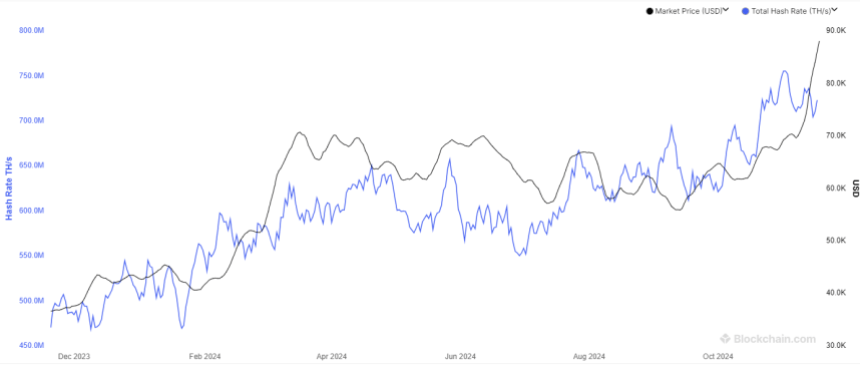

In this bearish market sentiment, it appears that Ripple’s native token XRP might be nearing the end of its bearish phase, as highlighted by a crypto analyst in a recent post. On September 16, 2024, a crypto expert made a post on X (Previously Twitter) that XRP is poised for a bullish breakout, which has been forming over the past seven years.

Analyst Bullish View on XRP

The crypto analyst noted that the formation of a bullish pattern on the XRP chart is a “mother of all bull flags” due to its long duration. Additionally, the post on X mentioned that this type of bullish price action pattern is very rare and unique in the cryptocurrency landscape, as cryptocurrencies haven’t been around long enough to form a similar pattern.

The analyst also highlighted that once the whales and investors notice this pattern, there is a high possibility they could potentially bag up XRP, resulting in a significant price rally.

XRP Price Prediction for September 2024

According to expert technical analysis, XRP appears bullish and has been consolidating in a tight range between $0.57 and $0.595 for the last four trading days. Additionally, it is trading above the 200 Exponential Moving Average (EMA), signaling that it is in an uptrend.

Based on the historical price momentum, if XRP price closes a daily candle above the $0.60 level, there is a strong possibility it could soar by 20% to the $0.75 level, while also breaching the $0.65 level. This bullish outlook will only hold if XRP closes its daily candle above the $0.65 level otherwise, it may halt at the $0.65 level.

Current Price Momentum

Currently, XRP is trading near the $0.586 level and has experienced a price surge of over 0.4% over the last 24 hours. During the same period, its trading volume declined by 22%, indicating a lack of trader participation, potentially due to the current market sentiment.