MANA, Decentraland’s native cryptocurrency, has seen an impressive 70% price increase over the past week. This MANA crypto price surge is part of a broader rally in Metaverse-related tokens, which has caught the attention of the market.

While the development might have surprised some, a closer look by BeInCrypto provides insights into the catalysts behind this movement. This on-chain analysis looks at what could be next for the token.

Decentraland Active Addresses, Volume Reach New Heights

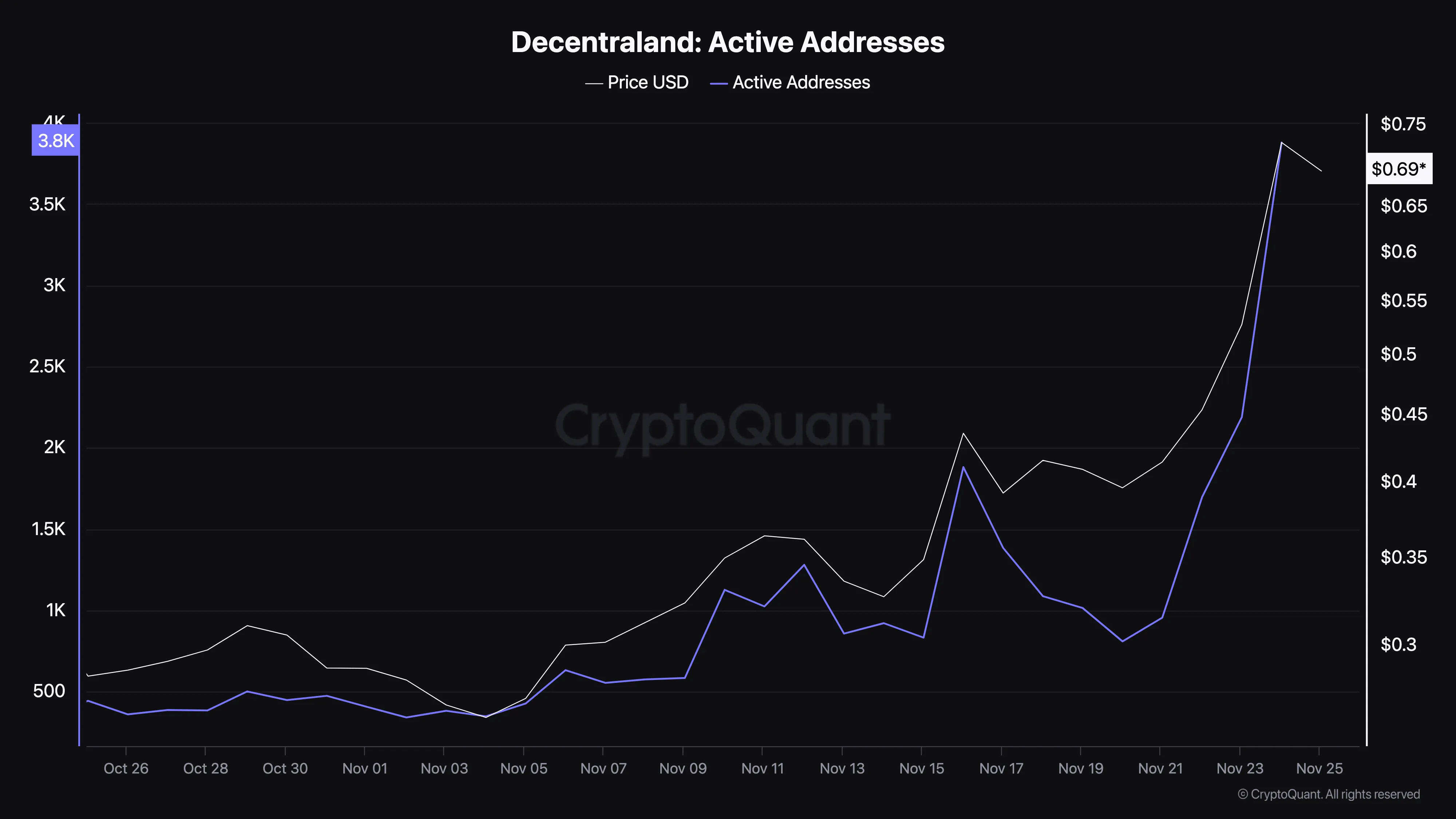

The recent rally in MANA crypto price can be attributed to a significant increase in the token’s active addresses, which indicates heightened user interaction on the blockchain. Interestingly, this also matches the condition of The Sandbox (SAND), which was also one of the frontrunners of the Metaverse revival.

Active addresses measure the number of unique users successfully completing transactions. A rise in this metric signals increased engagement with the network, which is often considered bullish for a cryptocurrency. Conversely, a decline implies reduced traction, which is typically seen as bearish.

On November 20, MANA’s active addresses were around 810. Fast-forward a few days, and this figure has surged nearly fivefold, reflecting a growing interest in the token. This spike in activity likely provided the momentum for MANA’s price to climb from $0.40 to $0.70 — the highest level since March.

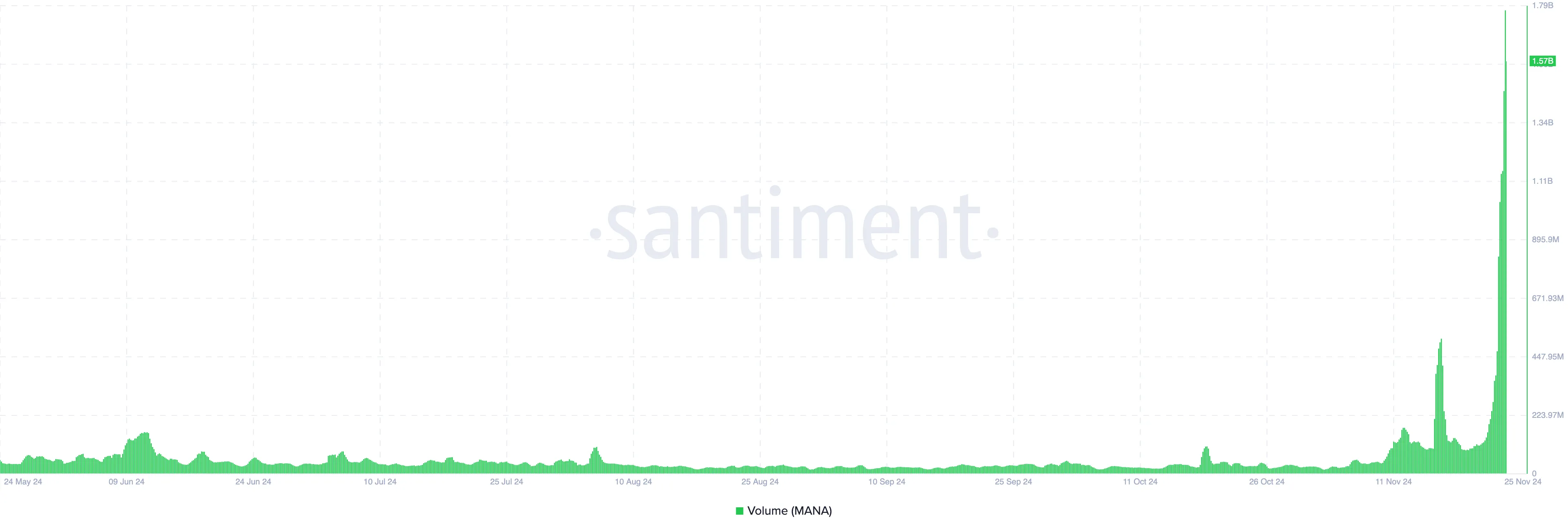

Following the development, Santiment data showed that MANA’s volume climbed to $1.57 billion. Volume represents the total value of a specific cryptocurrency traded over a defined period.

This metric reflects a coin’s level of activity and liquidity. A high trading volume indicates notable buying and selling, which often suggests strong market participation. On the other hand, low volume may signify reduced activity, leading to weaker market interest.

Therefore, the hike in the token’s volume validated the signs shown by the active addresses. However, since MANA’s price has dropped from its recent peak, it could be challenging to keep up with the uptrend, with this analysis suggesting that another pullback could be close.

MANA Price Prediction: Pullback Imminent

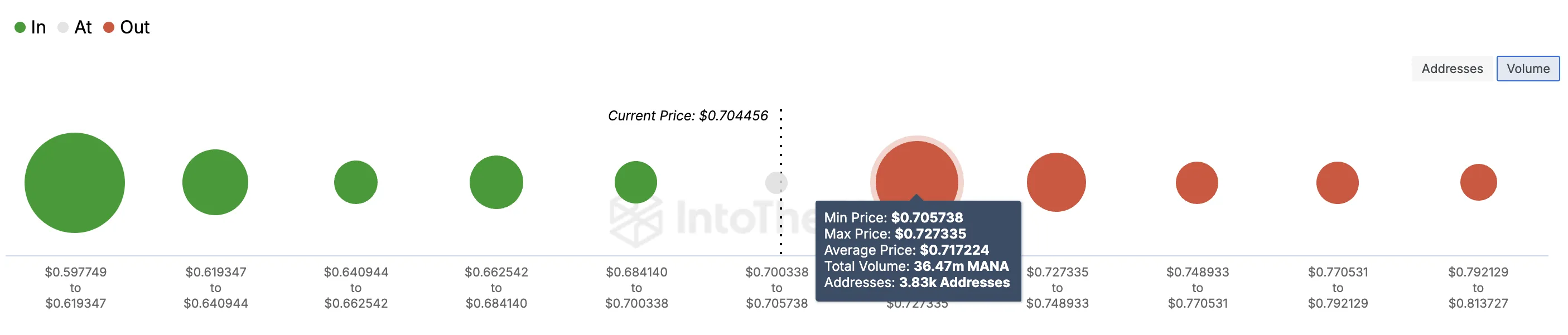

From an on-chain perspective, the MANA crypto price rally might have hit a local top. This prediction is based on the signs shown by the In/Out of Money Around Price (IOMAP).

The IOMAP is a key metric that analyzes the distribution of cryptocurrency holders based on whether their holdings are in profit, loss, or at breakeven. It also provides insights into potential support and resistance levels in the market.

When there are large clusters “out of the money,” this indicates addresses holding at a higher price than the current market value. Such areas often act as resistance. Conversely, Large clusters “in the money” typically act as support, as holders may buy more or hesitate to sell, expecting further price gains.

For MANA, approximately 36.47 million tokens held by addresses that accumulated near $0.70 are currently “out of the money.” This volume surpasses the tokens held between $0.61 and $0.68, marking that range as a key resistance zone.

As such, the MANA crypto price might experience retracement. If that is the case, then the cryptocurrency’s value could drop to $0.61 in the short term.

However, if buying pressure increases and volume outpaces the one at $0.70, this might not happen. Instead, MANA could climb to $0.80.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.