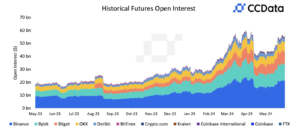

In May, Bitget recorded its highest-ever monthly inflows in derivatives trading. Despite a 20.1% decline in trading volumes on centralized exchanges overall, the derivatives open interest across the market grew by 30.5%.

Bitget specifically experienced a significant surge, with inflows totaling $975.4 million and a 39.2% increase in open interest, reaching $9.74 billion.

Bitget Sets New Records Amid Crypto Market Surges

May proved to be a standout month for the crypto markets, driven by significant economic events and anticipation surrounding Ethereum spot ETF approvals. Investors shifted focus from short-term trading to long-term investments during this period. Bitget, in particular, thrived, achieving its highest-ever monthly inflows in derivatives trading.

According to CCData, while combined spot and derivatives trading volumes across centralized exchanges dipped by 20.1% to $5.27 trillion in May, the derivatives market showed a stark contrast. Open interest surged by an impressive 30.5%, reaching $55.2 billion. Bitget played a pivotal role with its derivatives trading inflows soaring to $975.4 million. Additionally, Bitget’s open interest surged by 39.2% to $9.74 billion.

Source: CCData

Over the past year, Bitget has expanded significantly in both spot and derivatives trading. Notably, its native token, BGB, has outperformed other centralized exchange tokens, trading at $1.16 with a market cap of $1.63 billion and a 24-hour trading volume of $111 million at the time of reporting.

Overview of Current Trends in the Derivatives Market

In the derivatives market, Bitcoin’s dominance has slightly decreased by -1.24%, settling at 54.16%. Despite this, open interest in derivatives has shown a positive trend, increasing by +1.90% to reach $64.34 billion. However, the twenty-four Futures Volume has seen a significant decline of -19.08%, totaling $152.56 billion.

Source: Coinglass

There has also been a notable decrease in liquidations, indicating a more stable market environment. Total options open interest has risen by 2.1% recently. According to Coingass data, there is a bullish trend across all cryptocurrency categories, with an average price increase of 3.62%.

Specifically within the Ethereum ecosystem, there has been a 4.64% increase in open interest despite a modest price gain of 2.81%. Meme coins have stood out with the highest price changes, surging by 6.40%, although they also face significant liquidation risks.

Source: Coinglass

Arbitrum has seen remarkable interest with a substantial 9.89% increase in open interest, yet its trading volume has decreased, signaling caution among traders.

Overall, funding rates remain low, indicating a balanced market sentiment between long and short positions. This suggests a stable trading environment with no clear bias favoring either bulls or bears in the immediate future.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News