- Toncoin has a strongly bearish short-term bias.

- Traders need to wait for a deviation beneath the range lows before looking to go long.

Toncoin [TON] experienced a tough week. The founder of Telegram, Pavel Durov, was arrested in France and faces a 10-year jail term. This news had a huge negative impact on the Telegram-based altcoin.

The network also saw downtime of more than seven hours, which led to a further erosion of confidence from users. However, the network restoration could ease the severity of the incident over time.

Has TON formed another range?

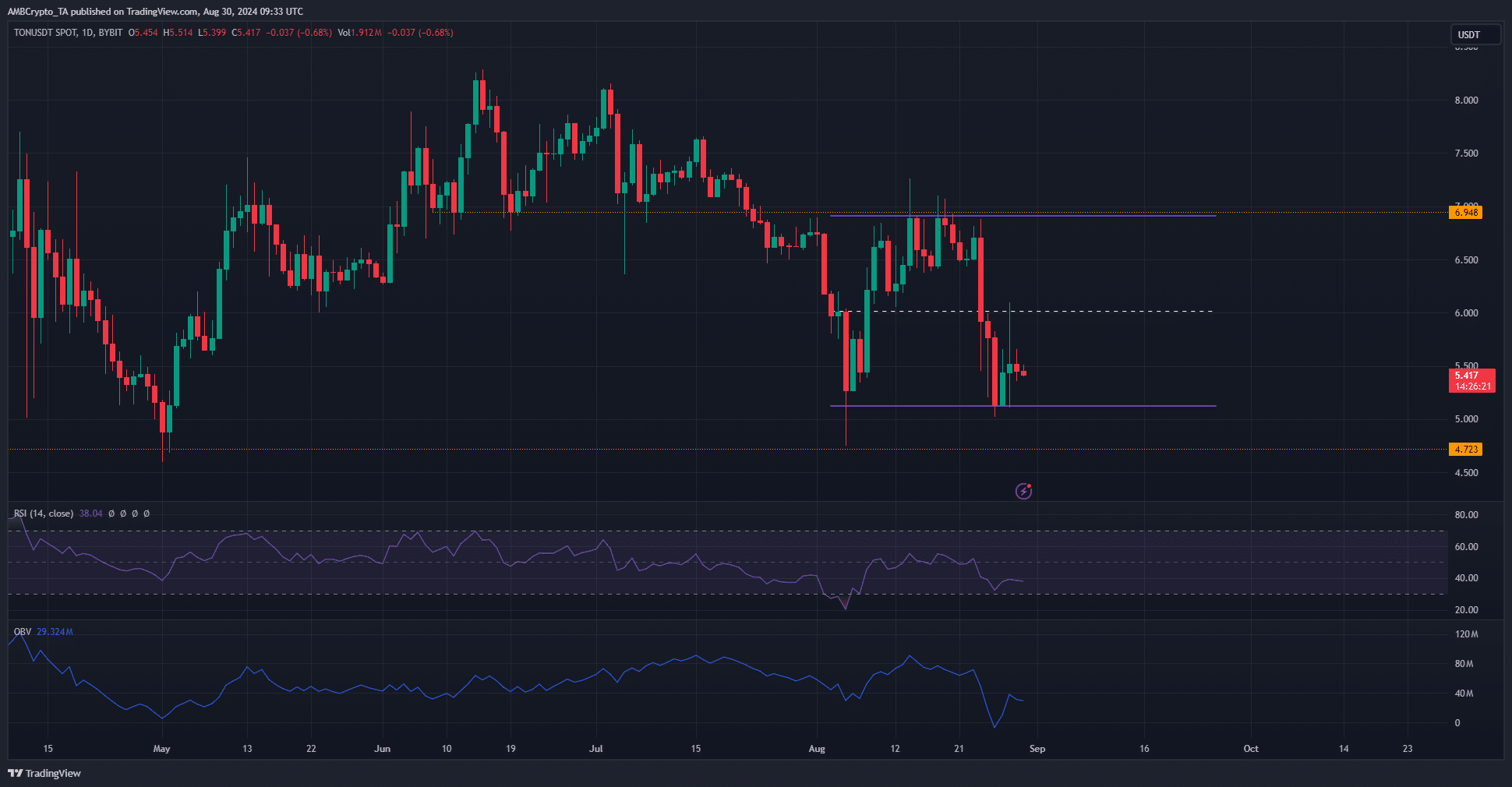

In June and July, Toncoin formed a range whose lows were at the $6.94 level. The selling pressure in late July forced prices to fall as deep as $4.75, changing the $6.94 level into a stern resistance.

The price action of the past month supported this range formation idea. The mid-range level has acted as resistance over the past week. Another move toward the $5.13 local lows appeared likely.

The RSI showed bearish momentum and the OBV highlighted rising selling pressure. The chances of a Toncoin recovery shortly were low, and a move to $5 appeared possible.

Should traders short the token right now?

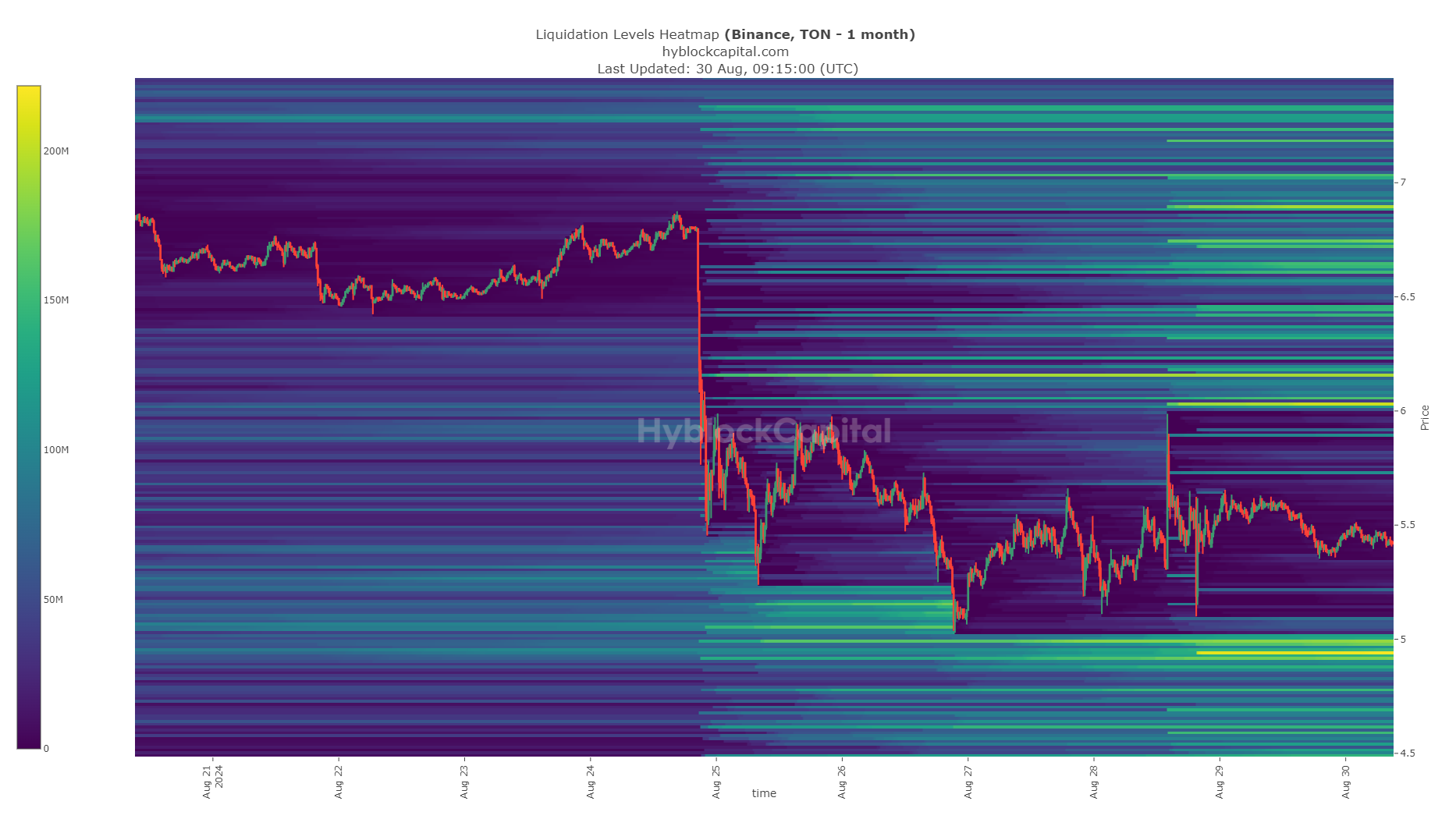

Source: Hyblock

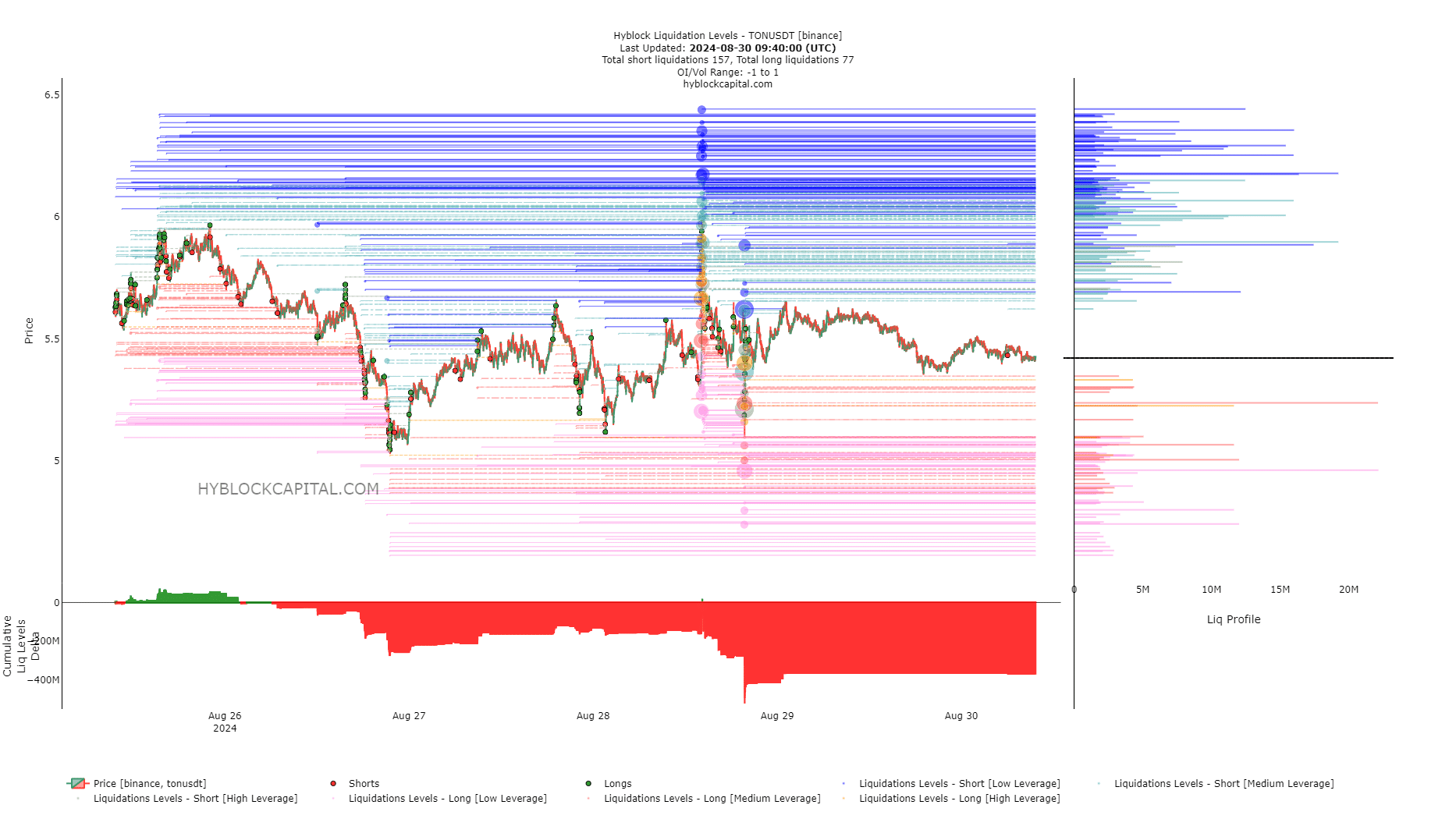

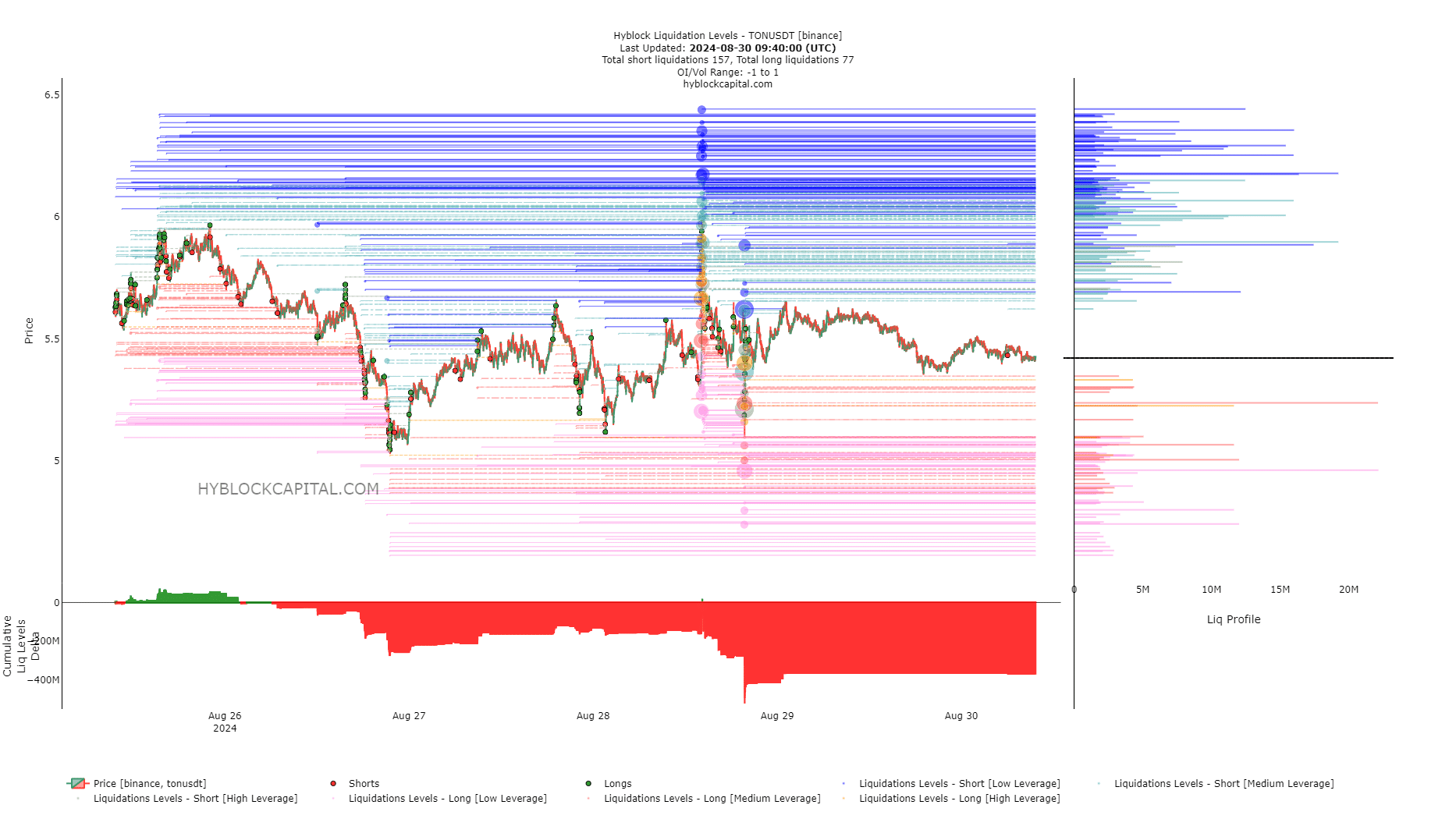

AMBCrypto found that the cumulative liq levels delta was negative, but not overwhelmingly so. This showed that short positions were more than the long ones in recent days.

A short squeeze is possible but unlikely over the next 24–48 hours.

Source: Hyblock Capital

Is your portfolio green? Check out the TON Profit Calculator

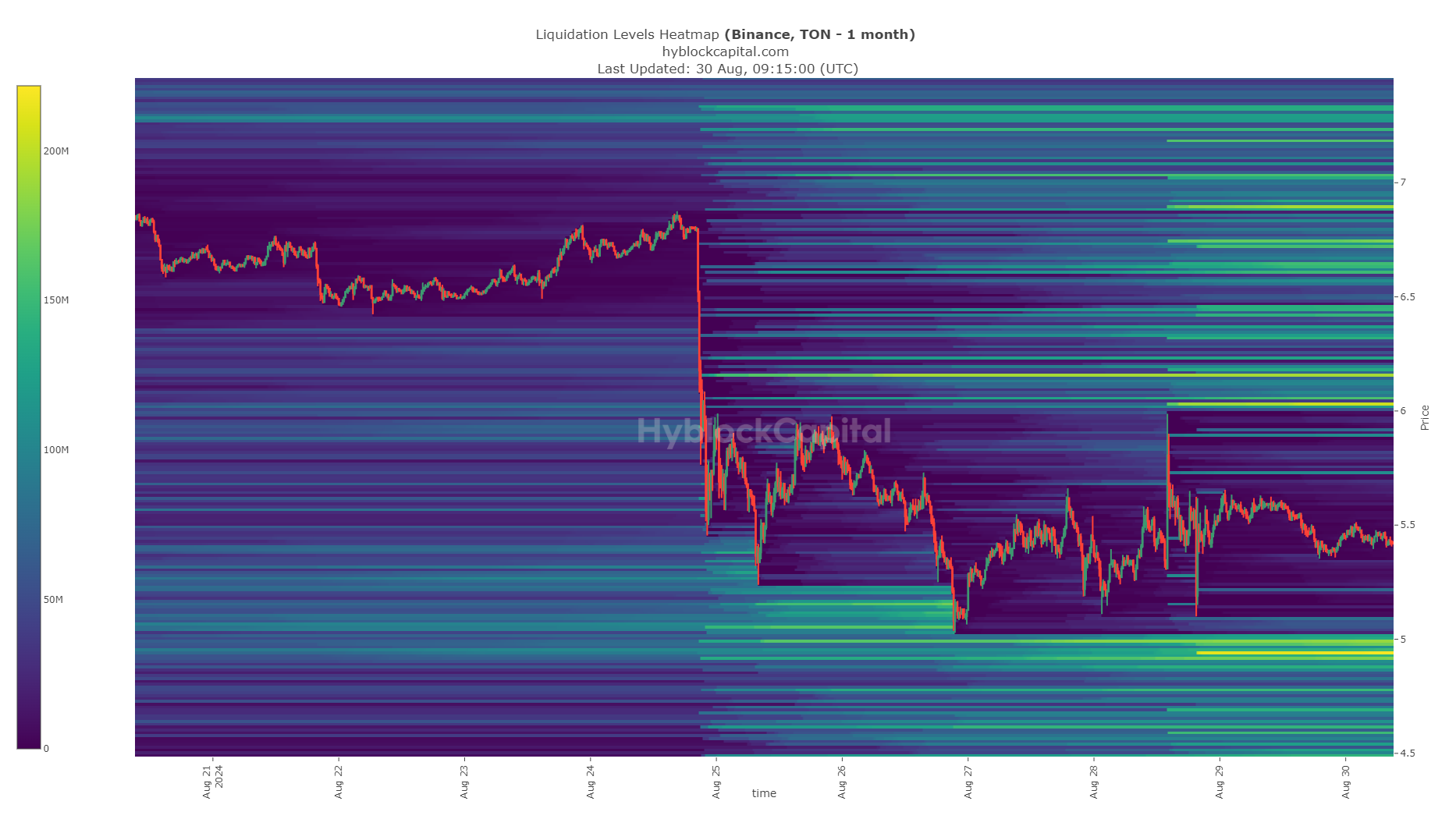

While the daily chart showed the $5.13 level is a support zone, the liquidity pools could drag TON lower. The $4.92-$5 zone was densely populated with long liquidations.

Once the price sweeps this level, a recovery would become more likely. In the meantime, traders should beware of minor price bounces that hunt liquidity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion