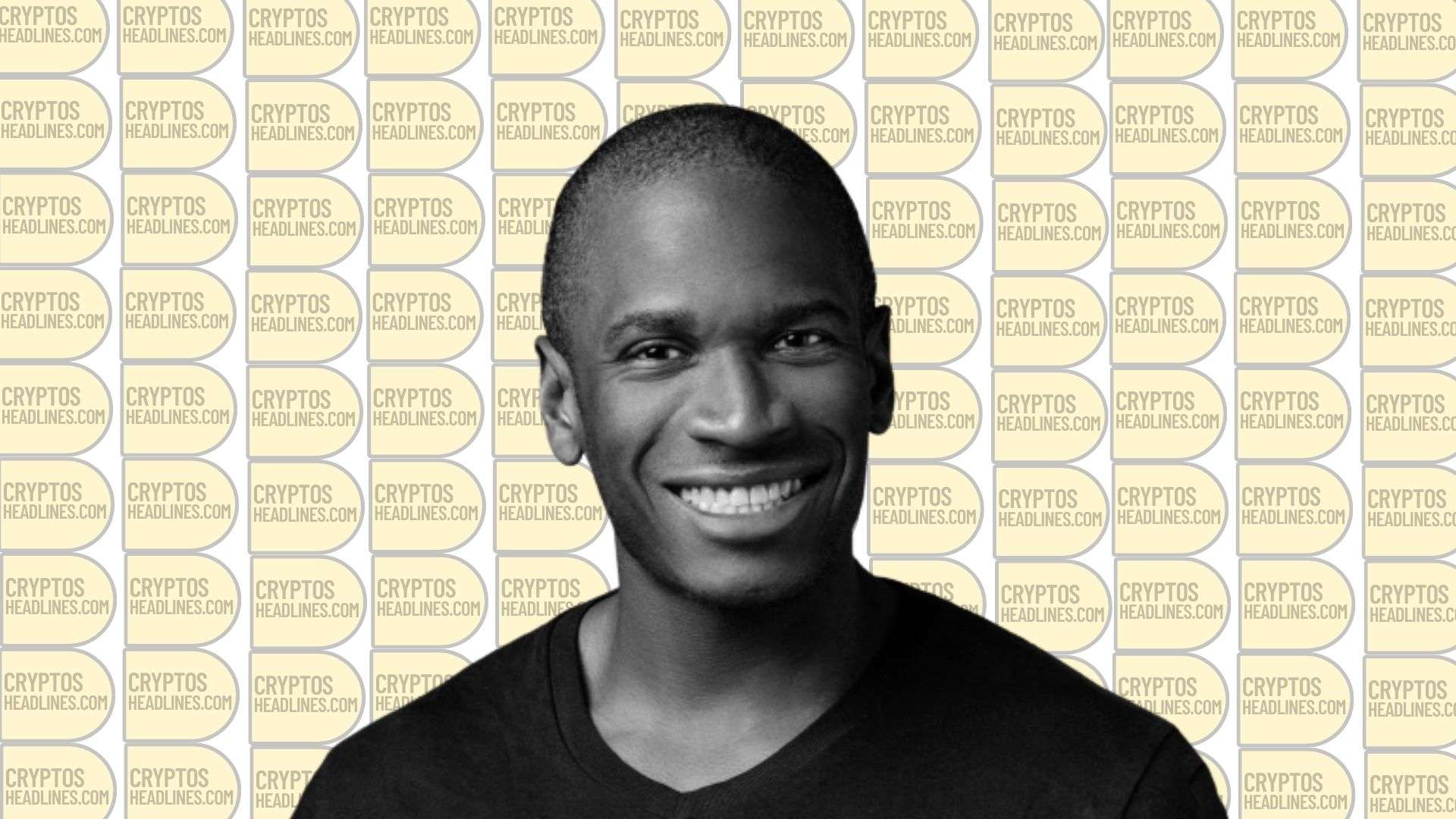

BitMEX founder Arthur Hayes has dropped hints about a possible Bitcoin rally, causing ripples of speculation in the cryptocurrency market.

In a recent update on the X platform, Arthur Hayes, co-founder of BitMEX and a well-known figure in the crypto world, provided intriguing insights into a potential Bitcoin rally. Alongside the message, he shared a chart illustrating changes in net Reverse Repurchase Agreement (RRP) and Treasury General Account (TGA) balances.

Notably, within discussions about dollar liquidity and market dynamics, Hayes humorously referred to Treasury Secretary Janet Yellen as “Bad Gurl Yellen.” Amidst these discussions, Hayes highlighted significant indicators that point towards a positive direction for Bitcoin prices.

Getting my feet did and observing how Bad Gurl Yellen is busy pumping financial assets. Don’t get distracted, $ liquidity is increasing and $BTC will go up as well. This is the chart of net RRP and TGA balance changes. pic.twitter.com/l2US0FzlAX

— Arthur Hayes (@CryptoHayes) November 25, 2023

Hayes: Dollar Liquidity Sparks Bitcoin Rally

In a recent post, Arthur Hayes, a prominent figure in the Bitcoin community, urged fellow enthusiasts to stay focused, highlighting a notable increase in dollar liquidity. He emphasized that as dollar liquidity grows, Bitcoin (BTC) is likely to experience positive price movements.

The accompanying chart showcased the net changes in Reverse Repurchase Agreement (RRP) and Treasury General Account (TGA) balances, suggesting a potential correlation between increased liquidity and an upward trajectory for Bitcoin.

Adding more concrete figures, another crypto analyst, Dharmafi, shared insights on X. The post revealed a Reverse Repurchase Agreement (RRP) of $65 billion and a Treasury General Account (TGA) balance of $35 billion, resulting in a substantial net liquidity increase of $106 billion since Tuesday.

This disclosure marked a significant surge in liquidity within a short timeframe, indicating dynamic shifts in the financial landscape.

Liquidity Surge Spurs Crypto Watch Amid Bitcoin Growth

The recent surge in liquidity, highlighted by Arthur Hayes, signifies dynamic changes in financial markets, closely monitored by investors and Bitcoin enthusiasts. Hayes, co-founder of BitMEX, pointed to the connection between dollar liquidity and potential movements in Bitcoin’s future.

Concrete figures shared by Dharmafi, revealing a $106 billion net liquidity increase since Tuesday, add numerical weight to the influx. This rapid injection of funds prompts speculation about its effects on various asset classes, including cryptocurrencies.

As the crypto community navigates these nuanced observations, the role of influential figures like Janet Yellen in shaping market dynamics becomes a focal point of discussion. Enthusiasts are watchful for potential shifts as Bitcoin responds to this liquidity surge.

Bitcoin’s price, currently at $37,800.42, reflects a 0.89% increase, reaching a yearly high of $38,415.34 in the last 24 hours.

Notably, Yellen, recognized as a Bitcoin critic, recently issued warnings to crypto exchanges, emphasizing the need for compliance with the law. In response to the US Department of Justice’s (DOJ) verdict finding Binance guilty of money laundering and other charges, Yellen stressed the importance of adherence to regulations for operating within the US financial system.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News