After a long wait, Bitcoin’s fourth halving happened on April 20th GMT. With the completion of the fourth Bitcoin halving, what does this mean for both the market and you?

Because of this, mining rewards have been reduced from 6.25 BTC to 3.12 BTC. This rare event happens once every four years, and Bitcoin went through it when the 840,000th block was added to its blockchain. Now that the fourth Bitcoin halving is complete.

Bitcoin Volatility Surrounding Halving

As anticipated, Bitcoin’s price charts have shown significant volatility in recent weeks due to the halving. At the time of writing, BTC was valued at $63,370, having dropped by nearly 2% in the past 6 hours alone. Indicators suggested bearish tendencies, with the Moving Average positioned well above the price candles. However, the CMF remained well above zero, indicating positive capital inflows.

Source: BTC/USD, TradingView

Bitcoin was designed to be a deflationary currency, meaning its supply decreases gradually with each halving until it reaches the hard cap of 21 million. This reduction in supply, combined with increasing demand, could enhance its potential as a store of value asset, similar to how Gold is perceived in mainstream markets.

Bullish Sentiment Surrounding Bitcoin Halving

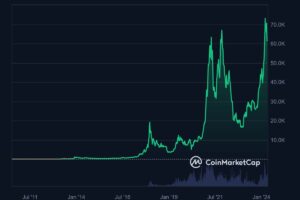

Market participants perceive the halving as a bullish event, given Bitcoin’s historical trend of increasing in value thereafter.

Source: CoinMarketCap

For instance, after the halving in July 2016, BTC’s value surged threefold over the next 12 months. Similarly, the last halving in May 2020 witnessed Bitcoin’s price skyrocket by 500% in the following year. The latest halving holds significance as it occurs amidst what still seems to be a bullish market phase.

The demand for Bitcoins has surged following the listing of spot exchange-traded funds (ETFs) in the U.S earlier this year. These new investment avenues have attracted a Cumulative Total Net Inflow of over $12.23 billion since their listing. On average, nearly $120 million in Bitcoin flows into these funds daily.

Supply-Demand Dynamics in Bitcoin Mining

According to Glassnode’s data, the number of new Bitcoins mined daily averaged around $50 million. This indicates that, at the time of writing, demand exceeded supply by more than 2x.

Source: Glassnode

As supply is set to decrease further due to the halving, the gap between demand and supply is likely to widen even more. This situation is expected to fuel a rally in Bitcoin’s price.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News