In a recent update from Capriole Investments, founder Charles Edwards offered an insightful analysis, projecting a notable surge in Bitcoin’s price to $58,000. Edwards’ prediction is based on a comprehensive assessment of various factors including market trends, developments in ETFs, technical patterns, and fundamental indicators.

The analysis starts by closely examining recent market movements, particularly following the introduction of Bitcoin ETFs. Edwards notes that after two months of uncertainty and careful scrutiny of ETF data, there are signs of a positive resolution emerging.

Bitcoin ETF Momentum Shift

Charles Edwards highlights a notable change in momentum following the initial reaction to Bitcoin ETF launches, observing a decrease in outflows from the Grayscale Bitcoin ETF. This shift aligns with his earlier predictions and signals a positive turn in market sentiment.

Edwards emphasizes the remarkable success of Blackrock and Fidelity’s Bitcoin ETFs, which have attracted over $6 billion in assets in less than a month. This achievement underscores Bitcoin’s growing acceptance in traditional finance and marks a historic milestone in ETF launches.

Here's a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

Fidelity’s inclusion of Bitcoin in its “All-in-One Conservative ETF” is seen as a significant endorsement of Bitcoin’s investment value. Edwards views this move as a crucial step towards Bitcoin’s recognition within traditional investment avenues.

Edwards predicts a potential trend where major ETFs allocate a portion of their assets to Bitcoin, ranging from 1-5%, within the next 12-24 months. This development is seen as pivotal for Bitcoin’s broader acceptance and integration into mainstream investment portfolios.

Technical Analysis Signals Bullish Momentum

Charles Edwards identifies a bullish trend in Bitcoin’s technical analysis, noting the breakthrough of the $44,000 resistance level. He interprets this breakout as a positive indication of the market’s bullish sentiment, suggesting potential for further upward movement.

Key Level Confirmation for Bullish Trend: Edwards emphasizes the importance of Bitcoin’s weekly closing above the $47,000 mid-range bound, stating that it would provide strong technical confirmation of a new bullish trend. This level serves as a crucial determinant of the market’s trajectory moving forward.

Attractive Risk-to-Reward Setup: Highlighting low timeframe technicals, Edwards discusses a measured move towards monthly resistance, presenting an appealing risk-to-reward (R:R) setup for investors. He suggests that strategic risk management, coupled with this technical breakout, offers potential for significant price appreciation in the short term.

Bitcoin price analysis | Source: Capriole Investments

Potential Price Targets: According to Edwards, a clean breakout above the $44,000 resistance level on the daily timeframe could lead to a measured move towards monthly resistance. This setup offers a favorable risk-to-reward ratio, with potential rewards of 3-4 times higher at price targets ranging from $58,000 to $65,000.

Fundamental and On-Chain Analysis Bolster Bullish Outlook

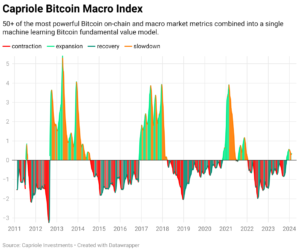

Capriole Bitcoin Macro Index | Source: Capriole Investments

Charles Edwards’ bullish perspective is grounded in a comprehensive analysis of both fundamentals and on-chain data. A pivotal component of this analysis is Capriole’s Bitcoin Macro Index, which consolidates more than 50 Bitcoin-related metrics into a single model, providing valuable insights.

Confirmation of Fundamental Uptrend: According to Edwards, the fundamental uptrend resumed recently, coinciding with a supportive continuation of the technical move. He emphasizes the importance of ongoing on-chain fundamental growth aligning with price action to confirm the mid-range breakout. Edwards highlights the significance of Monday’s reading in this context.

BTC price, 1-day chart | Source: BTCUSD on TradingView.com

Bullish Conclusion: Edwards concludes his analysis on a bullish note, noting a clear technical breakout and a transition of on-chain fundamentals into growth territory. With the resolution of ETF-related concerns and positive developments in both technical and fundamental aspects, he expresses optimism for Bitcoin’s short-term prospects, setting a positive tone for the beginning of February.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News