Bitcoin whales, major players in the cryptocurrency market, orchestrated a massive movement of funds totaling $2.3 billion in just 24 hours. Notably, substantial withdrawals from the exchange Coinbase, exceeding $1 billion, were part of this activity.

These large-scale transactions, tracked by Whale Alert, suggest a significant reshuffling of Bitcoin holdings among major players, potentially impacting the cryptocurrency’s price and market dynamics.

Record-Breaking Bitcoin Transactions Signal Whirlwind in Crypto Market

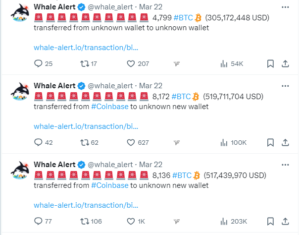

The cryptocurrency market experienced a whirlwind as Whale Alert reported five enormous Bitcoin transactions, the smallest involving 4,799 BTC. These transfers, totaling $2.3 billion, set a new record for Bitcoin movement within 24 hours.

BTC Outflows: Whale Alert

Of particular note were two transactions originating from Coinbase, accounting for over $1 billion of the total amount transferred. This massive movement of funds suggests a strategic reallocation of assets by Bitcoin whales, potentially signaling their outlook on the market. Despite large outflows from Coinbase and other exchanges, signs of bullish sentiment among Bitcoin investors persist.

Optimistic Influx into Long-Term Holding Wallets

On-chain analyst Ali Martinez, known for his insights on X, highlighted a substantial movement in the cryptocurrency market. Over 25,000 BTC, totaling about $1.6 billion, has been transferred into wallets typically associated with long-term holding.

This influx suggests that certain investors are optimistic about Bitcoin’s future value, aligning with historical trends of market uptrends. Despite short-term price fluctuations, this trend indicates confidence in Bitcoin’s long-term growth potential.

Bitcoin Shows Resilience Amidst Market Volatility

Bitcoin’s price encountered a minor setback, declining by 5.29% on Friday. However, the cryptocurrency swiftly recovered, reclaiming the $65,722 price level.

BTC/USDT Price Chart: TradingView

This resilience amidst significant whale activity and market volatility highlights the enduring strength of Bitcoin as both a store of value and an investment asset.

Looking ahead, technical analysis suggests that Bitcoin may enter a period of sideways trading in the short term. The upcoming bar closure is anticipated to provide insights into future price movements.

Bitcoin ETF Outflows Signal Shifting Investor Sentiment

Bitcoin exchange-traded funds (ETFs) on Wall Street saw a record week of outflows totaling $888 million, as reported by Farside Investors. This significant withdrawal of funds from spot Bitcoin ETFs indicates a shift in investor sentiment, potentially influenced by Bitcoin’s recent price decline and institutional trading strategies.

Despite these outflows, trading volumes for spot Bitcoin ETFs remain high, indicating sustained interest from institutional investors in these financial products.

The recent surge in high-value Bitcoin transfers and outflows from Bitcoin ETFs underscores the dynamic nature of the cryptocurrency market. While short-term volatility is expected, the ongoing trend of accumulation and the resilience of Bitcoin’s price suggest that the cryptocurrency remains an attractive investment opportunity.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News