The amount of staked ether has reached a new record high of 19.55 million, with ETH staking deposits surpassing withdrawals.

Looking back, the selling pressure on ether (ETH), the native token of Ethereum, was not significant after the Shanghai upgrade, which allowed for staking redemptions for the first time. This conclusion was drawn from a report by blockchain analytics firm Nansen.

It has been more than a month since the Shanghai upgrade, which marked Ethereum’s complete transition to a proof-of-stake blockchain. During this time, ETH staking deposits have exceeded withdrawals, leading to a new all-time high of 19.55 million staked ETH. As a result, a report on May 8 stated that the removal of risks associated with unstaking has effectively balanced out the selling pressure from withdrawals.

Leading up to the Shanghai upgrade, there were extensive discussions among crypto enthusiasts about how the market would react. Since the upgrade went live on April 13, the price of ETH has declined by approximately 8% to $1,851, as per CoinDesk data. During the same period, the CoinDesk Market Index, which tracks the overall performance of the digital asset market, has experienced a nearly 10% drop.

According to the Nansen report, withdrawals have been minimal, and any withdrawals that occurred were balanced out by new inflows. This indicates that investors have shown strong confidence in the Ethereum network and the asset itself.

Crypto exchange Kraken, in accordance with regulations from the Securities and Exchange Commission (SEC), discontinued its crypto staking-as-a-service platform for U.S. customers in February. As a result, Kraken witnessed the highest number of withdrawals, totaling over 646,000 ETH. Coinbase, a competing crypto exchange, followed behind with over 376,000 ETH in withdrawals.

Image source “coindesk”

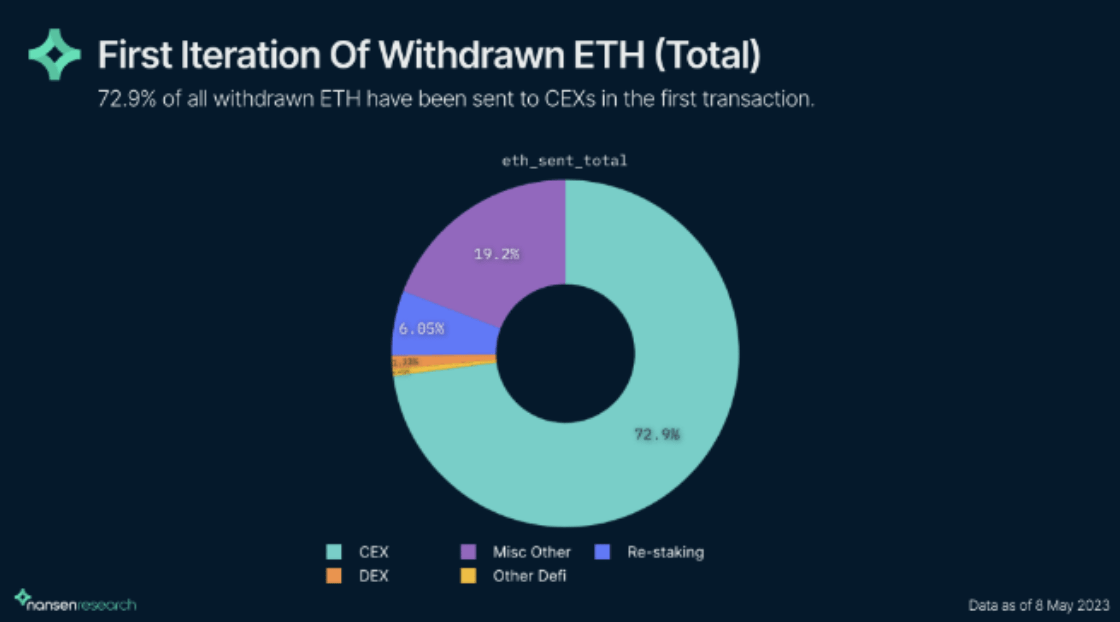

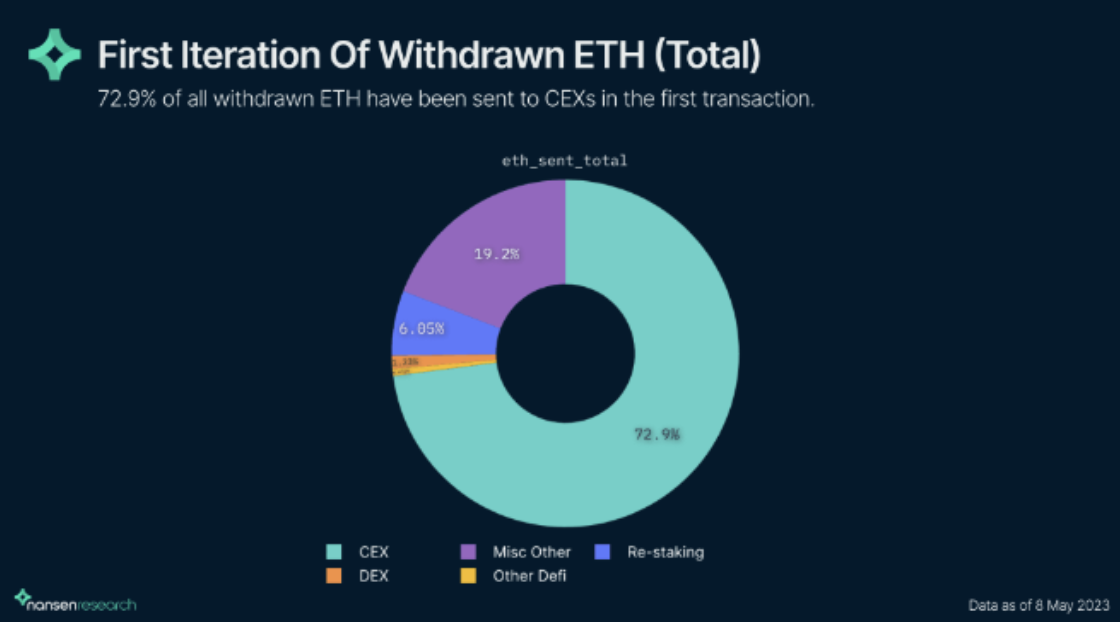

Approximately 73% of the ETH that was withdrawn from staking has been transferred to centralized exchanges (CEXs) such as Kraken and Coinbase. However, it is important to note that the majority of the withdrawn ETH from these exchanges is actually being transferred to the exchanges themselves.

According to Nansen, this indicates that the majority of ETH being sent to centralized exchanges (CEXs) is not primarily intended for selling purposes. Instead, it is primarily utilized for the internal operations of the exchanges themselves.