- XRP presents a good risk-to-reward buying opportunity.

- Sentiment is bearish and traders might have to cut their losses quickly if the price trends the other way.

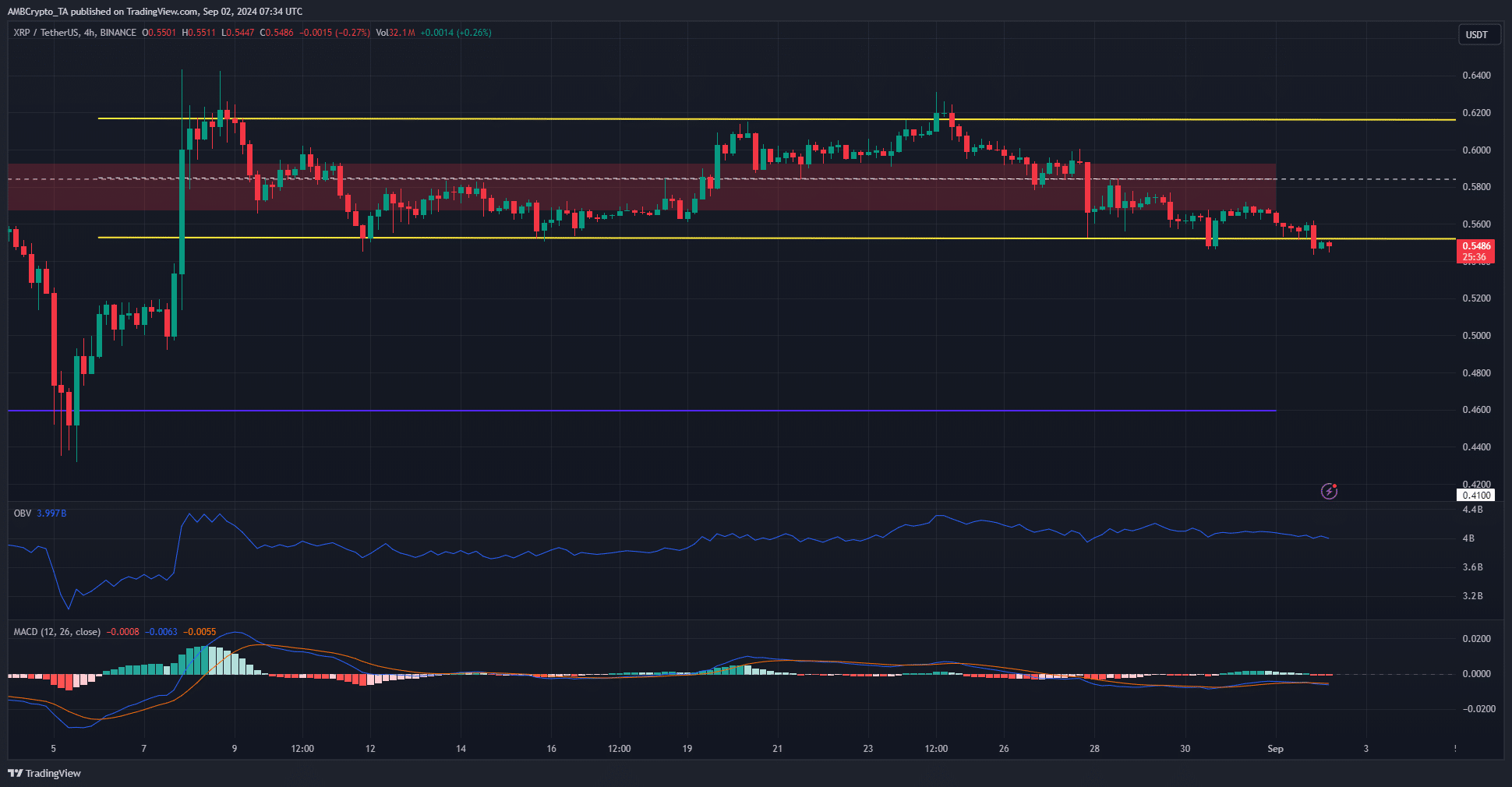

Ripple [XRP] continued to trade within the short-term range. The bears were attempting to push prices below it and appear to have succeeded at press time, but bulls need not be worried.

A deviation below the range lows sets up the market for a short-term reversal, and coming on a Monday, swing traders might want to lean bullish at the range lows.

Do the indicators support a reversal?

The OBV on the 4-hour chart has been flat over the past eight days. During this time, XRP dropped by 13.5%. The OBV’s behavior was encouraging because the steady price drop was not accompanied by overwhelming selling.

Instead, a revisit to the range lows presented a buying opportunity instead. Meanwhile, the MACD showed momentum was slightly bearish, reflective of the past week’s trading.

The risk-to-reward for short-term bulls is high, and the invalidation is nearby. More cautious bulls can wait for the New York trading session to begin and the associated volatility spike to level out before entering the market.

Assessing the sentiment behind XRP

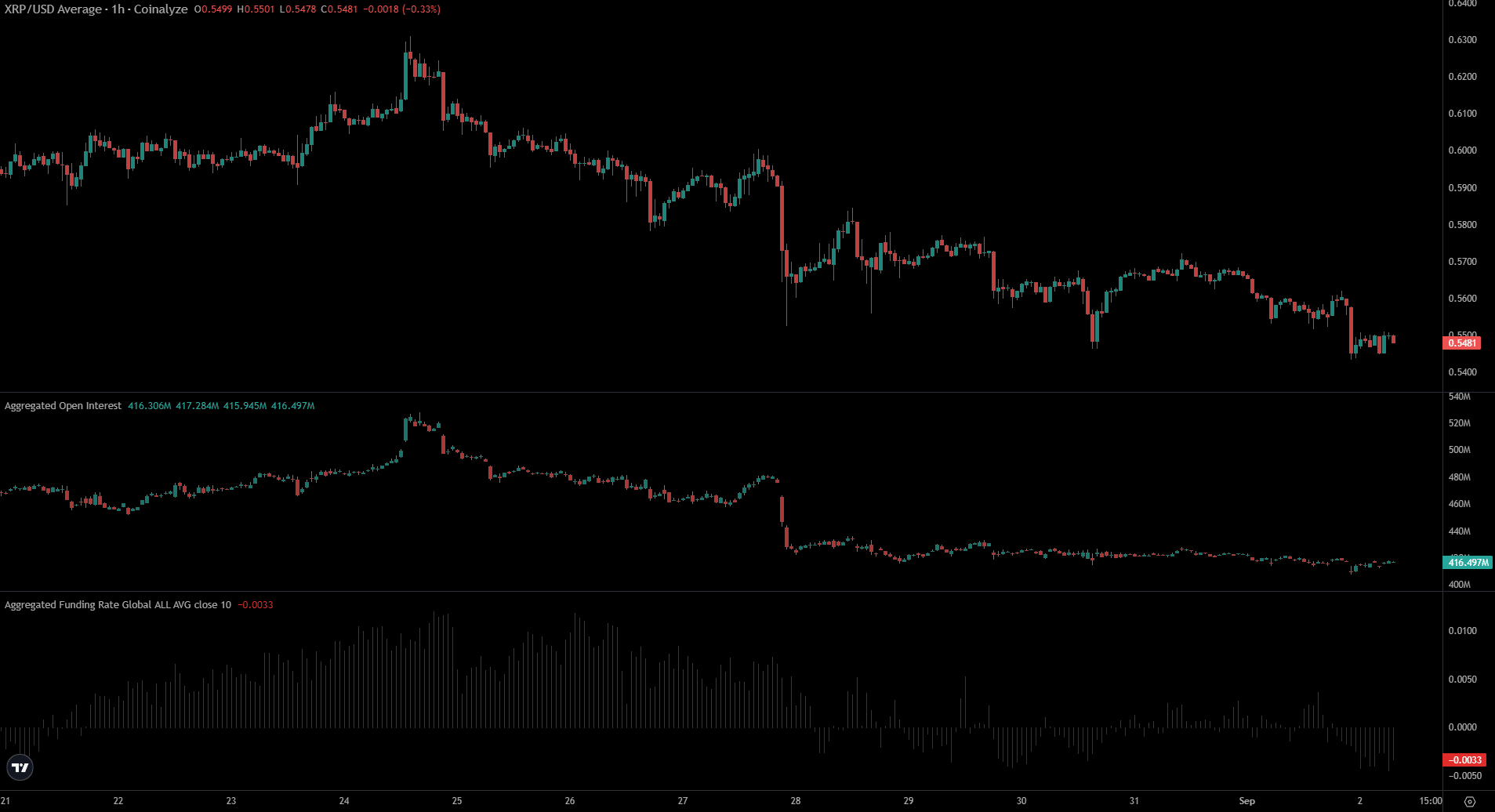

Source: Coinalyze

The Funding Rate was negative and the Open Interest refused to climb higher. Both indicators meant that futures traders were wary of going long and preferred to sell or remain sidelined.

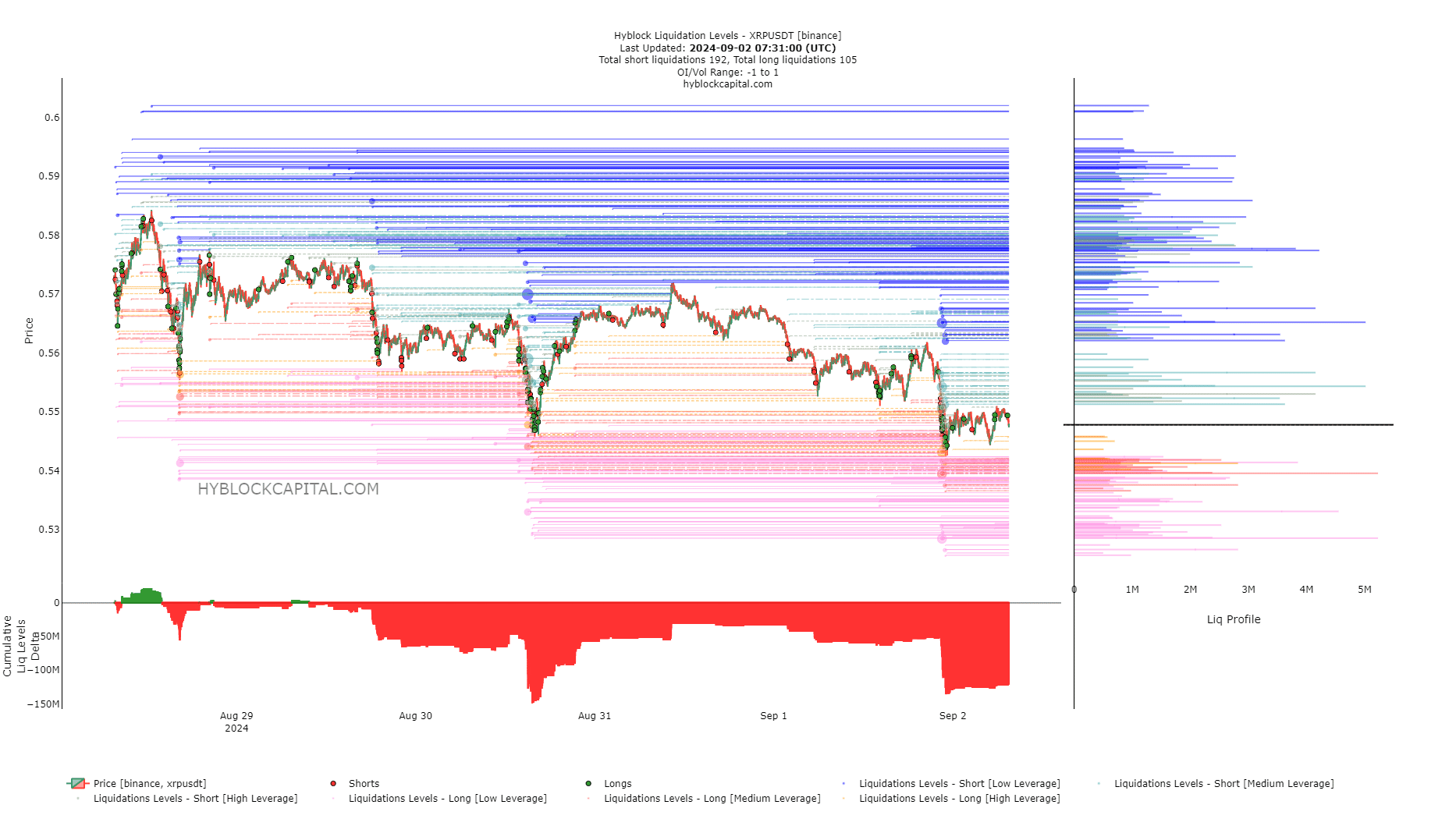

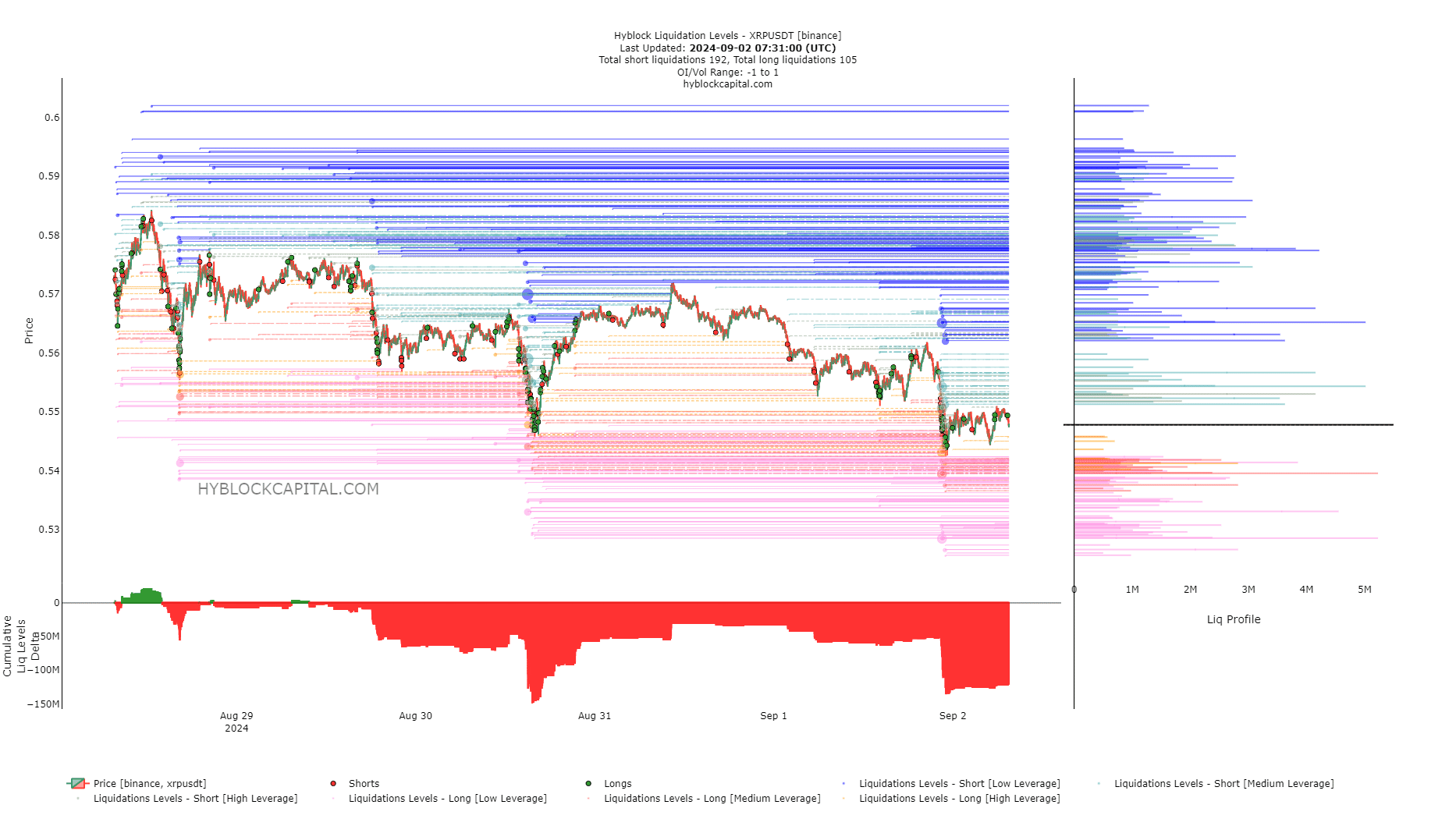

Source: Hyblock Capital

Read Ripple’s [XRP] Price Prediction 2024-25

This bearish sentiment was reflected in the liquidation levels data. The cumulative liq levels delta was negative and nearly reached the levels of the 30th of August. XRP managed to bounce 4.7% from the range lows then.

It is likely a similar scenario unfolds, but traders should be cautious. Bitcoin [BTC] could decide to fall toward or below the $56k mark, dragging the altcoin market with it.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion