On Monday, Bitcoin ETFs saw a big boost with a net inflow of $520 million. This influx of money helped push the price of Bitcoin past $57,000, as trading volumes soared. Investors were keen on getting into the action, contributing to the cryptocurrency’s rally.

Bitcoin ETFs kicked off the week with a bang, attracting a hefty $520 million on Monday. This big influx of money was fueled by investors feeling very optimistic about Bitcoin, which helped drive its price up past $57,000. People are really bullish on Bitcoin, meaning they expect its price to keep rising. Some believe that a shortage of available Bitcoin before the next halving event will cause its price to quickly surpass $55,000.

Record Inflows Propel Bitcoin ETFs Beyond $57,000

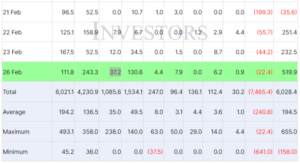

On February 26, according to data from Farside, spot Bitcoin exchange-traded funds (ETFs) saw a remarkable net inflow of $520 million. This surge in inflow was widespread, with almost all nine spot Bitcoin ETFs experiencing significant increases. Notably, Grayscale’s GBTC observed a decrease in Bitcoin outflow, signaling strong bullish sentiment among both retail and institutional investors.

One standout performer was BlackRock (IBIT), which recorded a record inflow of $111.8 million, pushing its net inflow to an impressive $6 billion. The total asset holdings of BlackRock’s Bitcoin ETF now approach nearly $7 billion. However, the spotlight of the day was on the Fidelity Bitcoin ETF.

Fidelity (FBTC) and Ark 21Shares (ARKB) Bitcoin ETFs attracted $243.3 million and $130.6 million, respectively. Additionally, Bitwise (BITB), VanEck (HODL), and other ETFs also experienced substantial inflows amidst the prevailing bullish sentiment.

Meanwhile, GBTC saw an outflow of $22.4 million, an increase from the previous day’s $51.8 million outflow, yet still within the range observed last week. Bloomberg ETF analyst James Seyffart highlighted that this represents a record low outflow for the fund. The record-breaking volume of $3.84 billion, coupled with the significant net inflows, propelled Bitcoin’s price beyond $57,000 in less than 30 minutes.

Source: Farside

Bitcoin FOMO Reaches New Heights Amidst Extreme Greed

The Crypto Fear and Greed Index surged to 79 (Extreme Greed) on Monday, up from 72 the day before, signaling a peak in FOMO (Fear of Missing Out) as traders’ interest in Bitcoin (BTC) reaches unprecedented levels. Experts are anticipating BTC to soar to $60,000 before the upcoming Bitcoin halving, adding to the fervor in the market.

This latest rally was ignited by MicroStrategy’s announcement of acquiring approximately 3,000 additional BTC tokens this month. With this latest purchase, the company’s Bitcoin holdings have now skyrocketed to 193,000, further bolstering confidence in Bitcoin’s long-term value.

Bitcoin’s price surged to a market value as high as $57,250, inching within 19.9% of its all-time high of $68,600 established 27 months ago. Currently, BTC is trading at $56,325, reflecting a remarkable 10% increase in the last 24 hours alone. The cryptocurrency experienced a 24-hour low of $50,931 and a high of $56,728. Moreover, trading volume has surged by an impressive 230% in the last 24 hours, indicating a surge in trading activity and heightened interest among investors.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News