Open interest in Bitcoin options has reached its highest level so far this year, but what’s causing this surge in positive investor sentiment?

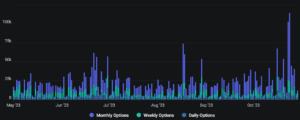

Bitcoin, represented as BTC, saw a drop in its value to $34,206. However, the options trading volumes for BTC experienced a big increase on October 23 and 24. This surge was the highest in over six months and happened at the same time as a remarkable 17% increase in BTC’s price over two days.

Now, traders are wondering whether this increased BTC options activity is because people are expecting a Bitcoin exchange-traded fund (ETF) or if it’s because of reduced optimism following BTC’s recent price rise above $34,000.

These recent gains are unusual for 2023, even though Bitcoin has performed impressively with a 108% increase in its value since the start of the year. A similar price surge was last seen on March 14 when Bitcoin jumped from $20,750 to $26,000 in just two days, a 25.2% increase.

Deribit BTC options daily volume, in BTC. Source: Deribit

Record Bitcoin Options Activity

A massive 208,000 Bitcoin options contracts were traded in just two days, a significant amount. To put it in context, the prior peak was 132,000 contracts on August 18, but that happened during a time when Bitcoin’s price dropped by 10.7% in two days, going from $29,090 to $25,980. Interestingly, Bitcoin’s options open interest, which measures the number of outstanding contracts for every expiration date, reached its highest level in over a year on October 26.

Gamma Squeeze Potential

This increase in trading activity has some analysts talking about the potential risk of a “gamma squeeze.” This theory revolves around the idea that option market makers might need to protect themselves based on their likely risk exposure.

the #bitcoin gamma squeeze from last week could happen again 👀

if BTCUSD moves higher to $35,750-36k, options dealers will need to buy $20m in spot BTC for every 1% upside move, which could cause explosiveness if we begin to move up towards those levels

more 👇 pic.twitter.com/OA9tJ0ZaK9

— Alex Thorn (@intangiblecoins) October 30, 2023

According to estimates from Galaxy Research and Amberdata, BTC options market makers may have to cover $40 million for every 2% positive move in Bitcoin’s price. Although this might sound like a lot, it’s relatively small compared to Bitcoin’s daily trading volume, which stands at a staggering $7.8 billion.

Assessing Bitcoin Options Use

When we look at Bitcoin options trading and open interest, it’s essential to figure out whether these tools are mainly being used for protection or more optimistic strategies. To do this, we can watch the demand for call options (buying) versus put options (selling).

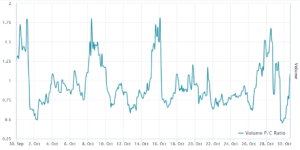

Bitcoin options put-to-call volume ratio. Source: Laevitas

Between October 16 and October 26, there was a dominance of call options, indicating more neutral-to-bullish sentiment. The demand for call options consistently exceeded put options during this period. The excessive trading volume on October 23 and 24 leaned towards call options.

However, things changed as investors started seeking protective put options, and this demand reached a peak of 68% higher on October 28. More recently, the metric shifted to a balanced demand between put and call options, with a ratio of 1.10 on October 30. This indicates a more even mix of protective and optimistic strategies.

Analyzing Investor Confidence in Bitcoin

To understand if investors using options have become more confident while Bitcoin’s price stayed above $34,000 on October 30, we can look at something called the Bitcoin options delta skew.

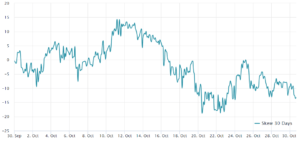

Bitcoin 30-day options 25% delta skew. Source: Laevitas

When traders expect Bitcoin’s price to drop, the delta 25% skew tends to go above 7%. Conversely, when they are excited about Bitcoin’s prospects, it usually goes below negative 7%.

On October 24, the Bitcoin options’ 25% delta skew moved to a neutral position. It had been in a bullish state for five days prior. However, as investors saw that the support level at $33,500 was stronger than expected, their confidence increased on October 27. This shift caused the skew indicator to return to a bullish zone below negative 7%, indicating increased optimism.

Notable Insights from the Data

There are a couple of important things to notice in this data.

1. Bullish Bitcoin Premiums: Before the 17% Bitcoin rally that began on October 23, those who were optimistic about Bitcoin and using options were paying the highest premium in over a year compared to those who were more cautious with put options. This unusual negative 18% skew suggests extreme confidence and optimism. This optimism was likely fueled by expectations of a Bitcoin ETF.

2. Surprising Optimism: What’s even more remarkable is that even after Bitcoin’s price surged by 26.7% in the 15 days leading up to October 27, the negative skew was still at 13%. Typically, when investors see such substantial gains, they seek protective options to safeguard their profits. But this time, they didn’t. So, even if the initial interest in call options was linked to ETF expectations, the overall optimism has remained strong as Bitcoin went above $34,000.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News