With the 2024 Bitcoin halving drawing near, Bitcoin (BTC) faces challenges to maintain its position above $63,000. Analysts anticipate a further decline in price, referring to it as a “correction.”

Crypto analyst Michael van de Poppe shared on X that the ongoing consolidation in the market is typical of a period just before a halving event. He believes that there’s still an opportunity for Bitcoin to reach a new all-time high before the halving occurs.

Bitcoin Price Drops Ahead of Halving, Analyst Points to Upcoming Event

The consolidation on #Bitcoin continues.

I don't think we'll see much spectacle coming from Bitcoin; if we do, it will need to break $70.3K.

Above, there is time for new ATHs, but I suspect we're still seeing the case of peaking pre-halving.

Just like any other cycle. pic.twitter.com/1N1Z0JW4sj

— Michaël van de Poppe (@CryptoMichNL) March 22, 2024

Bitcoin has witnessed a 2.6% decline in price over the past week and a 4% drop in the last fortnight. Analyst Michael van de Poppe suggests that this could be attributed to the approaching halving event. He notes that historically, Bitcoin tends to peak before a halving, indicating that the current dip might be part of this cycle. However, he emphasizes that Bitcoin may not show significant upward movement unless it surpasses the $70,300 mark.

Halving is an essential event in the Bitcoin ecosystem, occurring approximately every four years or after 210,000 blocks are mined. During halving, the rewards received by miners for validating transactions are halved, leading to a reduction in the rate of new Bitcoin issuance. The next halving event is anticipated to occur in April 2024.

Analyst Predicts Long-Term Bull Market for Bitcoin

In some way, the price action of #Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later. pic.twitter.com/s68C70W76G

— Michaël van de Poppe (@CryptoMichNL) March 22, 2024

Crypto analyst Michael van de Poppe drew parallels between Bitcoin’s current price action and the 2016–2017 cycle, suggesting that history could repeat itself, leading to a significant upward trend for Bitcoin. He emphasized his belief in a prolonged bull market, indicating that the recent pre-halving hype may pave the way for substantial gains.

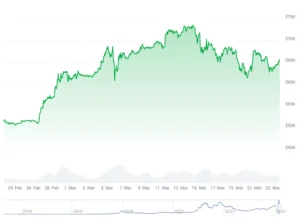

As of the latest data from CoinGecko, Bitcoin is trading at $65,537, reflecting a 3.2% increase over the past 24 hours. However, it’s worth noting that Bitcoin has experienced a 2.6% decline over the course of seven days. Despite this short-term drop, the cryptocurrency has shown a notable improvement of 26% over the past 30 days.

Bitcoin 30-day price chart | Source: CoinGecko

Analyst Predicts Pre-Halving Correction for Bitcoin

Pseudonymous analyst Rekt Capital has suggested that this year’s Bitcoin pre-halving correction has already begun. Typically, Bitcoin experiences retracements in the 14–28 days leading up to the halving event.

Rekt Capital pointed out similarities between this year’s price decline and the pre-halving corrections seen in previous cycles. For instance, there was a 20% pre-halving correction in 2020 and a 40% pullback before the 2016 halving.

According to Rekt Capital’s analysis, the current correction phase could last approximately 77 days, although it may be less severe than corrections observed in previous cycles.

The Bitcoin Pre-Halving Retrace

Bitcoin is officially in the "Danger Zone" (orange) where historical Pre-Halving Retraces have begun

Historically, Bitcoin has performed Pre-Halving Retraces 14-28 days before the Halving

In 2020, this retrace was -20% deep, occurred 14… pic.twitter.com/PcWJrqCLRQ

— Rekt Capital (@rektcapital) March 22, 2024

Despite the current downward trend, Rekt Capital views it as a favorable opportunity for investors to buy Bitcoin before the upcoming halving event. Historically, such corrections have been followed by bullish trends, suggesting the potential for future price appreciation.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News