Bitcoin’s price dropped when the Asian markets opened, with BTC falling to $56,952. Altcoin sales also reached troubling levels, signaling a broad decline in the market. Experts recommend focusing on risk management to navigate these deeper losses.

Bitcoin’s price fell when the Asian markets opened today, following several days of warnings. With US markets closed for a holiday, the impact of ETF sales will become clear tomorrow. Experts from 10x Research have shared their predictions for cryptocurrencies based on the recent decline. These predictions match their earlier assessments and might provide useful insights into future trends.

Bitcoin Faces Further Decline: Analysts Weigh in

Sales in altcoins have reached troubling levels, with Bitcoin’s price dropping to $56,952. This decline has already led to discussions about why Bitcoin lost its crucial $60,000 support level. The key question now is whether the downward trend will push the price to $50,000 or even lower.

Markus Thielen, an analyst at 10x Research, highlighted the risks of ongoing declines, noting that data from early June indicated an overbought market poised for a correction. The recent daily price drops of over 5% have resulted in a 57% increase in trading volume, signaling a shift to panic selling among investors.

Thielen warned that breaking through key support levels for Bitcoin miners and spot Bitcoin ETF buyers could lead to even greater losses as sellers rush to find liquidity.

Markus Thielen Warns: Caution Advised as Bitcoin Support Breaks

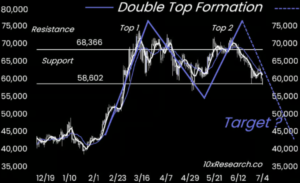

Markus Thielen cautions that only uninformed investors are likely to buy Bitcoin after it broke the $60,000 support level. His latest analysis report, which identified a double top formation, emphasizes the need for risk management. Thielen suggests that Bitcoin may recover after further losses, as MTGOX returns and government Bitcoin sales, coupled with miner sales and general market fears, have created a significant supply surplus.

On July 3, the long-term investors’ spent output ratio (SOPR) exceeded 10, indicating that sold Bitcoin is being disposed of at least 10 times its original purchase price. This suggests that holders of Bitcoin for 5-7 years may have been caught up in the recent selling frenzy.

Additionally, experts tracking large on-chain Bitcoin movements suggest that the MTGOX returns may have genuinely begun in July. Despite improvements in the macroeconomic environment for investors, recent events are proving to be quite unfortunate.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News