The value of assets held by Binance, a popular cryptocurrency exchange, for its users has exceeded $100 billion. This milestone comes as a result of significant inflows and increasing prices of digital assets throughout March.

Binance states that it holds user assets at a 1:1 ratio, along with extra reserves, which can be verified using its proof-of-reserves (POR) system covering 31 digital assets. However, critics argue that such transparency measures lack auditing of fiat reserves, client and company liabilities, and other vital financial details.

Binance Surpasses $100 Billion in User Assets

Binance, a leading cryptocurrency exchange, has achieved a significant milestone as the total value of user assets held by the platform has exceeded $100 billion. This accomplishment comes after Binance’s latest proof-of-reserves (POR) snapshot in early March revealed reserves nearing this figure. According to the exchange, a combination of strong inflows and the subsequent rise in cryptocurrency prices throughout March has propelled them to reach this milestone for the first time since they began disclosing user asset holdings in November 2022.

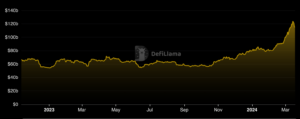

Over the past year, the total value locked on Binance’s centralized exchange has nearly doubled, surging from approximately $67 billion to $115 billion, as per data from DeFiLlama. This substantial increase underscores the platform’s growing prominence and the increasing trust of users in Binance’s services.

Binance TVL. Image: DeFiLlama.

Crypto Market Hits $100 Billion Milestone Across Various Metrics

March has proven to be a milestone month for the cryptocurrency industry, with several key metrics surpassing the $100 billion mark. Daily trading volume on crypto exchanges, total value locked (TVL) in decentralized finance (DeFi) protocols, assets under management (AUM) in global crypto investment products, and cumulative trading volume of U.S. spot bitcoin exchange-traded funds (ETFs) all achieved this significant milestone earlier in the month.

Daily Trading Volume Surges: Crypto exchanges experienced a surge in daily trading volume, with the combined volume exceeding $100 billion. This heightened trading activity reflects the growing interest and participation of investors in the cryptocurrency market, contributing to the overall liquidity and market dynamics.

Decentralized Finance Reaches New Heights: The total value locked in DeFi protocols also surpassed $100 billion, indicating the increasing adoption and utilization of decentralized financial services. DeFi continues to revolutionize traditional finance by offering innovative solutions such as lending, borrowing, and yield farming, attracting significant capital from users worldwide.

Rise in Global Crypto Investment Products: Assets under management in global crypto investment products soared past the $100 billion mark, reflecting the growing demand for crypto-based investment opportunities. Institutional and retail investors alike are increasingly diversifying their portfolios with exposure to cryptocurrencies through various investment vehicles.

Bitcoin ETF Trading Volume Soars: Additionally, the cumulative trading volume of U.S. spot bitcoin exchange-traded funds (ETFs) exceeded $100 billion, highlighting the growing popularity of bitcoin as an investment asset among mainstream investors. The introduction of bitcoin ETFs has provided investors with easier access to the cryptocurrency market, contributing to its widespread adoption and acceptance.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News