AVAX holders purchased significant amounts of the token as its price reached $57. While a potential rise to $100 seemed plausible, a correction might precede this upward movement.

In the past day, the price of Avalanche (AVAX) rose by 13.13%, surpassing the $50 mark. However, this surge wasn’t arbitrary; there were specific reasons behind it.

Factors Behind AVAX’s Price Surge

According to IntoTheBlock, a significant increase in large transaction volume played a crucial role in driving up the price of Avalanche (AVAX). The crypto intelligence platform reported that the volume reached $329 million on March 11th.

Source: X

This marked the highest volume the cryptocurrency has seen since December 2023. While large transaction volumes don’t always guarantee a price increase, the case was different for AVAX.

AVAX Price Analysis and Future Outlook

Not only did large holder activity increase, but Avalanche (AVAX) also experienced more buying pressure than selling pressure. If this trend persists in the near term, there’s a possibility that the cryptocurrency’s price could double.

Based on the 4-hour analysis, AVAX initially reached $57 on March 12th but failed to break through the key resistance. At present, bulls are attempting to retest this region. A successful close above $57 could propel AVAX to $59.92. However, if another rejection occurs, the token’s price might decline to the $47.53 support level.

Source: Coinalyze

Previously, the Relative Strength Index (RSI) entered the overbought region and then declined, resulting in a drop in AVAX’s price. If the oscillator continues to decline, AVAX may struggle to maintain $50. On the other hand, the Exponential Moving Average (EMA) provided other signals, such as the 20 EMA (blue) crossing over the 50 EMA (yellow).

Analysis of AVAX Price Trends and Market Conditions

A position like this suggests that the bullish trend in AVAX has not yet concluded. As long as the price remains above $45.89, there’s potential for a rebound. Additionally, the positive Funding Rate indicates that the price could target the resistance level and breach it.

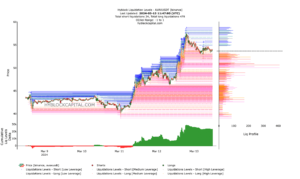

Traders have shown a preference for high-risk positions at $57 and above, implying a possible reversal as the price struggles to establish a bullish bias. If this scenario persists, AVAX’s price might decline below $50. Moreover, the Cumulative Liquidation Levels Delta (CLLD) is positive, contributing to a slightly bearish bias.

Source: HyblockCapital

In a highly bearish situation, the price of AVAX could drop as low as $45. However, it’s important to note that this doesn’t rule out the possibility of the value reaching three digits in the future.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News