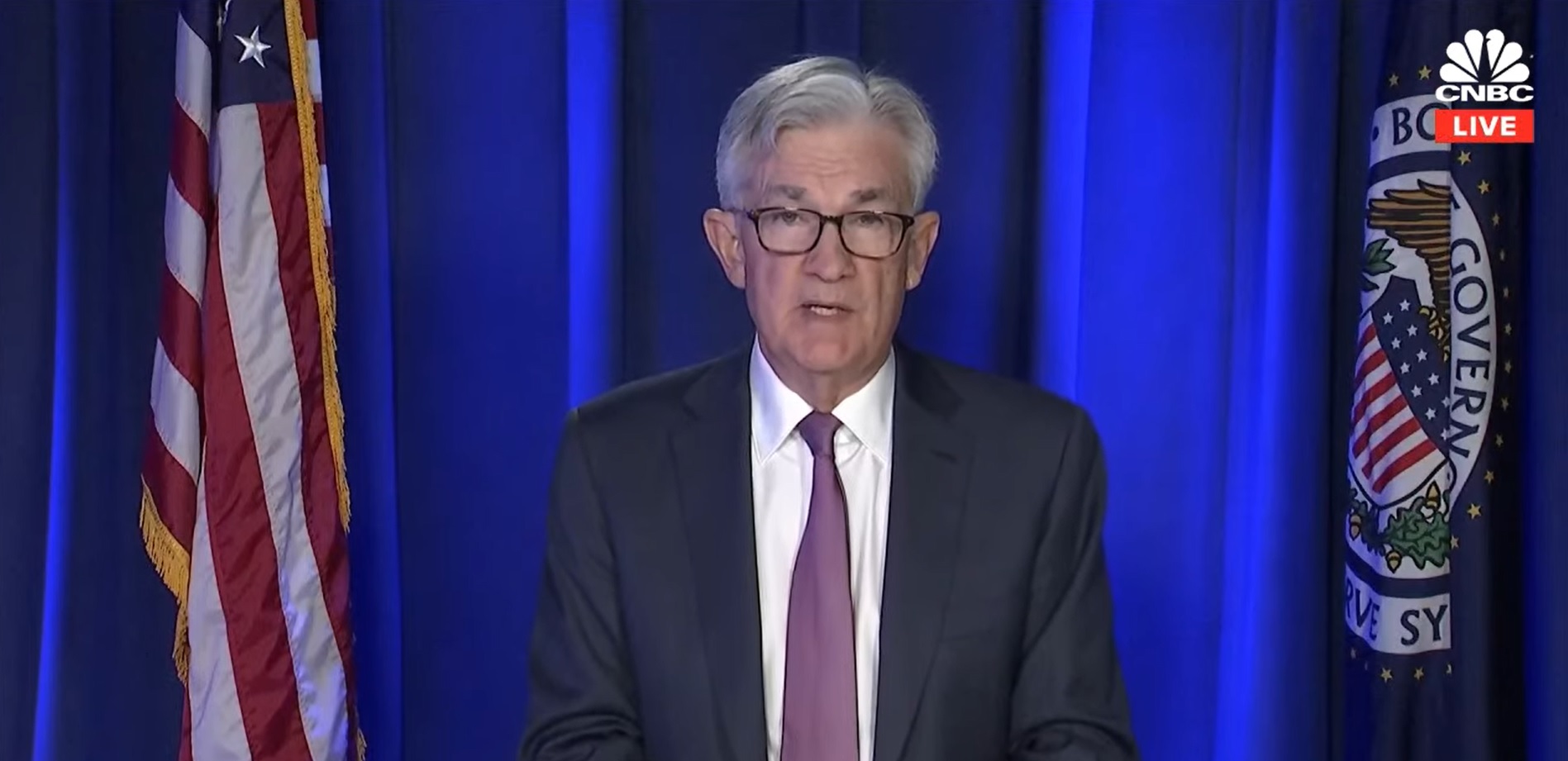

President-elect Donald Trump will give Federal Reserve Chair Jerome Powell time off to finish his term, which ends in May 2026, according to a senior adviser to Trump’s transition team.

While Trump has historically clashed with Powell over the Fed’s monetary policies, his current stance and that of his economic team is for Powell to remain in place as the Fed continues its recent trend of lowering interest rates.

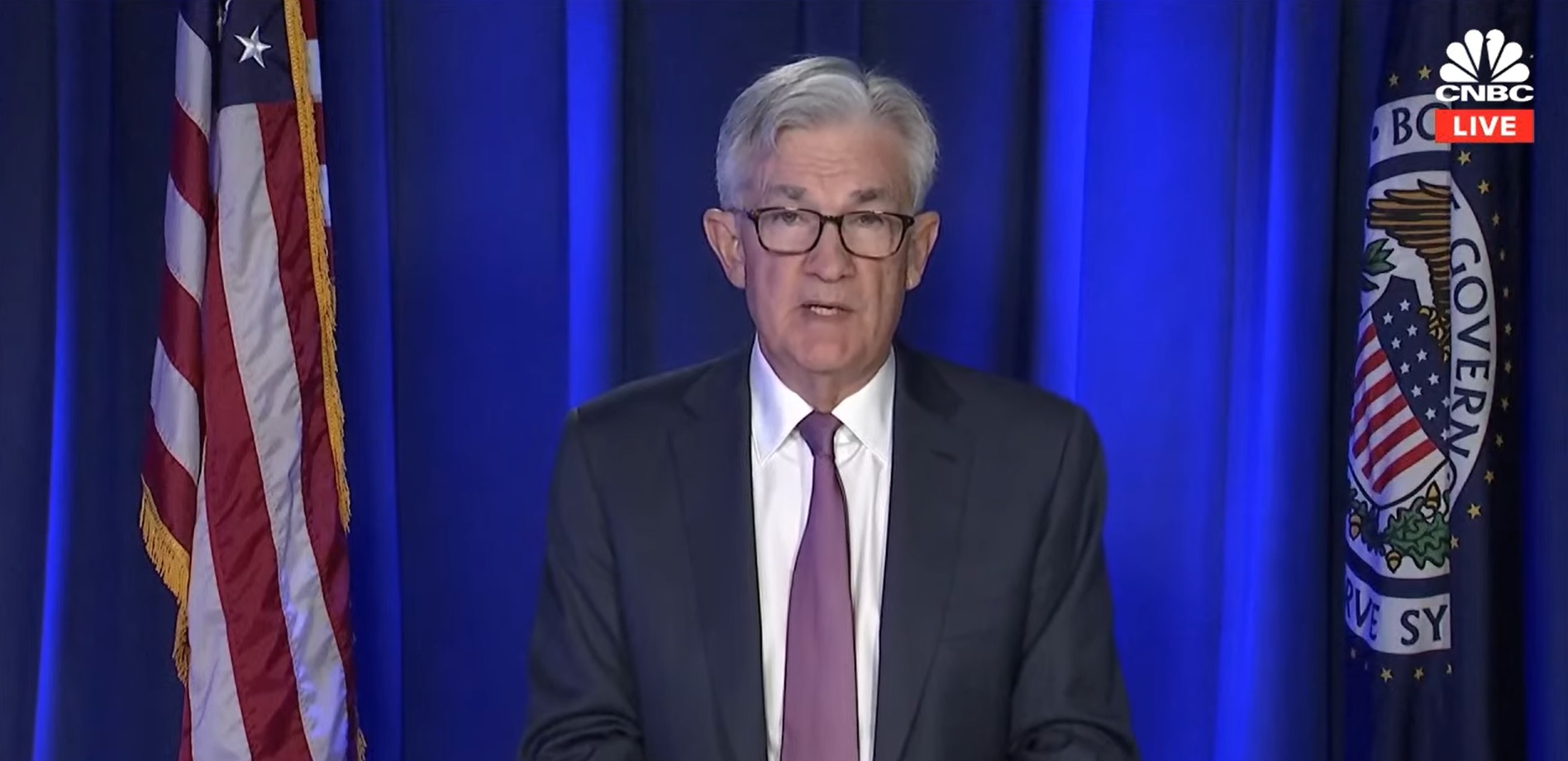

Powell, who was first appointed by Trump in 2018, was reappointed to a second term by President Biden. Powell, known for his private equity background, has faced criticism from Trump, who has questioned his leadership and the transparency of the Fed’s policy meetings, which are held privately and whose notes are released only weeks later. Reports suggest Trump has floated the idea of live meeting feeds and faster release of Fed minutes, as well as other changes that would increase transparency.

Despite Trump’s history of criticizing Powell and hinting at his removal, he has no legal basis to fire a confirmed Fed chair, barring legal misconduct. The tension between the two became apparent in 2018, when Trump considered replacing Powell after the Fed raised interest rates, and again during the pandemic in 2020. In recent comments, Trump has downplayed the role of the Fed chair, joking that the job involves little more than “flipping a coin.”

While Powell has a lot of influence, the Fed’s interest rate decisions are made collectively. The chairman and 11 other officials vote at each Federal Open Market Committee meeting, providing a broad perspective on policy decisions.

Other possible candidates Trump could consider for the future Fed leadership include Kevin Warsh, a former Fed chairman, and Trump’s former chief economist Kevin Hassett. Trump’s former economic advisor Gary Cohn has expressed interest, though Trump’s opposition to steel tariffs makes him an unlikely choice.

For now, Trump’s focus appears likely to remain on Powell, whose leadership he is expected to tolerate, if not enthusiastically endorse, while continuing his role in guiding U.S. monetary policy.

*This is not investment advice.