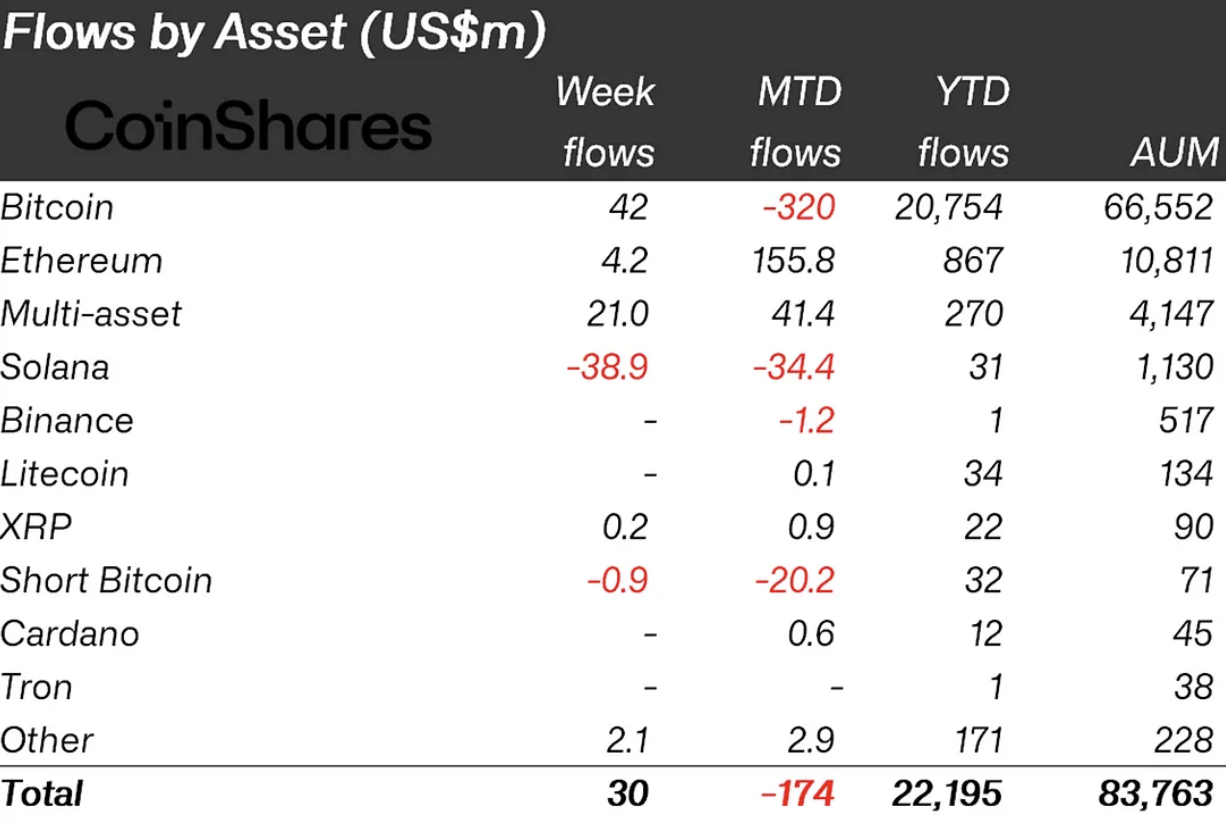

Investment in XRP-focused exchange-traded products plunged 72% last week. According to the latest weekly report from CoinShares, flows into XRP ETPs dropped from $700,000 to $200,000 over the past seven days.

However, they are still inflows, which is rather positive, especially considering that the majority of crypto ETPs have seen no activity at all or even outflows. For example, products tied to Solana (SOL) saw outflows of $38.9 million, which is more than their remaining year-to-date result.

More to the point, considering the latest round, XRP-focused investment products have attracted $22 million since the beginning of the year. This is more than BNB, Cardano (ADA) and Tron (TRX) combined.

Conjecture

The reason for such a drop is likely the end of a long-running legal battle between Ripple and the SEC. The event was a significant fundamental for XRP, as the cryptocurrency had been a focal point of the case.

Once the final verdict was delivered, with the subjective advantage on the side of Ripple and XRP, the interest of investors may have faded. Still, we can see that there are more funds coming in than going out.

In general, digital asset investment products saw inflows of around $30 million last week. Meanwhile, with recent macroeconomic data suggesting that the Fed is less likely to cut interest rates by 50 basis points in September, weekly trading volume in investment products fell to nearly 50%.