Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

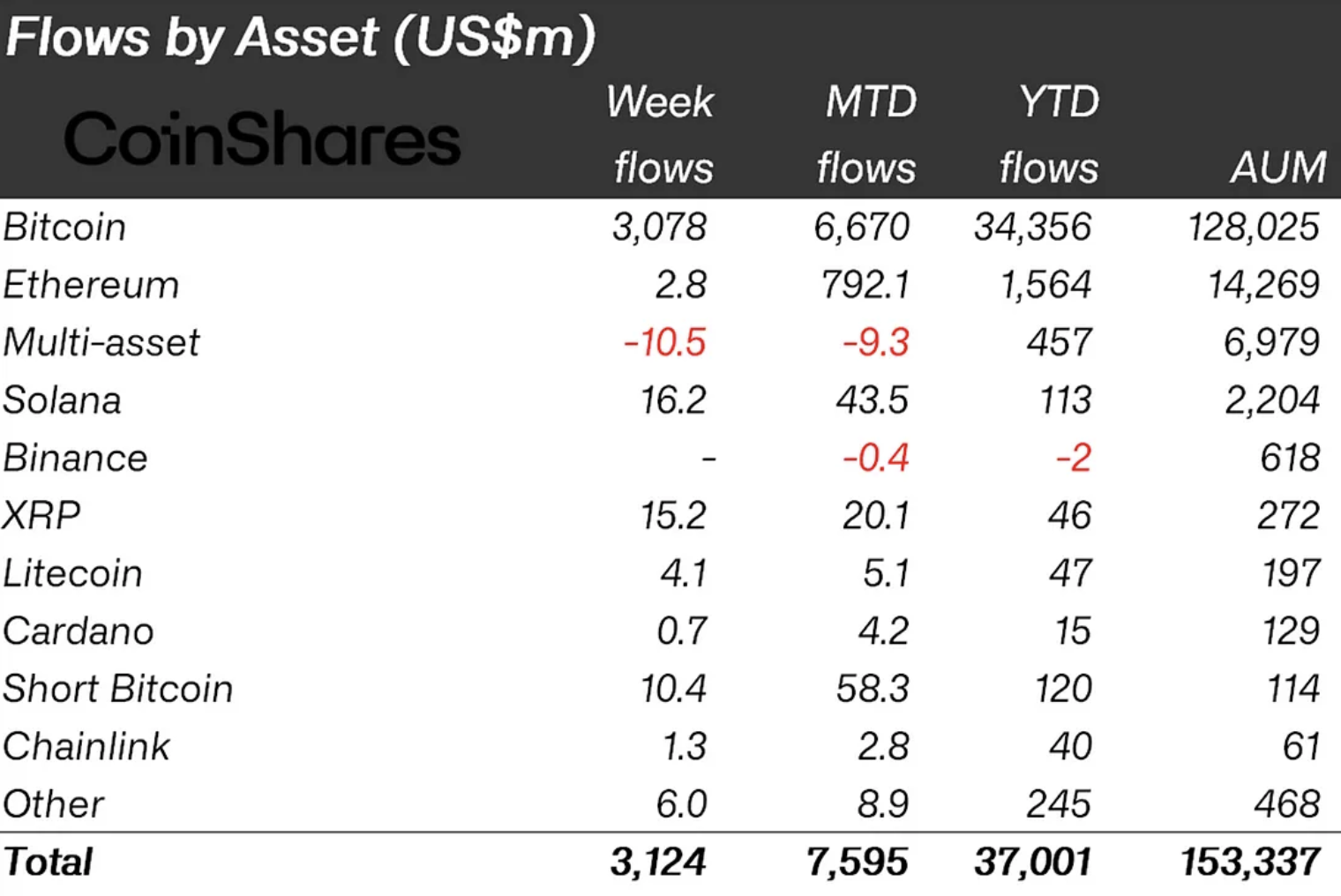

As became known thanks to the latest weekly research by CoinShares, investment products linked to the popular cryptocurrency saw a staggering result with inflows of $15.2 million. In fact, this is 353% higher than the week before and brings the year-to-date total for XRP-focused ETFs to $46 million.

In other words, based on simple math, last week saw almost half as much money flow into XRP ETPs, as in the previous 11 months. The reason for this avalanche of money lies in the price action of the popular cryptocurrency. What drove crypto market participants to push the price of XRP up more than 222% at its peak is what drove ETP traders to buy XRP investments last week.

Apart from Gensler’s resignation from the SEC chairmanship, the possible reasons behind the surge on both crypto and traditional markets could be the long-awaited IPO of Ripple, the San Francisco-based company that uses XRP in its enterprise blockchain services and solutions.

Ripple IPO

A week ago, the CEO of SBI, a Japanese financial conglomerate, said that Ripple should prepare for an IPO in the near future due to upcoming changes in the U.S. government. Previously, the company was valued at about $30 billion, which is interesting since there is about $55 billion worth of XRP in the company’s escrow accounts right now. Yes, there is an ongoing process of emptying them, but the coffers still hold a massive amount.

If Ripple does indeed go public, despite three years of tough battles with the SEC over XRP’s status, it will be a huge benefit to the cryptocurrency, its adoption and popularity. Not many digital assets have similar utility, adoption and regulatory status upheld by U.S. courts.