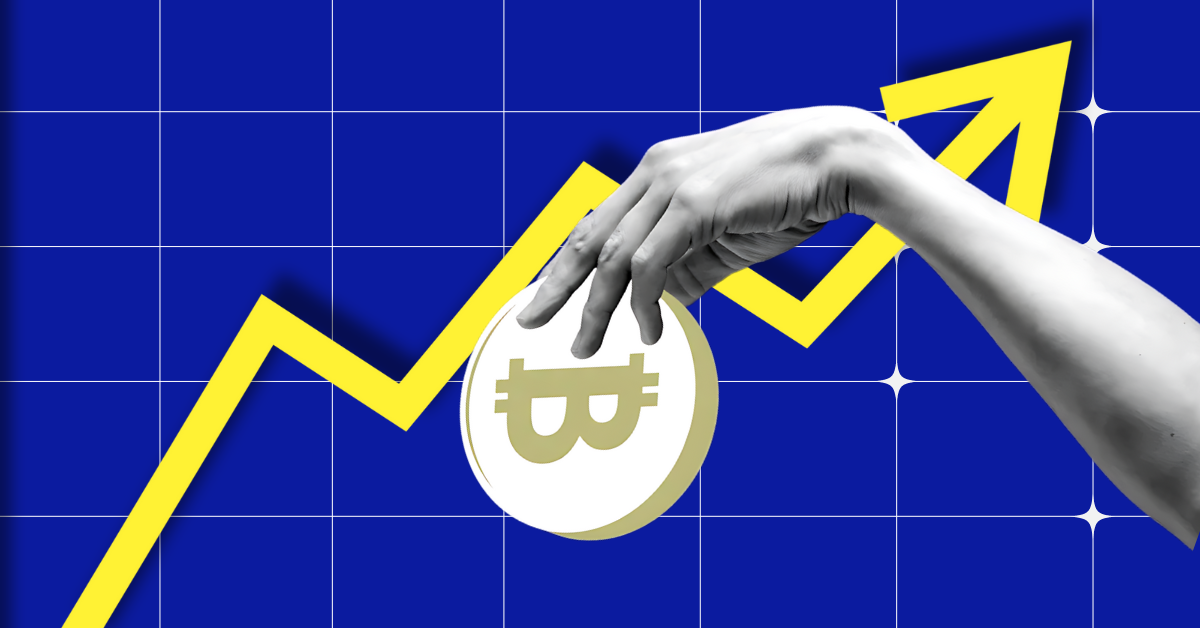

Bitcoin is on the edge of a major move as it tests a key level for the third time since August. According to well-known crypto chart analyst Ali Martinez, this level could signal a significant move for Bitcoin, potentially leading to a bullish breakout. The last time Bitcoin broke through this level, it surged to $70,000. Could we see another massive price jump soon?

Importance Of 200-Day SMA

Bitcoin has seen an impressive surge of over 8.7% in the past week, following the recent Fed rate cut announcement. This upward momentum has pushed the cryptocurrency to $63k, pushing it within striking distance of the crucial $64k mark of the 200-day Simple Moving Average (SMA).

The 200-day Simple Moving Average (SMA) is one of the most important indicators used by traders, as it shows the average price over the last 200 days. This line gives a long-term view of the market trend, and when Bitcoin crosses above it, it often hints at an upcoming bullish move.

Bitcoin Approaching Critical Level

Crypto analyst Ali Martinez highlights that Bitcoin is currently testing this critical level, sitting around $63,176, for the third time since August. After several attempts to push through this resistance since August, it has returned to test this level again.

Back in October 2023, Bitcoin broke above its 200-day SMA at around $28,000, igniting a massive rally fueled by excitement over a potential spot Bitcoin ETF approval in the U.S. This led to Bitcoin reaching an all-time high of over $70,000 by March.

Now, similar conditions are in play. With the recent approval of options trading for BlackRock’s Bitcoin ETF and increasing institutional interest in crypto, many experts believe another breakout is on the horizon.

Meanwhile, a sustained move above the 200-day SMA could kick off a fresh bull run, pushing Bitcoin back into the $64,000 to $74,000 price range and attracting even more investors into the market.

Bitcoin Liquidations Show Caution

Bitcoin is currently hovering near its 200-day Moving Average (MA), a crucial level for traders. According to data from CoinGlass, around $16.42 million worth of long positions and $7.12 million in short positions were liquidated in the past 24 hours.

This shows that traders are treading carefully, with liquidation levels suggesting there is little downward pressure on the market right now.