Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

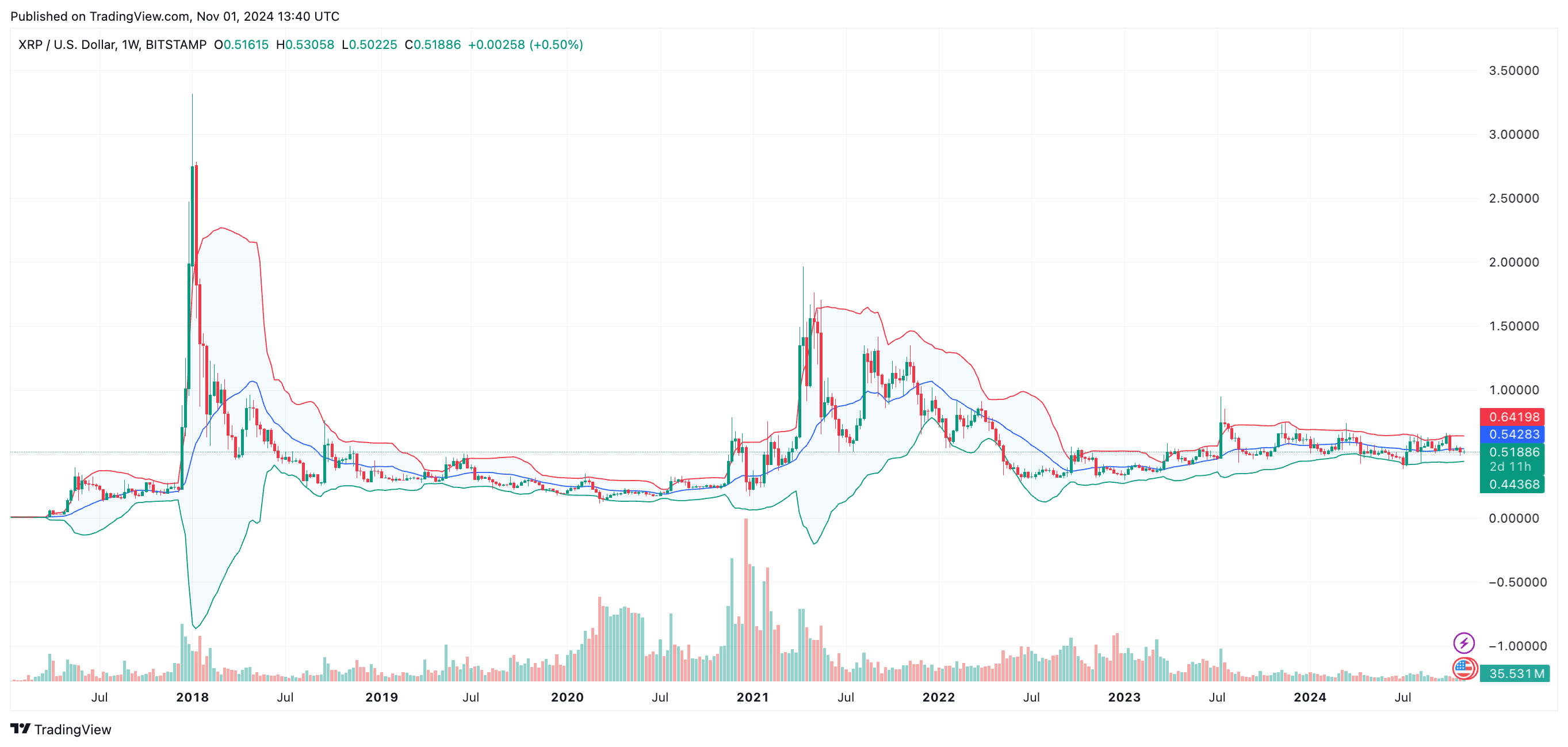

With the Bollinger Bands indicator showing a contraction not seen since 2016, XRP is poised for a major move that could change its path on the cryptocurrency market. Currently, the popular cryptocurrency is valued at $0.5174, and its Bollinger Bands have narrowed to an unusually tight range, which often signals a major price shift.

The Bollinger Bands are a popular indicator for measuring market volatility, represented by three moving averages and when they tighten, it indicates that volatility is decreasing – a condition that can lead to a decisive price breakout.

The last comparable tightening of Bollinger Bands for XRP took place in 2017, just before the extraordinary 60,000% surge that took the price from $0.006 to over $3.8 per token – one of the most dramatic rallies in the asset’s history. Something similar happened in 2020, when the bands narrowed and the price of XRP jumped an impressive 716%.

Currently, Bollinger Bands signal a 71.5% contraction for XRP, and some market analysts believe that if this historical trend continues, there could be a big price shift to a potential new all-time high of $4.2.

Although many people in the XRP community see this as a key indicator, it is not yet set in stone whether this action will lead to an upward spike or the opposite.

One thing for sure, though, is that the narrowing bands highlight a potential turning point, marking what could be another impactful phase in XRP’s journey.