Avalanche (AVAX) demonstrates exhaustion close to a crucial resistance area, hinting at a possible correction in its price trajectory. Given the discrepancies in prices, investors are advised to keep a close watch on specific levels for potential accumulation opportunities.

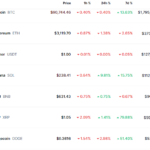

Avalanche (AVAX), ranked 10th in the crypto world, shows signs of exhaustion nearing the $51 to $56 resistance zone. Despite fluctuating between $50 and $60, there’s a potential correction indicated by the downward trend on the weekly chart. Long-term buyers may find the current price range suitable for accumulation. However, weakening upward momentum and the chance of price falling back to $39 support suggest caution. Investors should monitor key levels closely.

Bearish Divergence Signals Potential Correction for Avalanche (AVAX)

Avalanche (AVAX) surged past the $40 mark in late December, marking a significant milestone. However, from late December to mid-March, while AVAX’s price reached higher peaks, indicators like the Relative Strength Index (RSI) and Awesome Oscillator (AO) displayed lower peaks. This discrepancy, known as a bearish divergence, often precedes corrective movements in the asset’s price.

As a result, AVAX has retraced from its recent peak of $65, experiencing a 19% decline and showing potential for further downside. Currently, the price fluctuates between $45 and $50, indicating the first accumulation zone lies approximately 5% to 10% below the current level of $53. Investors should remain vigilant as the cryptocurrency navigates through this correction phase.

Potential Price Scenarios for Avalanche (AVAX)

If historical patterns repeat, a decline towards the accumulation zone could trigger sufficient buying pressure. This might enable AVAX to break through the resistance zone of $51 to $56 and potentially retest the critical barrier at $80. Notably, this level represents the midpoint of AVAX’s previous bear market.

Conversely, should AVAX’s price continue to decline beyond the $45 to $50 range, it would signal overall market weakness. In such a scenario, AVAX could retreat towards the weekly support level of $40.

Of particular concern is the possibility of a significant increase in selling pressure, potentially turning the $40 level into a resistance level for AVAX. This outcome could invalidate the bullish outlook, leading to a further 28% decline for AVAX and testing the next significant support level at $28. However, it’s important to note that this scenario is currently deemed unlikely.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News