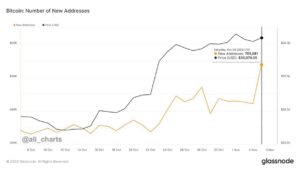

Over the weekend, over 700,000 new Bitcoin addresses were created, showing that many people are feeling really confident about investing in Bitcoin.

Bitcoin (BTC) has maintained a stable price of around $35,000 during the past week, while alternative cryptocurrencies (altcoins) took the lead in a weekend crypto market rally.

In the previous week, the United States released its employment data, which showed lower-than-anticipated job growth for October 2023. Consequently, analysts have become more optimistic that the Federal Reserve may adjust its policies earlier than initially anticipated for the year 2024.

Certain analysts have already begun to assign higher probabilities to the first rate cuts occurring as early as March 2024. If this scenario unfolds, it could trigger a significant rally in riskier assets like stocks and cryptocurrencies. Interestingly, the next Bitcoin halving is also expected around April 2024, potentially adding more momentum to the Bitcoin price surge.

The likelihood of the central bank lowering the primary interest rate by 25 basis points below the current levels in the March meeting increased to 25.9% on Friday, up from 12.9% on Thursday, according to the CME FedWatch Tool.

Fed-fund futures suggest a 66.5% chance that the Fed will keep interest rates unchanged in the March meeting.

The probability of interest rates staying the same is 95.4% for the December meeting and 89.4% for the January meetings. There is no chance of a rate cut at either meeting, but there is a 10.3% probability of a rate hike in January. Charlie Ripley, senior investment strategist at Allianz Investment Management, commented:

“Overall, the employment report could signal a turning point in the US economy, and more importantly, it demonstrates that monetary policy is effective. This should reduce the debate over whether policy is adequately restrictive.”

Potential for Upcoming Bitcoin Price Rally

While Bitcoin has held steady around $35,000 for some time, it might just be the quiet period before a major Bitcoin price rally. Well-known crypto analyst Ali Martinez pointed out a significant development: over 700,000 new BTC addresses were created in a single day. This surge in the BTC network is often seen as one of the most reliable indicators for making price predictions.

Courtesy: Ali Charts

With Bitcoin maintaining a positive short-term trend, CrediBull Crypto is expressing optimism that the cryptocurrency could continue to gain momentum, possibly reaching the psychologically significant $40,000 mark. If this milestone is achieved, the analyst envisions the potential for Bitcoin to make a journey toward a new All-Time High (ATH) well within reach.

A lot of capital is flowing into #crypto right now, signaling strong investor confidence.

In fact, we spotted nearly $10.97 billion in positive capital inflows, the highest level in 2023! pic.twitter.com/XfXz6aaVOK

— Ali (@ali_charts) November 5, 2023

On a different note, the inflow of capital into the cryptocurrency market has exceeded $10 billion in the past month, a clear sign of strong investor confidence.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News