It appears that Ripple’s native token is poised for a massive price crash as whales and institutions continue to offload their holdings. Over the past seven days, Binance, the world’s largest crypto exchange, has seen a significant dump of XRP tokens by whales and institutions, according to the on-chain analytics firm CryptoQuant.

Binance’s XRP Reserve Soars

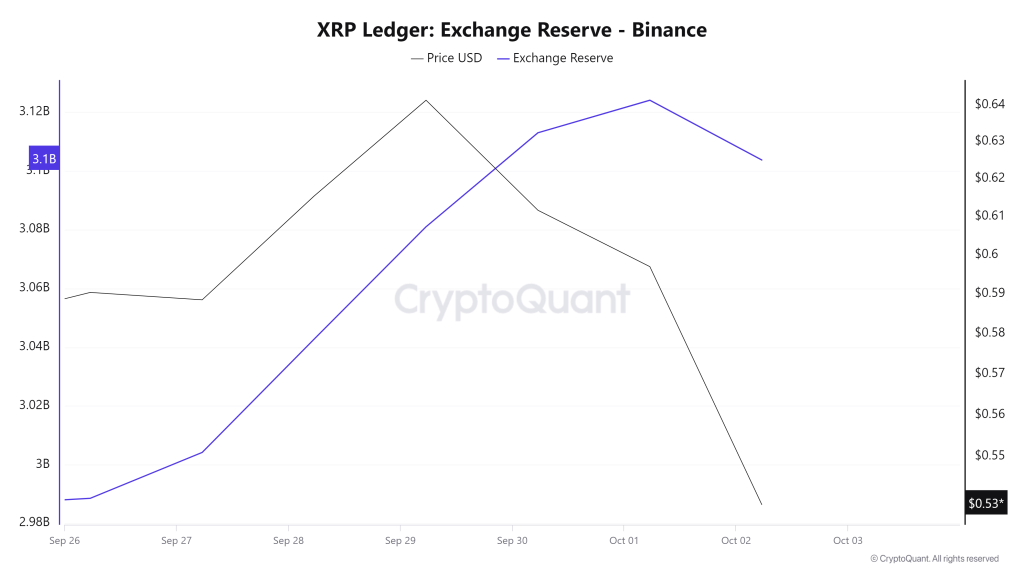

According to the data, Binance’s XRP reserve has increased by 135 million worth $72.63 million, over the past seven days. This significant rise in exchange reverse is a bearish sign for the XRP holders. Investors and whales often transfer their holdings to exchanges either to sell or stake.

Data shows that when XRP reached its resistance level of $0.65 level, the exchange reserve started increasing. Since then, the asset’s price has declined by over 20%.

Current Price Momentum

Currently, XRP is trading near $0.523 and has experienced a price decline of over 8.32% in the past 24 hours. During the same period, its trading volume increased by 30%, indicating higher participation from traders and investors. In this, some may be accumulating, while others are potentially dumping, leading to a spike in trading volume.

XRP Technical Analysis and Upcoming Levels

According to expert technical analysis, XRP appears bearish as it fails to hold a strong support level of $0.542 and falls below the 200 Exponential Moving Average (EMA) on a daily time frame. The 200 EMA is a technical indicator that indicates whether an asset is in an uptrend or downtrend.

Given the current market sentiment and XRP’s price action, there is a strong possibility that the token could face another 12% decline to reach the next support level of $0.462 in the coming days.

Bearish On-Chain Metrics

This negative outlook is further supported by on-chain metrics. Coinglass’s XRP Long/Short ratio currently stands at 0.90, indicating strong bearish sentiment among traders. Currently, 52.54% of top XRP traders hold short positions, while 47.46% hold long positions.

When combining both technical analysis and on-chain metrics, it appears that bears are currently dominating the asset and price may decline in the coming days.