:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/PXV62LYT6ZBGLJIWW54TG7JQA4.png)

Image source: “coindesk”

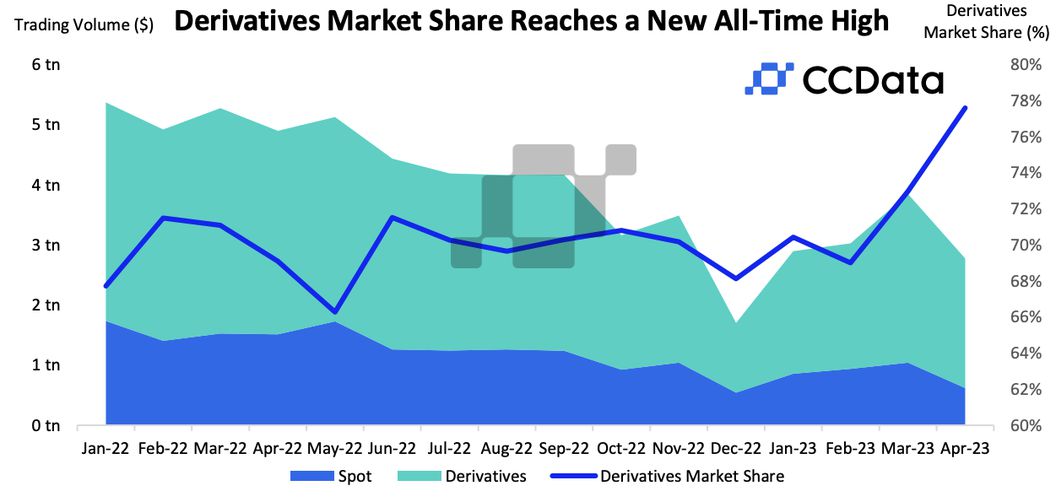

In April, the trading volume of cryptocurrency derivatives on centralized exchanges experienced a decrease, while spot trading volume declined even further. This resulted in the derivatives market share reaching a new record high.

As reported by CCData, the market share of crypto derivatives trading reached an all-time high of 77.6%, despite a 23.3% decrease in the absolute trading volume of derivatives, which amounted to $2.15 trillion. This increase in market share was driven by a significant 40.2% drop in spot trading volume to $621 billion.

CCData suggests that the rising market share of crypto derivatives, which has been increasing for three consecutive months, highlights the speculative nature of the crypto market. This trend is influenced by uncertainties surrounding the potential pause on rate hikes by the Federal Reserve, indicating the market’s sensitivity to such factors.

Binance holds the top position as the largest derivatives trading platform, capturing 61.4% of the market. OKX and ByBit follow closely in second and third place, with market shares of 15% and 14.6% respectively.

In May, Coinbase introduced its derivatives platform, while Gemini announced its plans to launch one as well. These developments are expected to contribute to the growth of the crypto derivatives market and potentially expand its market share even further.