Despite price consolidation within a tight range at a support level, it appears that XRP bulls are back in the market as its trading volume skyrockets. On October 7, 2024, most top cryptocurrencies experienced a notable price surge, but XRP’s price has remained stable over the past 24 hours.

XRP Current Price Momentum

Currently, XRP is trading near $0.538 and has experienced a modest price surge of 0.75% in the past 24 hours. During the same period, its trading volume has skyrocketed by 90%, suggesting strong participation from investors and traders, which is a positive sign for XRP holders.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP appears bullish but has been stuck in a consolidation zone between $0.512 and $0.545 for the past five trading days. Based on recent performance, whenever XRP’s price reaches this level, it tends to experience a 20% rally.

However, if XRP breaks out of this consolidation zone and closes a daily candle above the $0.55 level, there is a strong possibility it could soar by 20% to reach the $0.65 level in the coming days.

This bullish outlook is further supported by, XRP’s Relative Strength Index (RSI), which is currently in an oversold territory which signals a potential bullish price reversal in the coming days. However, it is still trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend.

Bullish On-Chain Metrics

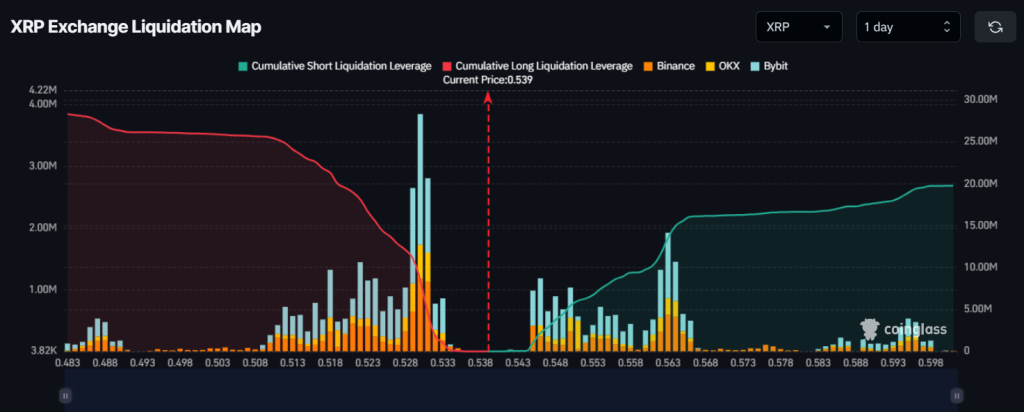

Apart from technical analysis, XRP’s on-chain metrics also support this bullish outlook. According to the on-chain analytics firm Coinglass, the major liquidation levels are at $0.53 and $0.563 as traders are over-leveraged at these levels.

However, data shows that bulls have placed over $8.45 million worth of long positions believing the market will not fall below the $0.53 level.

In addition, XRP’s future open interest has increased by 3.75% over the past 24 hours and has been steadily increasing, indicating growing trader interest, with many likely betting more on long positions.