The U.S. Treasury Secretary, Janet Yellen, has cautioned that the country may reach its debt limit by June 1. If the limit is exceeded and the government defaults on its debt, it could lead to a recession.

On Tuesday, the price of Bitcoin (BTC) continued to slightly decline, falling just below $27,000. Investors closely monitored the ongoing debt ceiling negotiations in Washington.

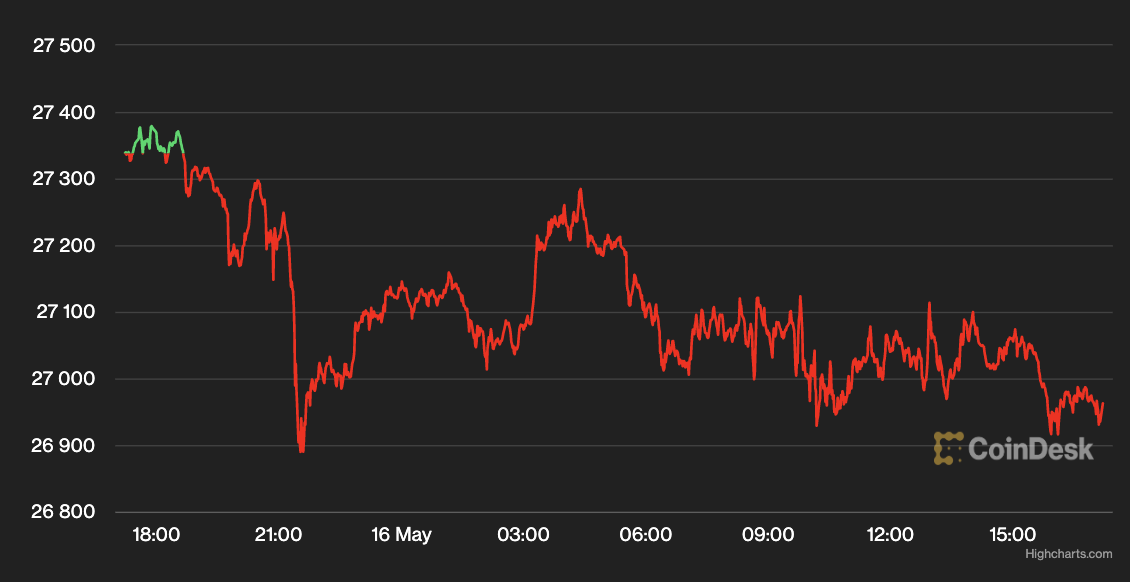

According to data from CoinDesk, the largest cryptocurrency by market capitalization was trading at around $26,950, marking a decrease of approximately 1.3% for the day. Throughout the past 24 hours, the price of BTC has stayed within the range of $26,800 to $27,400.

Bitcoin price chart showed that the cryptocurrency’s price hovered below $27,000 on Tuesday. Source: (CoinDesk)

Treasury Secretary Janet Yellen has cautioned that the U.S. is expected to surpass the debt limit by June 1, and she expressed concerns that a default could result in a recession. However, some analysts believe that resolving the debt ceiling matter could positively impact Bitcoin, potentially giving it a boost.

According to Joe DiPasquale, the CEO of crypto fund manager BitBull Capital, the current macroeconomic conditions are favorable for greater cryptocurrency adoption. In an email to CoinDesk, he mentioned that raising the debt ceiling would also be beneficial for risk assets as people look for ways to safeguard their wealth.

Lucas Outumuro, who is the head of research at blockchain analytics firm IntoTheBlock, informed CoinDesk that there may be a demand for BTC regardless of whether a deal is reached regarding the debt ceiling.

Outumuro believes that both the ongoing bank crisis and the negotiations surrounding the debt ceiling expose vulnerabilities in the existing system and raise doubts about its long-term stability. As a result, there is an increased demand for potential alternatives such as cryptocurrencies.

On Tuesday, Ether (ETH), the second-largest cryptocurrency by market capitalization, experienced a slight decline of 0.2%, trading at approximately $1,820. Meanwhile, LDO, the governance token for the liquid staking platform Lido, continued its positive momentum from Monday and increased by an additional 3%. However, the native token of Layer 2 blockchain Polygon, known as MATIC, dropped by 2.8%, reaching a value of around $0.82 cents.

On Tuesday, the stock markets ended on a negative note, with the Dow Jones Industrial Average (DJIA) falling by 1%, the S&P 500 decreasing by 0.6%, and the tech-heavy Nasdaq dropping by 0.2%.

In the bond markets, the yield on the 2-year Treasury rose by 6 basis points to reach 4.08%, while the yield on the 10-year Treasury increased by 3 basis points to reach 3.54%.

This information is for general knowledge only and should not be considered as advice for investing or making financial decisions.