Layer-1 (L1) blockchain Sui has achieved a series of milestones over the past month. This positions its native coin, SUI, to potentially reclaim its all-time high of $2.16 in October.

The bullish sentiment surrounding the altcoin makes this even more likely. As market participants anticipate a broader market rally in October, SUI holders may pocket some gains.

Sui Network Records Growth

The surge in SUI’s Total Value Locked (TVL) is one of its most important milestones over the past month. At $1.07 billion, the L1’s DeFi TVL sits at its highest level, noting a 65% uptick in the past 30 days.

This TVL rally is a net positive for the SUI coin because the surge suggests growing confidence in Sui’s utility. As more value flows into the network, it can create upward pressure on the coin’s price. Investors often view rising TVL as a bullish signal, attracting more buyers and potentially leading to SUI price appreciation.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

Moreover, Sui’s TVL is anticipated to increase in October, following the mainnet launch of its Sui Bridge. The Sui Foundation announced the bridge’s launch yesterday, enabling secure asset transfers between the Ethereum and Sui networks. This development is expected to attract a new wave of users and boost liquidity on the network, which could, in turn, drive up the price of SUI.

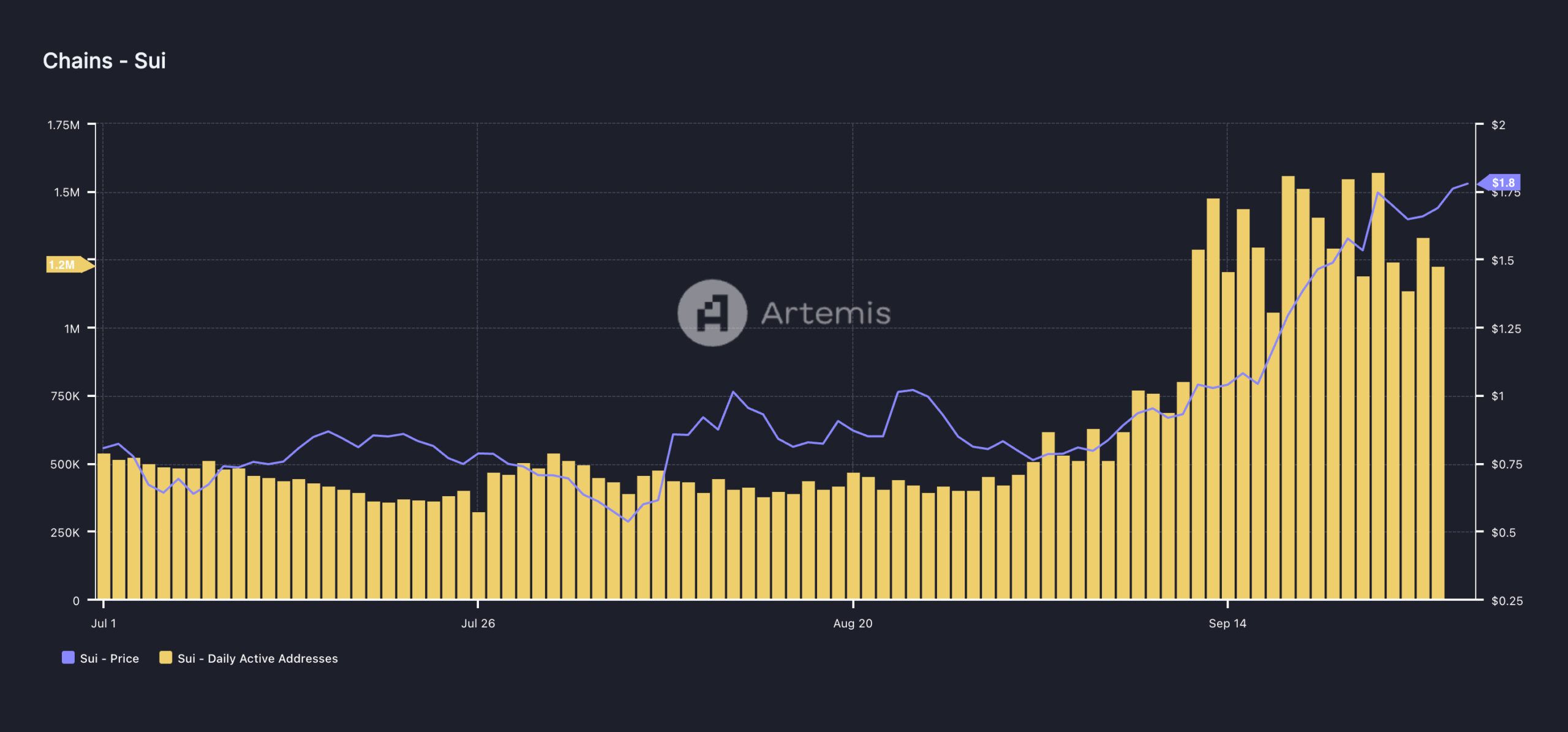

The steady rise in Sui’s daily active addresses supports the bullish thesis for its native coin. Artemis’ data shows that the number of unique addresses that have completed at least one transaction on the Sui network in the past month has skyrocketed by 140%. As such, SUI may experience a heightened demand, driving its price to reclaim its all-time high.

Sui Price Prediction: All-Time High Is the Next Target

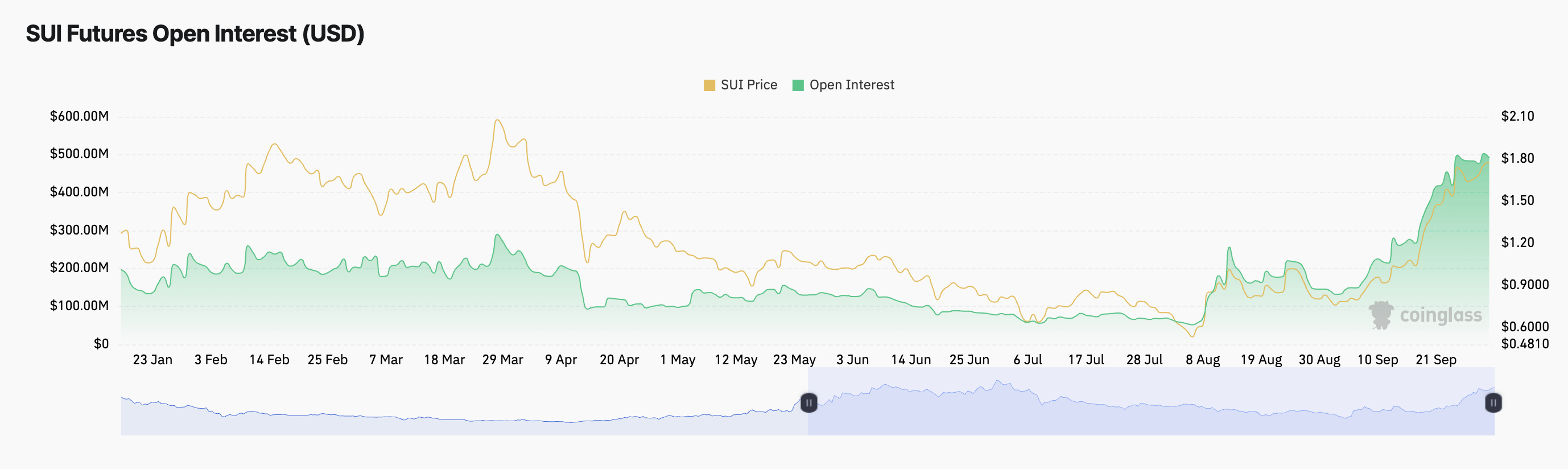

SUI’s rising open interest further supports a bullish outlook. At $750 million, it has reached its highest level since January.

Open interest measures the total number of outstanding derivative contracts that have not yet been settled. A rise in open interest typically signals new capital entering the market and increased buying activity, indicating a bullish trend.

If this buying momentum continues, SUI may reclaim its all-time high of $2.18. Fibonacci Retracement readings suggest this target is attainable, as SUI has broken through key resistance levels on its way to that price.

Read more: Everything You Need to Know About the Sui Blockchain

However, if selling pressure increases, SUI’s price could fall toward $1.11, attempting to establish it as a support floor. Failure to hold this line could result in a further decline to $0.86.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.