The Treasury’s efforts to replenish cash reserves following the resolution of the debt limit issue could result in a decrease in available dollars, potentially causing a decline in Bitcoin value.

As negotiations to increase the U.S. government’s $31.4 trillion debt limit remain unresolved, some analysts are expressing a different opinion. They caution that if a deal is reached, it could negatively impact the cryptocurrency market.

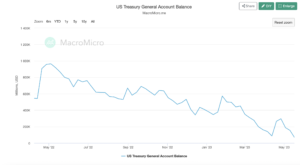

On January 19, the U.S. hit its debt limit of $31.4 trillion, leading the Treasury to take special measures and deplete its Treasury General Account (TGA) balance to keep the government operational. This helped maintain demand for assets like bitcoin, which are affected by changes in U.S. dollar liquidity. It also prevented concerns about a government default and the Federal Reserve‘s ongoing interest rate increases from causing a drop in bitcoin prices.

Also Read This: US Federal Officials Lean Towards Rate Hike Above 6% – Could Bitcoin Face an Impending Crash?

The TGA balance has decreased significantly from around $500 billion in early February to $68 billion last week, as reported by MacroMicro. According to Goldman Sachs, the Treasury’s cash balance is expected to reach the minimum required amount of $30 billion in early June. This indicates that a debt deal must be reached around that time to prevent what some consider a disastrous default.

Once the debt limit is increased, the Treasury will aim to replenish its cash balance by issuing government bonds. This process may reduce liquidity in the system and lead to higher bond yields. When there is increased bond issuance, prices typically decline, causing yields to rise. Bitcoin (BTC), on the other hand, is known to move in the opposite direction of bond yields.

In summary, if a potential deal is reached, it could remove significant economic uncertainty. However, assets like bitcoin, which are not connected to the real economy and rely heavily on fiat currency liquidity, might actually experience negative effects.

Noelle Acheson, former head of research at CoinDesk and Genesis Trading, and author of the Crypto Is Macro Now newsletter, explained that when debt is issued to increase funds, it has the opposite effect. Money tends to shift from cash and risky assets towards U.S. government bonds, particularly when bond yields rise to balance the increased supply.

According to Noelle Acheson, when bond yields rise, it can have negative consequences for assets like bitcoin and gold. These assets typically decrease in value during high-yield environments because they don’t generate any yield themselves. Additionally, increased issuance of U.S. government debt would boost public spending, which is beneficial for the economy but also prolongs the possibility of interest rate reductions.

The general belief in the market is that a default could trigger widespread selling and a global rush for cash, similar to what happened during the market crash in March 2020 caused by the coronavirus. During that time, bitcoin’s value dropped by more than 50%. On the other hand, if a debt deal is reached, it is anticipated to encourage a willingness to take on more risk in the market.

According to some observers, during the banking crisis in March, bitcoin was considered a safe haven investment. However, other assets sensitive to interest rates, such as tech stocks, also performed well as traders anticipated the Federal Reserve’s potential shift towards rate cuts. In simpler terms, bitcoin is still primarily influenced by liquidity and is categorized as a risk asset.

The Treasury’s cash balance has dwindled to $68 billion. (MacroMicro) (MacroMicro)

Satyakam Gautam, a rates trader at ICICI Bank in India, disagrees with that perspective. He predicts that the Treasury will probably issue $700 billion worth of bonds in the coming months, which he believes will result in a significant increase in risk aversion.

What this suggests is that there may be a shortage of USD funding right after a successful negotiation to raise the debt ceiling, if it happens. This could make it difficult for corporate bonds markets and private credit to refinance their existing debt that is maturing, potentially causing a significant downturn in funding for commercial real estate assets or companies issuing risky bonds. According to Gautam’s LinkedIn post, this scenario could be the crash that the U.S. interest rate markets have been anticipating.

Gautam further mentioned that there could be a sustained decrease in long-term interest rates and a significant increase in the difference between short-term and long-term rates (steepening) in the United States. This situation would likely benefit safe-haven currencies like the Japanese yen (JPY) and the Swiss franc (CHF).

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.