dropped by 40% during the same period, indicating lower participation from traders amid the recent price decline.

WIF traded below the 200 Exponential Moving Average (EMA) on a daily time frame. Additionally, it moved within an ascending channel pattern, and WIF was heading toward the lower boundary of the pattern.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Based on the historical price momentum, there is a high possibility that WIF could experience a 10% price drop to the $1.43 level.

This bearish outlook will hold as long as WIF trades below the $1.70 level; otherwise, it may be invalidated.