Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The last few hours have seen massive liquidations on the cryptocurrency market, with CoinGlass data showing that liquidated positions totaled nearly $50 million in one hour. This is quite a lot, but given the abruptness with which some changes occur on this market, it is not surprising.

What is surprising, however, is the nature of the liquidations, as 94.67% of this volume was accounted for by long positions opened in the cryptocurrency market’s derivatives segment.

Thus, we can say that with the liquidation of $2.55 million of short positions, the volume of liquidation of long positions amounted to almost 17 times more. This seems colossal, but for some cryptocurrencies, this ratio is even more dramatic.

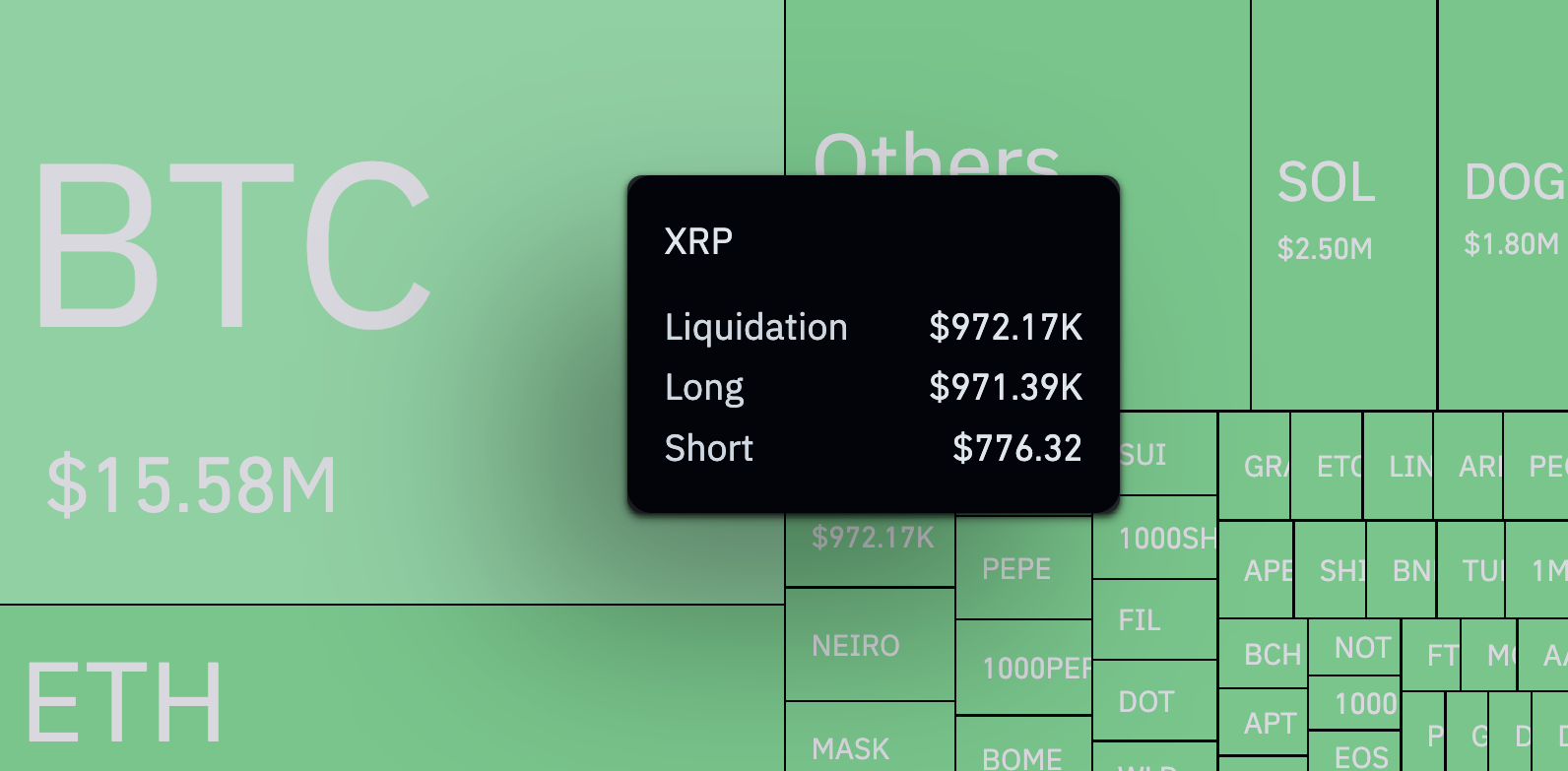

One of them is XRP where, according to the data, the volume of short liquidations amounted to only $776.32 and the volume of long liquidations amounted to $971,390. This literally means a crazy imbalance of 125,127.52%. Obviously, it is not so much about XRP itself, but the number of people who decided to go long on token futures.

XRP: Price outlook

While the price of the token fell by only 1.6% during the period in question, the number of bullish liquidations amounted to almost a million dollars.

In terms of total liquidations, XRP has become one of today’s leaders, but in terms of the size of the imbalance between bulls and bears, the ratio is worse.

What’s next? Time will tell, but the bulls’ desire to go long on XRP is likely to cool down for now.